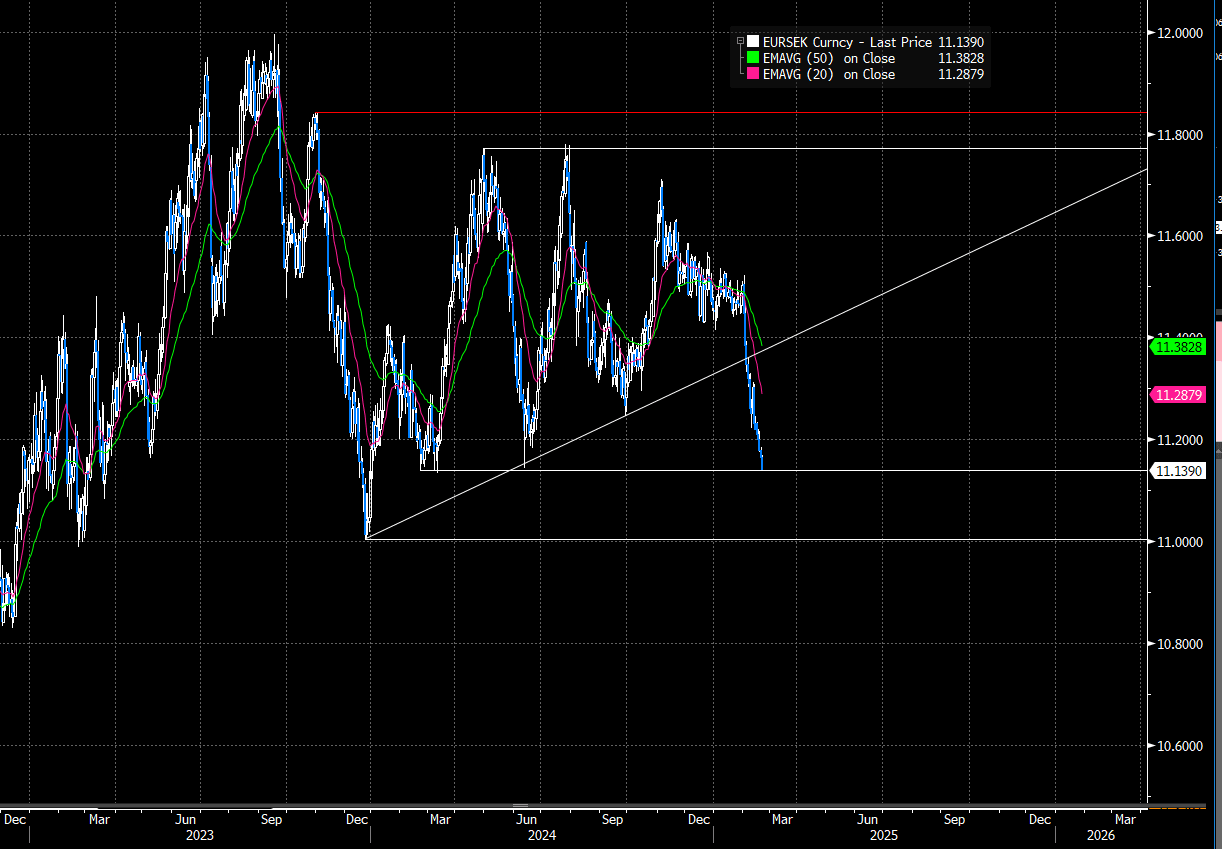

SEK: Bearish Technicals In EURSEK Re-asserting Themselves Once Again

Bearish technical conditions in EURSEK are reasserting themselves this morning, with the cross extending session lows at typing, now 0.2% lower today and on track for a seventh consecutive downward session. Support at the Feb 22nd 2024 low of 11.1385 is being tested, clearance of which would expose the December 2023 low at 11.0030 and the psychological 11.0000 handle.

- Single current weakness following the weak French flash PMI may be factoring in a little, but the SEK has also strengthened against the USD, NOK and GBP over the last 60 minutes, without an obvious headline trigger.

- On a 14-day RSI basis, EURSEK is once again at its most oversold since 2012.

- Yesterday, we wrote that the biggest upside risks to EURSEK likely come from an implementation of US President Trump’s tariff threats and/or an unwind of this month’s hawkish Riksbank repricing. Read more here.

Figure 1: EURSEK Since Mid-2022

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSY FUTURES: Long Setting In FV Through UXY Noted Over Last Two Sessions

Net long setting across TY, UXY and US futures dominated between Friday and Tuesday settlements, as markets remained sensitive to headlines surrounding Trump’s tariff plans.

- Net long cover in TU futures provided the only other net positioning move of note.

| 21-Jan-25 | 17-Jan-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 4,155,072 | 4,183,844 | -28,772 | -1,090,113 |

FV | 6,158,658 | 6,181,136 | -22,478 | -935,950 |

TY | 4,743,305 | 4,694,593 | +48,712 | +3,126,548 |

UXY | 2,270,826 | 2,266,718 | +4,108 | +359,336 |

US | 1,917,054 | 1,908,965 | +8,089 | +1,010,919 |

WN | 1,792,716 | 1,794,375 | -1,659 | -313,362 |

|

| Total | +8,000 | +2,157,378 |

EURIBOR OPTIONS: Latest Euribor upside Option, Looking for ECB cuts

More upside structures in Euribor, looking at back to back cuts from the ECB into June, but also deeper cut play into Year end have been noted in the past couple of Weeks.

- ERJ5 97.75/97.875/98.00c fly, bought for 2.5 in 3.9k.

- ERM5 98.00/98.25cs, bought for 2.75 in 3.4k.

EGBS: Earlier Rally Fades, ECB Speakers Consistent With Market Pricing

The earlier rally in major EGB futures has largely faded, with Bund futures now little changed today at 131.94, down from a session high of 132.22. The 20-day EMA at 132.37 remains a key resistance level in Bunds.

- OAT and BTP futures led the morning rally, seemingly driven by the bid in European equities.

- Several ECB policymakers have provided comments from the Davos forum, headlined by President Lagarde. However, comments were largely consistent with current OIS pricing, limiting the market reaction.

- Books for Spain’s 10-year Obli syndicated tap are in excess of E150bln, while the spread for Finland’s new 20-year RFGB has been set. Germany will hold a 15-year Bund auction at 1030GMT/1130CET.

- German cash yields are little changed, with a light twist steepening bias seen.

- 10-year peripheral/semi-core spreads to Bunds have tightened, as European equities rally. OATs outperform, though meaningful OAT/Bund tightening below 75bps may be limited by medium-term fiscal/political risks.

- The remainder of today’s macro calendar is light, with focus on ECB speakers and any tariff-related headlines from the US.