EM CEEMEA CREDIT: SASOL Weaker bond market post 1H25 production and sales update

Jan-24 10:41

Sasol (SASOL; Ba1/BB+/-)

Weaker bond market post 1H25 production and sales update

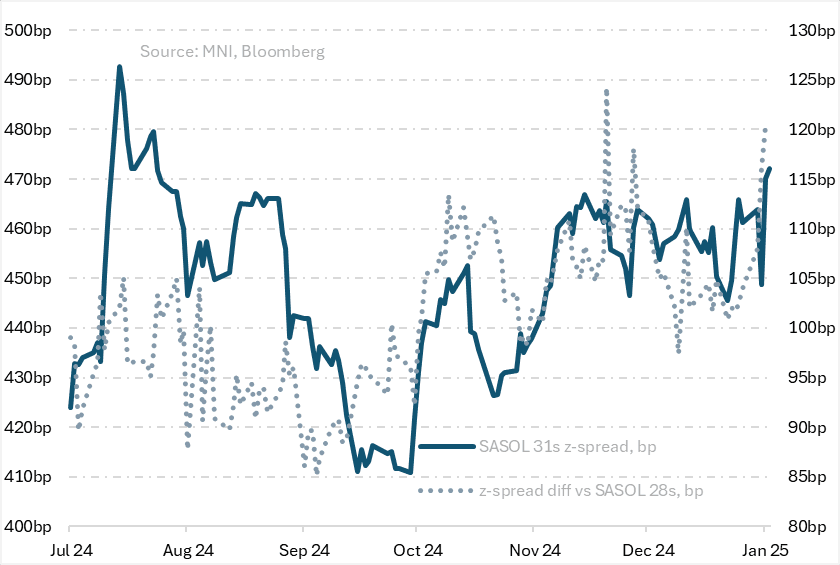

- The widening of SASOL secondary curve has left z-spreads elevated and charting near recent highs, with SASOL 5.5 Mar31s yielding in the region of 8.86% (or z+472bp) post 1H25 production and sales update. This is some 40bp wider vs levels seen post the 1Q25 update.

- The curve also shows some recent steepening, as visible in the z-spread differential for 28s/31s now @ +120bp (indicatively, as per chart below).

- No immediate USD refinancing is required, with the first redemption date for denominated tradable debt maturity profile being in September 2026, for a USD650mn notional outstanding.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: CHINA PBOC CONDUCTS CNY192.3 BLN VIA 7-DAY REVERSE REPOS WEDS

Dec-25 01:22

- CHINA PBOC CONDUCTS CNY192.3 BLN VIA 7-DAY REVERSE REPOS WEDS

MNI: CHINA SETS YUAN CENTRAL PARITY AT 7.1868 WEDS VS 7.1876

Dec-25 01:21

- CHINA SETS YUAN CENTRAL PARITY AT 7.1868 WEDS VS 7.1876

MNI: JAPAN NOV SERVICES PPI +3.0% Y/Y; OCT UNREV +2.9%

Dec-24 23:51

- MNI: JAPAN NOV SERVICES PPI +3.0% Y/Y; OCT UNREV +2.9%

- JAPAN NOV SERVICES PPI +0.4% M/M: OCT UNREV +0.8%

Related bullets

Related by topic

SASOL

South Africa

Africa

EU Basic Industries

Credit Sector