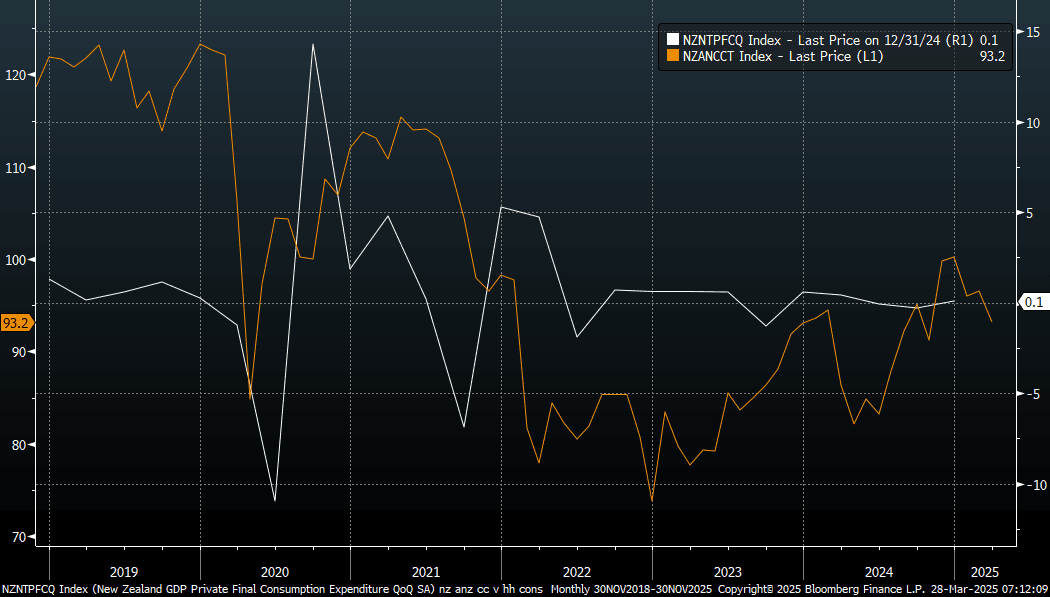

NEW ZEALAND: ANZ Consumer Confidence Measures Loses Further Ground

The ANZ New Zealand consumer confidence index fell to 93.2 in March, from 96.6 in Feb. This was a 3.5% m/m drop. The index is now back off late 2024 highs, which were around the 100 level. The chart below plots this consumer confidence measure against private consumption growth from NZ's national accounts. This suggests any upward momentum in consumption growth is likely to be fairly muted. This is consistent with other indicators suggesting a slow recovery process for the NZ economy. Still, confidence is well up from 2024 and 2023 lows.

- The detail of the survey showed a softer year ahead outlook for the economy, ticking down to -20, from -16 in Feb. Time to buy a major household item was little changed at -16 (-15 was the Feb read).

Fig 1: ANZ NZ Consumer Confidence & Private Consumption Growth

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

USDCAD TECHS: Bearish Theme Under Threat

- RES 4: 1.4948 High Mar 2003

- RES 3: 1.4814 High Apr 2003

- RES 2: 1.4503/1.4793 High Fb 4 / 3 and key resistance

- RES 1: 1.4380 High Feb 10

- PRICE: 1.4303 @ 16:50 GMT Feb 25

- SUP 1: 1.4151/4107 Low Feb 14 / 50.0% of Sep 25 - Feb 3 bull run

- SUP 2: 1.4011 Low Dec 5 ‘24

- SUP 3: 1.3944 61.8% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

- SUP 4: 1.3894 Low Nov 11 ‘24

The bear theme in USDCAD has weakened, however remains intact despite the rally off lows this week. The pair has recently cleared key support at 1.4261, the Jan 20 low. This strengthens a bearish set-up and signals scope for an extension of the current downtrend - a correction. Sights are on 1.4107, a Fibonacci retracement. Initial firm resistance to watch is 1.4380, the Feb 10 high. A move above this hurdle would highlight an early reversal signal.

US DATA: Services Activity Looks More Moderate In Feb, But Prices Look Steady

The three regional Fed services/non-manufacturing surveys for February (NY, Dallas, Philadelphia) are consistent with a slight moderation in national services activity versus January. Each of those three surveys' current activity indices fell in the month.

- However, they did not decline to the degree implied by the surprise 3.2 point pullback in the flash S&P PMI for the month (to 49.7). Conversely, February's ISM Services Index is currently estimated to print 53.0 in next week's release, an uptick from 52.8 in January.

- There is no consensus yet for ISM services prices paid (60.4 January). but prices in the regional services surveys were mixed: Philly Fed prices paid fell to 3-month lows but Dallas and NY Fed prices paid rose to multi-month highs.

- On aggregate regional services prices point to fairly steady inflationary pressures compared with the previous 6 months - in contrast to the clear increase in manufacturing prices paid in February amid tariff concerns.

AUDUSD TECHS: Bullish Outlook

- RES 4: 0.6471 High Dec 9 ‘24

- RES 3: 0.6429 High Dec 12 ‘24

- RES 2: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 1: 0.6409 High Feb 21

- PRICE: 0.6332 @ 16:49 GMT Feb 25

- SUP 1: 0.6315/6231 50-day EMA / Low Feb 10

- SUP 3: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.6000 Round number support

A bullish condition in AUDUSD remains intact despite the fade off highs this week. Sights are on key resistance at 0.6406/14 - the 100-dma and the 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg respectively. A clear break of both levels would set the scene for the next leg higher for the pair, making 0.6429 the next target, the Dec 12 ‘24 high. The 50-day EMA undercuts as support, crossing at 0.6315.