EU TRANSPORTATION: Accor; 8y FV

(ACFP; NR/BBB-/BBB- Pos)

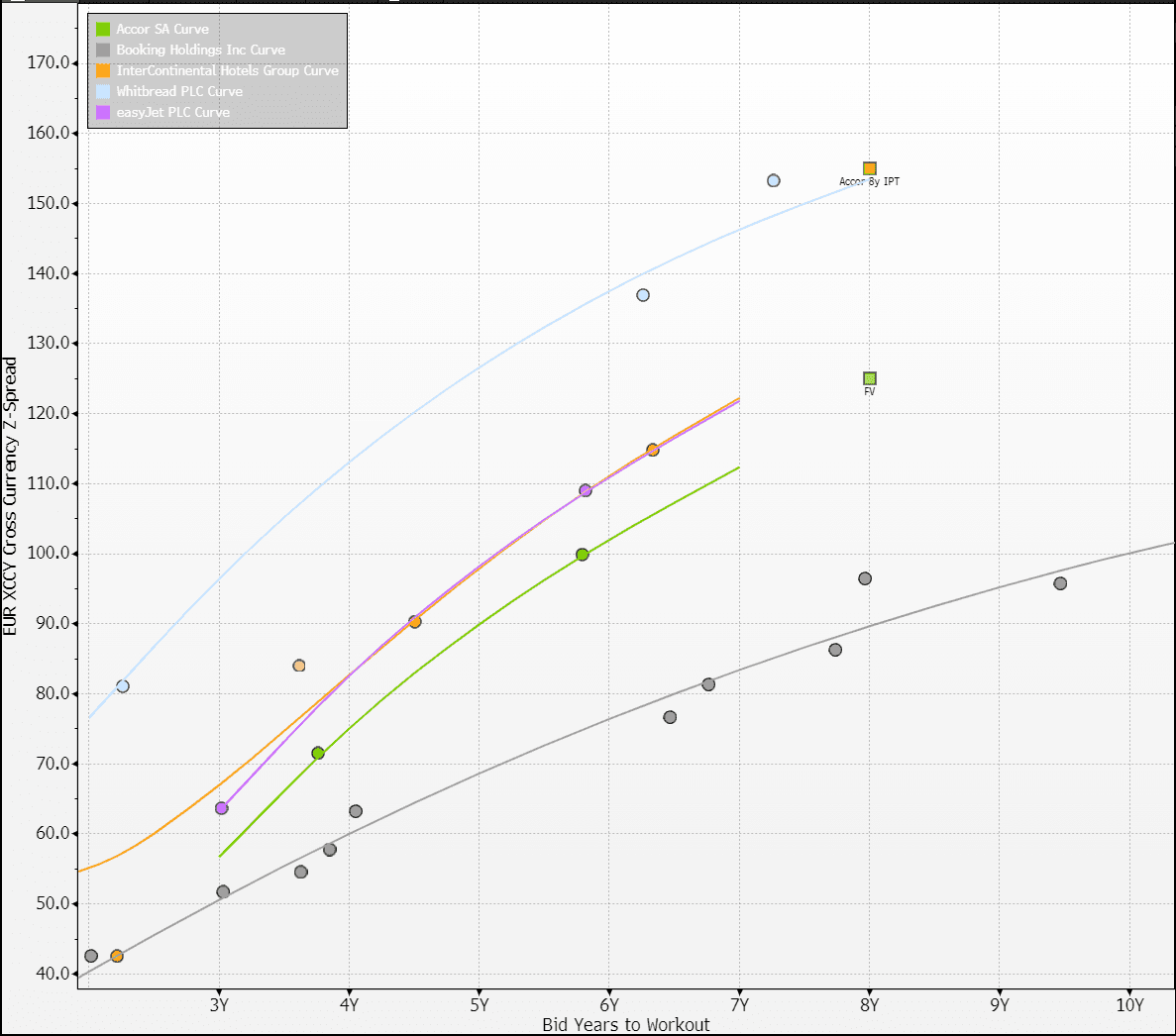

Likely to price through FV but we are tad confused why higher margin, similar double-digit growing and higher rated IHG is priced +10bps wide of Accor. Regardless levels among the three hotel operators are interesting - concerns will be if a Europe led slowdown in discretionary spend is coming.

exp. €500m 8y +155a vs. FV +125 (-30)

- Accor has 45% exposure to Europe and North Africa, another 45% in middle East, Africa and APAC and only 10% to Americas. That is within Premium, mid and economy rooms which is 85% of the group, 15% in luxury. In comparison IHG is US heavy (50%) and generally considered more premium.

