STIR: Fed Rates Pare Gains But Still Set For Second Lowest Terminal Since Oct

Mar-21 17:54

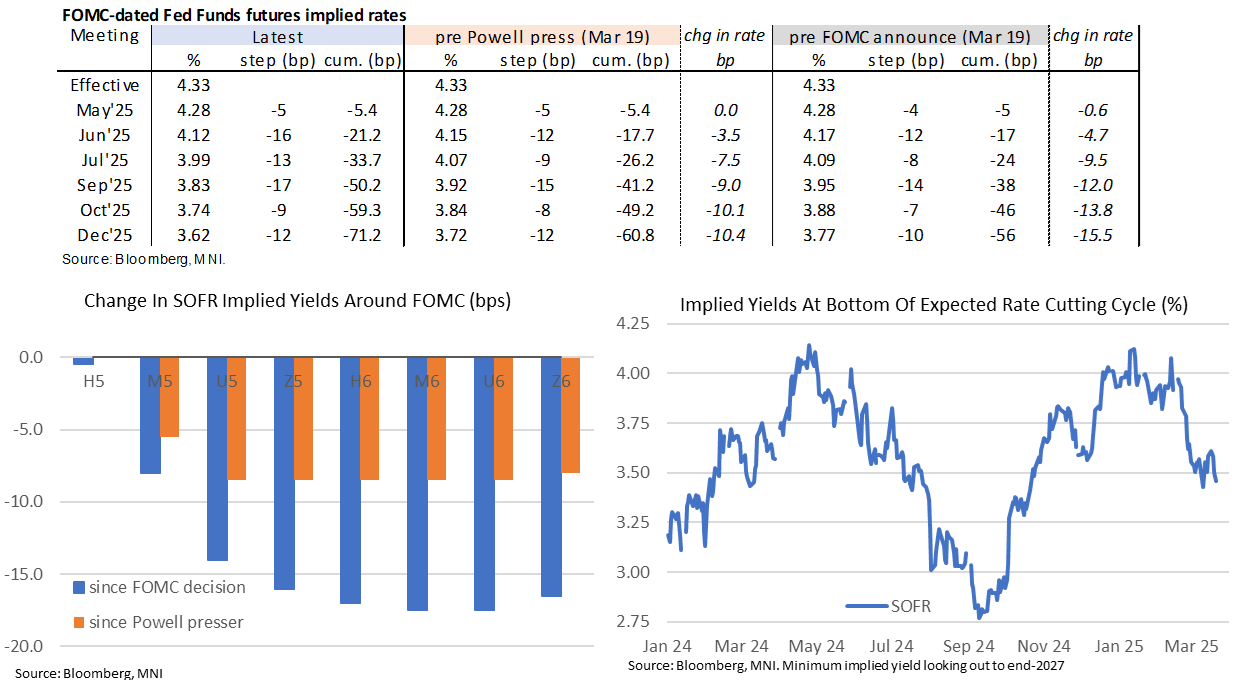

- Fed Funds implied rates have lifted off dovish lows that were last lower Mar 13 for the Dec’25 contract, with help from the paring of losses in equities and crude oil futures.

- Cumulative cuts from 4.33% effective: 5.5bp May, 21bp Jun, 34bp Jul, 71bp Dec.

- The SOFR implied terminal yield of 3.46% (currently in the SFRU6) last closed lower on Mar 10 and before that Oct 2024.

- Today’s first post-FOMC Fedspeak has seen Williams (permanent voter) and Goolsbee (’25 voter). We thought it notable that Goolsbee, the most dovish FOMC member in our view, didn’t sound at all like he's pushing hard for rate cuts anytime soon. See “Chicago's Goolsbee Sounds Increasingly Cautious, Auguring Later Cuts” - posted on MNI bullets at 0902ET - and “Goolsbee Has Narrow Definition Of "Transitory” - posted 0906ET.

- Williams meanwhile appears to have a similar stance to pre-FOMC: "The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still running somewhat above our 2 percent goal. It also positions us well to adjust to changing circumstances that affect the achievement of our dual mandate goals."

- Monday sees flash March PMIs although with data backloaded later in the week, whilst first US-China calls under the second Trump administration get underway ahead of the Apr 2 reciprocal tariffs deadline.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: USDMXN Rises 1% as US/Mexican Officials Discuss Trade

Feb-19 17:52

- The USD index is firming for a second consecutive session, with the likes of EUR and GBP underperforming in G10. Comments from President Trump on Zelensky have weighed on EURUSD, reflective of the souring sentiment towards how the potential Russia/Ukraine negotiations might progress.

- EURUSD continues to press towards 1.0400, placing weight on EURJPY (0.65%), which continues to hover near session lows as we approach the European close.

- Overall, EURJPY has pulled back from its recent high, and resistance at 160.68, the 50-day EMA, remains intact. A stronger reversal south would refocus the attention on 155.61, the Feb 10 low and a bear trigger. Furthermore, a trendline drawn from the August 2022 lows currently intersects just above this level, bolstering the significance of this area of support.

- UK inflation rose at the fastest pace in almost a year in January, outpacing even the Bank of England's expectation for a move higher. However, the small downside surprise in services inflation provided a cloudy signal for GBP, which has been dominated by broader dollar sentiment. As such, GBPUSD has slipped back below 1.2600, but overall is holding onto its recent gains.

- ZAR weakness was notable in EM amid the adjournment of the budget delivery, prompting a firm rally for USDZAR (+0.91%). This has weighed on the EM basket on Wednesday, with similar weakness being noted for the Mexican peso.

- USDMXN has risen a little over one percent on the session, to trade around 20.45 at typing. Key support at 20.1343 remains intact and the currency will remain particularly sensitive to developments in Washington, where US and Mexican officials are discussing the future trade relationship.

OPTIONS: A Downside Tilt To A Busy Session

Feb-19 17:52

Wednesday's Europe rates/bond options flow included:

- OEH5 117.00/117.25ps, bought for 18 in 7.5k.

- OEH5 117.25/117.75cs, bought for 7.5 in 3k.

- RXH5 130.5/129.5ps, sold 3 in 8k.

- RXK5 134.50 calls paper paid 24 on 3.1K.

- ERJ5 97.62/9750ps, bought for 1 in 11.5k.

- ERM5 97.9375c, sold at 4.75 in 10k (ref 97.825)

- ERM5 97.9375/98.1875 1x2 call spread, paper sells for 2.75 in 12k.

- ERM5 97.9375/98.0625/98.1875c fly, bought for 1.25 in 7k.

- ERU5 97.875/97.750/97.625 put ladder 10K given at -0.25.

STIR: European Rates Underperformance With Tariff 'Reprieve'

Feb-19 17:46

- Today’s hawkish shifts in ECB pricing on Schnabel ("we are getting closer to the point where we may have to pause or halt our rate cuts") and less so for the BOE (headline CPI beat but core inline and services a tenth softer than expected) sees reasonable underperformance to US rates.

- Looking over the next two years, Euribor implied yields are up to 6bps higher on the day, Sonia yields are 2.5bp higher for Dec’25 and 5.5bp for Dec’26 whilst SOFR yields are 0-1bp lower.

- US President Trump’s latest threats late yesterday on large tariffs on autos (“in the neighborhood of 25%”) and pharmaceuticals & semiconductors (“25% and higher”), but importantly not effective until Apr 2, has seen a similar reaction to after Trump’s pre-reciprocal tariffs announcement on Feb 13.

- That is the opposite of the US inflationary/European growth negative reaction seen on tariff-related headlines seen earlier in the Trump administration.

- Lending weight to this tariff reprieve angle is the admittedly more limited underperformance of CAD rates on the day amidst no new material local headlines.

- The right-hand chart below shows how the broader expectations of a significant increase in European defense spending has also helped drive a sizeable wedge in rate performance against the US since Trump’s reciprocal tariffs announcement last week.