EM CEEMEA CREDIT: SASOL: 1H25 production and sales update

Jan-23 08:30

Sasol (SASOL; Ba1/BB+/-)

1H25 production and sales update

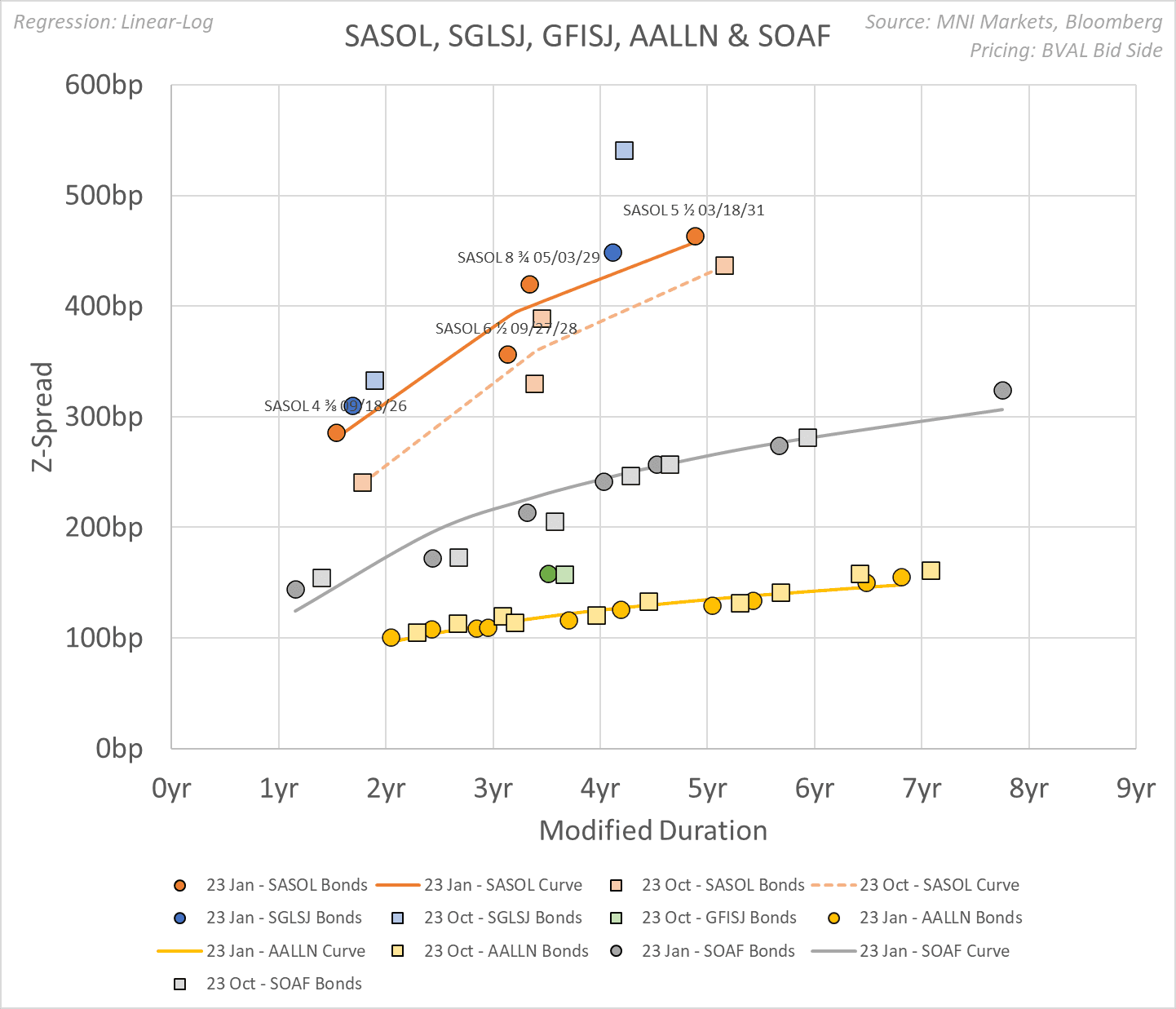

- The highlights of production and sales metrics read all in neutral with declines in Fuels segment, Sasol is also providing guidance for FY25. SASOL USD secondary bond curve charts some 30bp wider in z-spread terms since post 1Q25 update (see chart below).

- Mining production for 1H25 is reported roughly in line YoY. Saleable production for FY25 is estimated at 30-32mm tons (vs 30.2mm tons FY24).

- Gas production in Mozambique for 1H25 is reported up 2% YoY, although Q2 saw a 3% decline vs previous quarter, reportedly as a consequence of civil unrest.

- In Fuels, SO production volumes for 1H25 was down 5% YoY, whilst Natref production recovered in Q2 vs Q1 leaving 1H25 down 14% YoY. Overall FY25 sales are “expected to be largely in line with FY24”, as reported by Co.

- In Chemicals, in Africa total sales 1H25 stood @ 1668, -4% YoY. FY25 are expected to be in line with previous year. In America sales revenues are reported up 1% in 1H25 vs YoY, a combination of higher Base Chemicals prices and lower volumes following East Cracker outage. Eurasia business posted in line sales volumes YoY.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CROSS ASSET: MONTH END EXTENSION (update)

Dec-24 08:21

This should be a non event for Year End, they are small, and only the lower liquidity could get Govies moving, but unlikely, as investors turn their attention to 2025.

Bloomberg Bonds:

- US Tsys: +0.07yr (small, average).

- EU Govies: +0.04yr (small).

- UK Govies: -0.02yr (non event).

MS Bonds:

- US Tsys: +0.05yr (small).

- EU Govies: +0.03yr (small).

- UK Govies: To contract (non event).

Barclays FX:

- Their Quarter rebalancing model only shows a Weak Dollar Buying signal.

GILTS: Opens within the Calls

Dec-24 08:09

- A slightly higher open for Gilt, was just down 2 ticks at 92.46 vs close, a small wide range of 16 ticks on the Open, but as expected very poor volumes as also seen in the Sonia Strip.

- In Terms of Technical, support is at 91.87, while resistance moves down to 92.92.

GILTS: Opening calls

Dec-24 07:57

Gilt Calls will be taken from Tnotes, with Europe closed, 92.40, would be 8 ticks down.

Related bullets

Related by topic

SASOL

South Africa

Africa

EU Basic Industries

Credit Sector