EU AUTOMOTIVE: American Honda (HNDA: A3/A-/Au): Dual Tranche FV

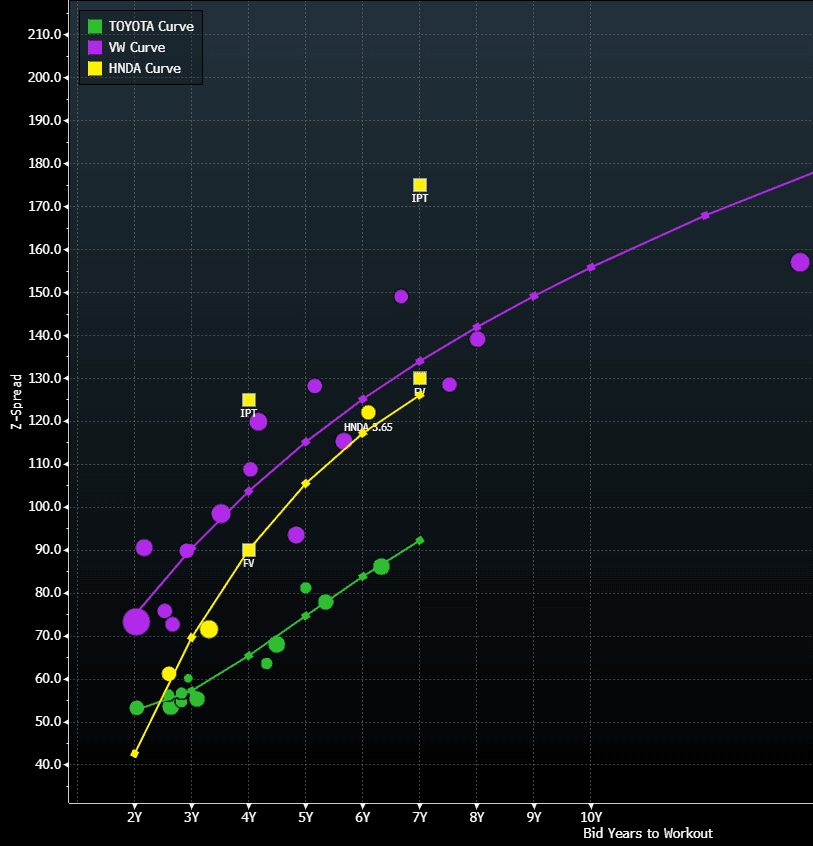

4yr IPT: €BMK 4yr +125-130a

• FV: we see ms+90

• 7yr IPT: €BMK 7yr +175a

• FV: we see ms+130 but does not mean it prices here.

• HNDA 3.65% Apr 31 came in July 24 ms+98 (in from ms+125 IPT). Currently screening ms+120/118. Curve should be worth c10bps to a 7yr looking at Toyota and VW curve. The FV is not a prediction of where the bond will price: it's an estimate of what it should be worth. 45bps inside IPT is probably a stretch.

Source: MNI/ Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Yields Pull Back Again With Consumer Growth Story In Question

Treasuries outperformed global counterparts Friday, fully completing a reversal from a midweek selloff.

- A large miss in January retail sales (-0.9% M/M vs 0.7% prior, -0.2% consensus) represented the biggest sequential drop in 22 months, with a similarly weak "control group" figure leading to a 0.5pp downgrade to the Atlanta Fed's GDP nowcast (to 2.3% GDP growth in Q1, i.e. no acceleration from Q4).

- That was enough to see the 10Y Treasury yield drop 7bp in the subsequent half hour, continuing the downtrend seen beginning in the immediate aftermath of Wednesday's hot CPI release. 10Y yields dropped over 21bp from the Wednesday high to Thursday's low, ultimately ending a tumultuous week 1.5bp lower.

- Yields ticked a little higher in afternoon trade Friday but the curve leaned bull steeper on the day, with the belly outperforming: 2-Yr yield is down 4.6bps at 4.261%, 5-Yr is down 5.7bps at 4.3328%, 10-Yr is down 5.1bps at 4.4782%, and 30-Yr is down 3.9bps at 4.6982%.

- In futures: Mar 10-Yr futures (TY) up 9/32 at 109-08 (L: 108-26 / H: 109-15.5).

- Other data (industrial production mixed, import prices soft) had little lasting impact.

- The coming week’s data schedule is relatively light, due in part to Monday’s Presidents Day holiday (SIFMA recommends bond cash close, equities closed), with initial jobless claims, February prelim PMIs, and regional Fed manufacturing surveys among the highlights. Supply includes 20Y Bond and 30Y TIPS auctions.

- We also get plenty of Fed communications including the January meeting minutes, and speaking appearances by both doves (Gov Waller) and hawks (St Louis Pres Musalem).

USDCAD TECHS: Bear Cycle Extends

- RES 4: 1.4948 High Mar 2003

- RES 3: 1.4814 High Apr 2003

- RES 2: 1.4503/1.4793 High Fb 4 / 3 and key resistance

- RES 1: 1.4380 High Feb 10

- PRICE: 1.4175 @ 16:54 GMT Feb 14

- SUP 1: 1.4107 50.0% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

- SUP 2: 1.4011 Low Dec 5 ‘24

- SUP 3: 1.3944 61.8% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

- SUP 4: 1.3894 Low Nov 11 ‘24

USDCAD broke lower Thursday, breaking out of a tight trading range this week and remains soft. A key support at 1.4261, the Jan 20 low, has been cleared and this signals scope for an extension of the current bear cycle - a correction. Scope is seen for a move towards 1.4107, a Fibonacci retracement. Initial firm resistance to watch is 1.4380, the Feb 10 high. A break would highlight an early bullish reversal signal.

OPTIONS: Mixed SOFR Rates Trade To Cap Week

Friday's US rates/bond options flow included:

- SFRH5 95.62p, traded half in 2k.

- SFRH5 96.93c, traded 0.25 in 4k.

- SFRH5 95.75/95.62ps 1x2, Traded 3.75 in 3k.

- SFRK5 97.00c, traded for 0.75 and 1 in 3k.

- SFRU5 95.93/95.81/95.68p fly, traded 1 in 1.5k

- SFRU5 96.50c, traded for 6.5 in 1.5k.

- SFRU5 95.87^, traded for 36 in 5k.

- SFRJ5 95.87/95.75/95.68p fly 1x3x2 with SFRK5 95.81/95.68/95.62p ladder 1x3x2, bought for 10 in 2k.

- SFRM5 95.68p, sold at 2.5 in 10k.

- 0QH5 96.00c, bought for 13 in 3k.

- TYH5 107p, bought for 11 in 15k

- TYJ5 107p, bought for 11 in 17k total.

- TYJ5 107/106ps, bought for 7 in 15k total.