SWEDEN: Tariff Implementation and Riks Repricing Present Greatest Risk To EURSEK

The biggest risks to EURSEK likely come from an implementation of US President Trump’s tariff threats and/or an unwind of this month’s hawkish Riksbank repricing. The cross has fallen 3% this month, on track for a thirteenth negative session in the last fourteen. The Feb 22nd 2024 low at 11.1385 presents the next key downside level.

- Although EUR is likely to weaken in the event of tariff implementation, SEK will also be pressured via the risk channel (i.e. weaker European equities) and from Swedish trade sensitivity with the US.

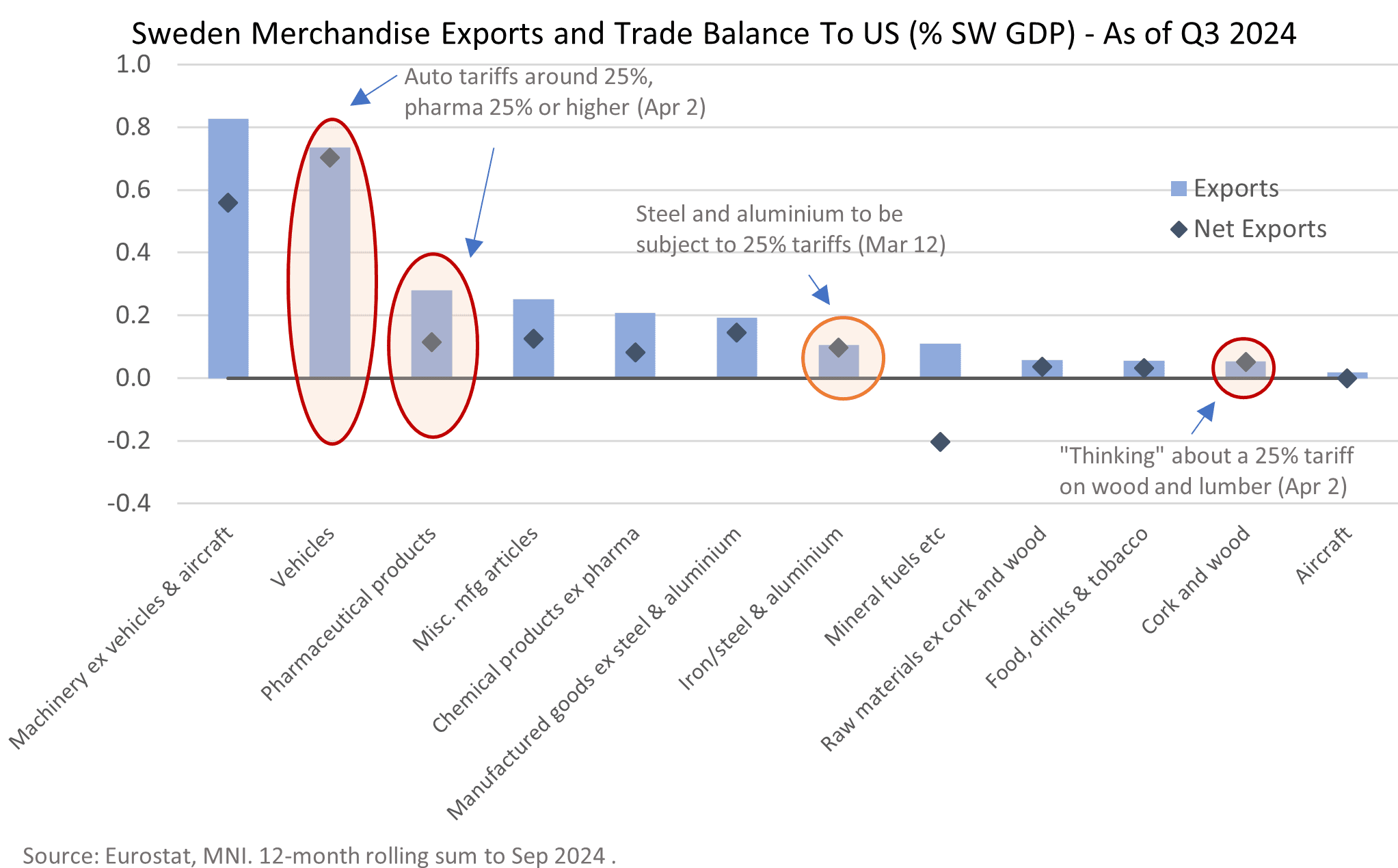

- The auto sector would be most impacted by Trump’s tariff threats (of “around 25%” from April 2). Swedish vehicle exports to the US were worth 0.7% of Swedish GDP in Q3 2024, while imports were negligible.

- Pharmaceutical products would also be affected (exports worth 0.3% of GDP, net exports 0.1%), while steel/aluminium and wood/cork (the latest category to be threatened yesterday) would have a smaller impact.

- From a monetary policy standpoint, markets price just 14bps of Riksbank easing through year-end (according to latest estimates from SEB). While this month’s hawkish repricing has been justified by the cautious January meeting minutes and higher-than-expected inflation report, we still think the bar to one more 25bp cut is lower than markets currently price.

- Activity data over the next few weeks will be key, with Q4 GDP due next Friday and the Riksbank’s business survey (which has been highlighted by board member’s Breman and Bunge as a key input) due March 3. Weak readings may not be enough to shift consensus back in favour of a March cut, but could prompt a reassessment of pricing for May and June.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: 5/15-year LITHUN EMTN: Priced

- EU1b 5Y Fixed (Jan. 28, 2030) at MS+60

- Revised guidance MS+60-65 area will price in range, guidance MS+70 area

- Reoffer price 99.542 to yield 2.975%

- Benchmark: OBL 2.5% 10/11/29 +68.2

- Books above EU2.05b (excluding JLM interest): Leads

- Coupon: 2.875%, annual, act/act ICMA

- ISIN: XS2979761769

- EU1b 15Y Fixed (Jan. 28, 2040) at MS+125

- Revised guidance MS+125-130 area will price in range, guidance MS+145 area

- Reoffer price 98.283 to yield 3.777%

- Benchmark: DBR 4.25% 07/04/39 +106.2

- Books above EU2.6b (excluding JLM interest): Leads

- Coupon: 3.625%, annual, act/act ICMA

- ISIN: XS2979761926

- Settlement: Jan. 28, 2025

- Bookrunners: BNPP (B&D), BofA, JPM

- Co-Lead (no books): SEB Lithuania

- Timing: FTT immediately

Details as per Bloomberg

STIR: Around 65bp Of BoE Cuts Priced Through Year-End, Friday PMIs Eyed

GBP STIRs have taken cues from the long end today, after the domestic labour market data had little lasting impact in pre-gilt open trade.

- BoE-dated OIS shows 64.5bp of cuts through year-end, with 22bp of cuts priced for February, 27bp through March and 40.5bp through May.

- ~62bp of cuts were priced through year-end at yesterday's close.

- The front end of that profile continues to look a little flat to us, as we still look for cuts at both the February and May meetings, with more information needed to provide a meaningful view beyond the latter decision. Still, we are cognisant of the correction from recent hawkish extremes (~36bp of cuts were priced through '25 at one point last Tuesday) and fiscal risks within the UK (and abroad).

- SONIA futures are 0.5-6.0 higher on the day, SFIZ5 and Z6 remain below year-to-date highs.

- A reminder that the BoE has de-emphasised the importance of the labour market data, which increases the importance of the likes of the PMI data (preliminary PMI releases due Friday).

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Feb-25 | 4.479 | -22.1 |

Mar-25 | 4.431 | -26.9 |

May-25 | 4.296 | -40.4 |

Jun-25 | 4.244 | -45.6 |

Aug-25 | 4.154 | -54.6 |

Sep-25 | 4.124 | -57.6 |

Nov-25 | 4.072 | -62.9 |

Dec-25 | 4.057 | -64.4 |

JAPAN: USDJPY 50-Day EMA Pierced Overnight, Trendline Support Remains Key

- A very moderate blip lower for USDJPY on the back of that Kyodo headline, however very much in the direction of travel across the NY crossover, with the pair unable to hold gains above the 156.00 handle overnight. While spot remains around 155.50, it is worth noting that the 50-day EMA was pierced overnight and while the overall trend condition remains bullish for now, a close below this average would be a bearish development.

- Trendline support drawn from the September lows appears significant and this level currently intersects at 154.35. Several analysts have pointed to a rate hike being unlikely to move the dial for the JPY at this juncture, with a greater focus placed on any accompanying guidance.

- Goldman Sachs economists have long been calling for a January rate hike, but they also expect an emphasis on gradual hikes going forward. They note that alongside a Fed now most likely to be on hold for a while, BoJ hikes are even less JPY-positive on the margin. Moreover, GS have previously stressed that gradual BoJ hikes are not an impediment to a weaker Yen and, in fact, a weak Yen allows for more sustained policy tightening.

- MUFG have said with the market already more fully pricing in another hike now, they doubt that the yen will strengthen significantly especially as the updated guidance is likely to stick to gradual rate hike plans.

- Recall that CIBC have recommended a tactical long at 156.00, details here.