- We have swapped over the sterling Whitbread curve - the weakest of the three hotel operators on its nearly entire UK and mid-market (through flagship Premier Inn) exposure. We have also swapped over the IHG28s - for reference.

- easyJet we have included as it is generating 27% of its bottom line from the holidays business. No firm view but we are small biased to see it a tad rich.

- Accor is n/g 2.2x/3.3x levered excluding the €1.1b in hybrids (targets net <3.0x)

- including 50% equity treatment on hybrid n/g 2.7x/3.8x

- FY25 (to Dec) outlook issued last week is for EBITDA growth of +9-12% (FY24 was +12%)

- given leverage in target upside directed to equity holders - €700m/yr in equity pay-outs the last two years

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE 10-YEAR TECHS: (H5) Resistance Remains Intact

- RES 3: 96.501 - 76.4% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 2: 96.207 - 61.8% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 1: 95.615/851 - High Dec 31 / High Dec 11

- PRICE: 95.510 @ 15:51 GMT Jan 24

- SUP 1: 95.275 - Low Nov 14 (cont) and a key support

- SUP 2: 94.477 - 1.000 proj of the Dec 11 - 23 - 31 price swing

- SUP 3: 94.495 - 1.0% 10-dma envelope

The Aussie 10-yr futures contract continues to trade below the Dec 11 high of 95.851, and has traded through the Dec low. A stronger bearish theme would expose 95.275, the Nov 14 low and a key support. Clearance of this level would strengthen a bearish theme. For bulls, a confirmed reversal and a breach of 95.851, the Dec 11 high, would instead reinstate a bull cycle and refocus attention on resistance at 96.207, a Fibonacci retracement point.

FED: MNI Fed Preview-Jan 2025: Keeping Rate Cut Hope Alive

We've just published our preview of the January FOMC meeting:

- The FOMC will keep the benchmark Fed funds rate on hold on January 29 for the first time in four meetings, as it shifts to a more patient phase of its easing cycle after delivering 100bp of cuts.

- The forward guidance adopted in December points to a data-dependent approach to assessing the “extent and timing” of additional rate adjustments. To this end, there has been only limited inflation and labor market data since then, while the Trump administration’s policies and their potential impact on the economic outlook are still in a formative stage.

- With minimal Statement changes expected and no new rate/macro projections, the focus will be on Chair Powell’s press conference which will likely repeat the same themes heard six weeks earlier.

- As such, the risks to the market reaction to the meeting lean slightly dovish in the context of only one more full rate cut being priced for the cycle.

- While he won’t be able to add any additional commentary on the Fed’s response to prospective fiscal/trade/immigration policy shifts, we suspect Powell will remain optimistic on the inflation trajectory and reiterate that 50bp of cuts remain the FOMC’s baseline scenario this year. In other words, the bias toward easing remains intact.

- Additionally, Powell probably won’t completely rule out another cut as soon as the next meeting in March, while being careful to couch any future moves as data- and outlook- dependent, and emphasizing that the Fed can afford to be patient so long as the economy and labor market remain solid.

Note to readers: MNI’s separate preview of sell-side analyst summaries to follow on Monday Jan 27

MACRO ANALYSIS: MNI US Macro Weekly: Fed Remains Firmly On Track To Hold

- Data in the week ahead of the January Fed meeting was thin and overall mixed, with President Trump’s apparently softer tone on tariffs helping implied rates soften slightly toward end-week.

- January’s preliminary Services PMI reading unexpectedly fell to its lowest since April 2024, though had some slightly less dovish details.

- Weekly continuing claims provided a surprise on the weak side, just exceeding recent highs, but the broad report (including initial claims a touch higher than expected) didn’t materially change the story of firms dampening down on re-hiring rather than turning to layoffs to manage headcount.

- Looking ahead to next week, the FOMC will keep the benchmark Fed funds rate on hold on January 29 for the first time in four meetings. With minimal Statement changes expected and no new rate/macro projections, the focus will be on Chair Powell’s press conference.

- He won't totally rule out a cut at the next meeting in March, but he’ll probably reiterate that the Fed can remain patient on its next move until receiving more clarity on both inflation data and the government policy outlook (i.e. not until later in the year). Markets continue to price between 1 and 2 cuts by end-2025.

- Aside from Tuesday’s preliminary durable goods report, data for the coming week is backloaded with the highlights being the first estimate of real GDP growth in Q4 on Thursday before the monthly PCE report for December on Friday.

PLEASE FIND THE FULL REPORT HERE: