STIR: One Way Rally In European Rates, Monday’s PMIs Next Focal Point

Mar-21 16:55

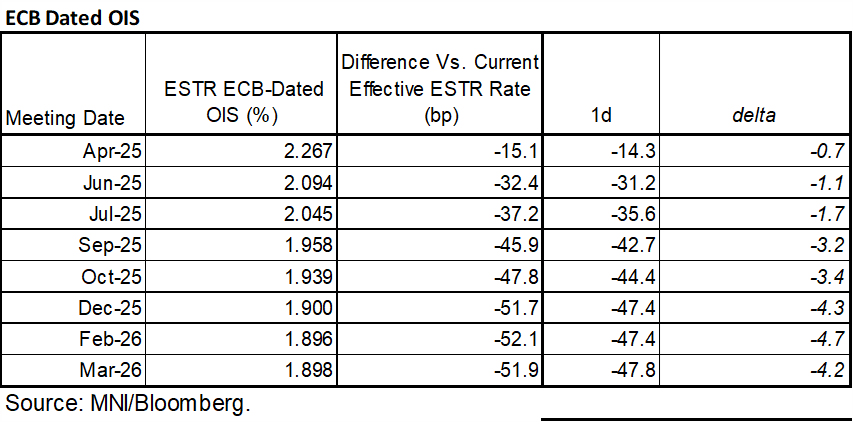

- ESTR ECB-dated OIS have seen a mostly one-way push lower today, with little sign of impact from equities paring losses over the past two hours.

- Near-term meetings have only seen modest changes, with ~60% chance of a 25bp cut at the Apr 17 decision (15bp vs 14.3bp yesterday).

- However, the 51.5bp of cumulative cuts to end-2025 from the current depo rate of 2.5% is from 47.5bp yesterday and comes from an implied rate that was last sustainably lower in Mar 4.

- Indeed, Euribor reds lead the day’s gains in Eurozone rates, currently +5.5 ticks. That translates to a Euribor-implied terminal yield of 2.03% in the ERZ5 for what would also be its lowest close since Mar 4.

- Earlier, Bank of Greece Gov. Stournaras was unsurprisingly dovish in his first comments since the March decision when speaking to Econostream (“everything points in the direction of a cut in April”). The remarks didn’t have a material reaction but equally won’t have hindered the modest further rally in rates since then.

- The decision of whether to cut for a sixth consecutive meeting or pause will hinge on incoming data (in particular the March flash PMIs and the March flash inflation round), the ECB's Q1 Bank Lending Survey, and developments in US/EU trade policies as of April 2. First up, the flash PMIs on Monday.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: Pre-Minutes FOMC Communications: Hawks Subtly Float Hike Potential (3/3)

Feb-19 16:45

The FOMC's hawks have generally been emboldened by post-January developments.

- Two of the FOMC’s most hawkish members (Cleveland’s Hammack, Dallas’s Logan) have very subtly speculated about a possible rate hike as the Fed's next move. Hammack: “while it's not my base case that we would raise rates this year, there's a lot of uncertainty there about a broad swath of policies”, Logan: “in other scenarios, we'll need to hold rates at least at the current level for quite some time” – note the “at least”.

- Gov Bowman, a hawk, doesn’t quite go that far but likewise doesn't see the current rate level as "exerting meaningful restraint" and supports a "cautious and gradual approach to adjusting policy".

- We still haven't heard from two of biggest hawks - KC's Schmid and St Louis's Musalem - since the January FOMC, and both of them are 2025 voters.

- Musalem is due to speak next on Feb 20, with Schmid not scheduled to speak before the March FOMC meeting.

Centrists showed no urgency to cut.

- Richmond's Barkin: "the case for wait and see is, you want to wait and see", and on whether the Fed will cut at some point this year, "we will see what happens.

- Atlanta's Bostic while pointing to an FOMC base case of 50bp of cuts this year noted "We're not in a hurry. We'll move when we have enough information to move."

- Minneapolis's Kashkari, whose monetary policy outlook has varied over time between dovish and hawkish, said "I would expect the federal funds rate to be modestly lower at the end of this year.”

FED: Pre-Minutes FOMC Communications: Doves Lean Increasingly Cautious (2/3)

Feb-19 16:36

Chair Powell’s semi-annual Congressional testimony more or less repeated the themes of the January FOMC meeting press conference – sometimes verbatim (“we do not need to be in a hurry to adjust our policy stance”) – and he sounded cautiously optimistic on inflation even after the January print (“I would say we're close, but not there on inflation.”) But he sounded more hawkish on the labor market front after January's employment data, telling the Senate Banking Committee that the labor market was "very strong".

- Powell is among the more dovish members of the Committee at this point, but it’s worth noting that the other prominent dovish-leaning members have taken a more cautious tone as well.

- NY Fed President Williams called policy “modestly” restrictive, a term that has been used by hawks and could be considered less dovish vs his previous commentary in mid-January ("somewhat restrictive”).

- Chicago's Goolsbee, a 2025 voter, said that despite his view that called January's CPI data "sobering" and said "there’s no question, if we got multiple months like this, then the job is clearly not done” Gov Kugler: "the prudent step is to hold the federal funds rate where it is for some time" VC Jefferson noted “I do not think we need to be in a hurry to change our stance”.

- Gov Waller called January's CPI "mildly disappointing...the data are not supporting a reduction in the policy rate at this time…if this wintertime lull in progress is temporary, as it was last year, then further policy easing will be appropriate. But until that is clear, I favor holding the policy rate steady."

- Boston's Collins (notably, pre-jobs and inflation data): "it's really appropriate for policy to be patient, careful, and there's no urgency for making additional adjustments, especially given all of the uncertainty, even though, of course, we're still somewhat restrictive… what I would say is, again, there is more to do".

- And SF's Daly "At this point, policy needs to remain restrictive until, from my vantage point, until I see that we are really continuing to make progress on inflation.”

- Philadelphia's Harker took a longer-run view: "While I won't commit to a specific timetable, I remain optimistic that inflation will continue a downward path and the policy rate will be able to decline over the long run".

FED: US TSY 17W BILL AUCTION: HIGH 4.215%(ALLOT 60.66%)

Feb-19 16:32

- US TSY 17W BILL AUCTION: HIGH 4.215%(ALLOT 60.66%)

- US TSY 17W BILL AUCTION: DEALERS TAKE 29.82% OF COMPETITIVES

- US TSY 17W BILL AUCTION: DIRECTS TAKE 11.86% OF COMPETITIVES

- US TSY 17W BILL AUCTION: INDIRECTS TAKE 58.32% OF COMPETITIVES

- US TSY 17W BILL AUCTION: BID/CVR 3.33