EM CEEMEA CREDIT: ARMEN: new issue deal USD 10Y benchmark

Mar-05 10:08

Rep of Armenia (ARMEN; Ba3/BB-/BB-)

“IPT: REPUBLIC OF ARMENIA $BMARK 10Y 7.5% AREA” – BBG

IPT @ 7.5% yield area

FV @ 7.125% yield or z+330bp

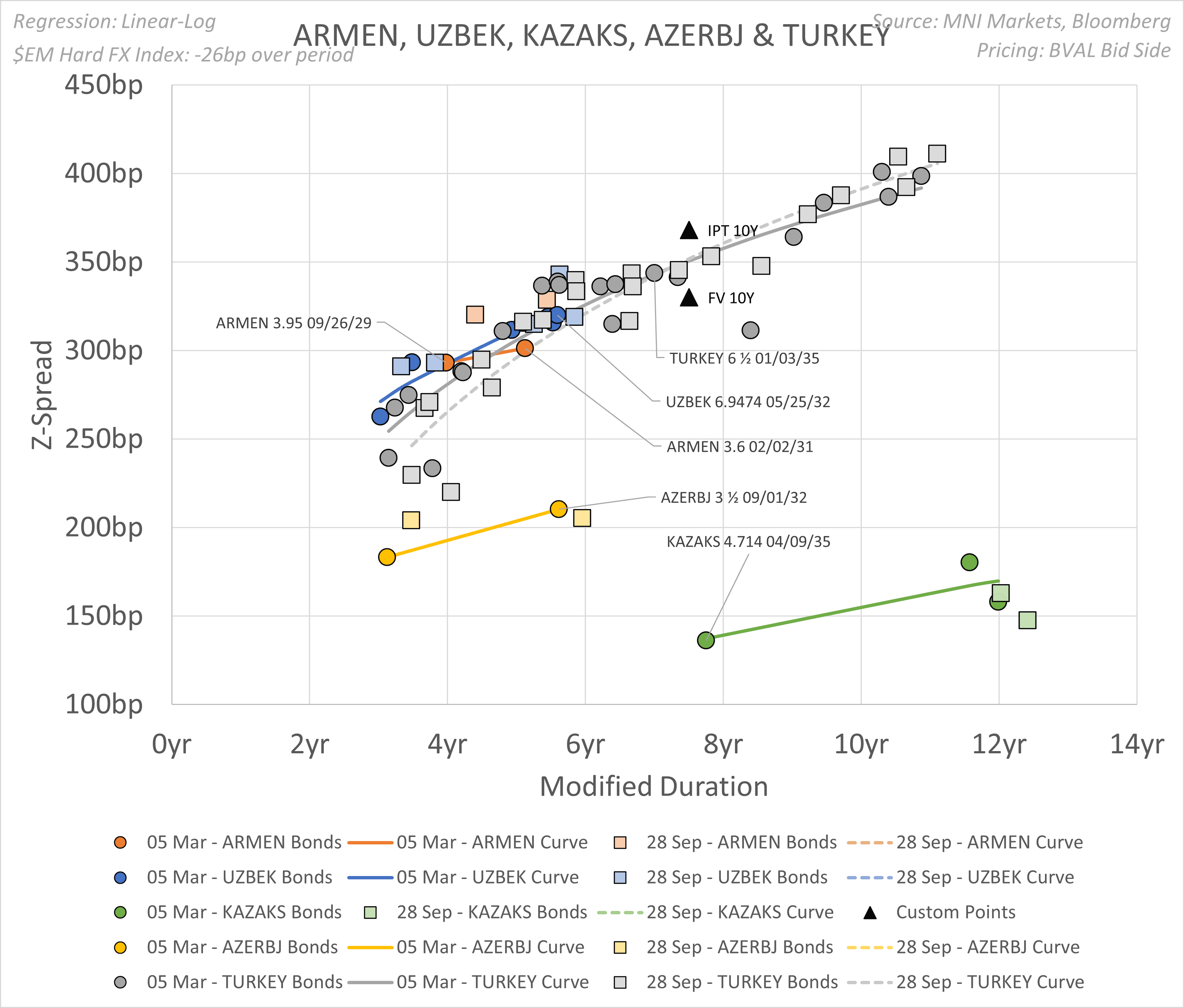

- For our FV considerations, we look at comparables across regional peers, including UZBEK and KAZAKS, AZERBJ and TURKEY sovereign curves. In particular, we focus on the more granular TURKEY USD secondary curve to gain some perspective.

- TURKEY 6.5 Jan35 is the most recent 10Y USD benchmark, issued at the end of Sep ’24, and charting @ z+345bp, which shows roughly unch vs issuance spread as Turkiye’s curve has steepened since but pivoting around 10Y point (see chart below). Over that timeframe, ARMEN curve has tightened some 27bp.

- When extrapolating ARMEN curve to 10Y, we take into consideration the steeper shape of Turkiye’s term structure to derive a FV @ z+330bp or 7.125% yield. That is some 15bp inside TURKEY 35s. For reference, that gives a 30bp spread pick up for curve extension vs shorter dated, low cash px ARMEN 3.6 Feb31 charting @ z+300bp.

- Armenia’s growth rate is heading back towards its longer-term levels. A slowdown in capital and labour inflows from Russia has meant real GDP growth has come down from elevated levels of 11% average between 2022-23 to around 6% in 2024 and expected to be 5% between 2025-27 (source: market consensus and rating agencies).

- Government debt is expected to reach around 55% of GDP in 2025 from about 50% in 2024, but still below the peak of 63.5% in 2020. Armenia’s debt burden remains modest, but the relative high share of foreign currency debt makes the governments balance sheet vulnerable to exchange rate movements.

Geopolitical risks are still elevated as highlighted by rating agencies, even though tensions between Armenia and Azerbaijan have eased somewhat since Azerbaijan regained control of the Nagorno-Karabakh region in a rapid military offensive in 2023. Armenia’s reliance on Russian energy (90% of total gas in Armenia and 60% of total energy used) as well as economic dependence (40% of Armenia exports were to Russia in 2023) still pose a concern (data source: S&P Ratings).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURIBOR: EURIBOR FIX - 03/02/25

Feb-03 10:07

Source: EMMI/Bloomberg

- EUR001W 2.7870 -0.0140

- EUR001M 2.6440 -0.0160

- EUR003M 2.5620 -0.0270

- EUR006M 2.5360 -0.0540

- EUR012M 2.4360 -0.0830

MNI: ITALY JAN FLASH HICP -0.7% M/M, +1.7% Y/Y

Feb-03 10:00

- MNI: ITALY JAN FLASH HICP -0.7% M/M, +1.7% Y/Y

MNI: EUROZONE JAN FLASH HICP +2.5% Y/Y

Feb-03 10:00

- MNI: EUROZONE JAN FLASH HICP +2.5% Y/Y

- MNI: EUROZONE JAN FLASH CORE HICP +2.7% Y/Y