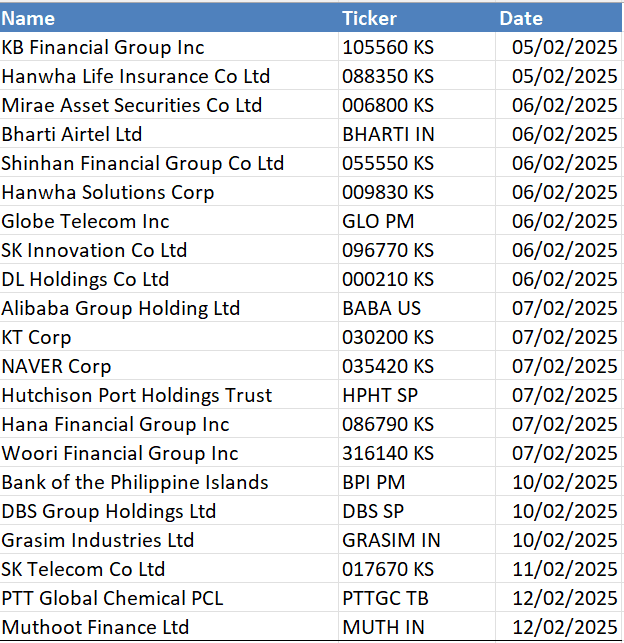

EM ASIA CREDIT: Asia EM Results Calendar - Next 7 Days

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURGBP TECHS: Resistance Remains Intact

- RES 4: 0.8448 High Oct 31 and reversal trigger

- RES 3: 0.8376 High Nov 19 and a bull trigger

- RES 2: 0.8356 High Nov 27

- RES 1: 0.8313/29 50-day EMA / High Dec 27

- PRICE: 0.8287 @ 06:38 GMT Jan 6

- SUP 1: 0.8263/23 Low Dec 31 / 19

- SUP 2: 0.8203 Low Mar 7 2022 and a major support

- SUP 3: 0.8200 Round number support

- SUP 4: 0.8188 1.00 proj of the Oct 31 - Nov 11 - 19 price swing

EURGBP is unchanged and continues to trade closer to its recent highs. Resistance at 0.8313, the 50-day EMA, has recently been pierced. A clear breach of the average would undermine the bear theme and highlight a stronger reversal. A resumption of the primary downtrend would pave the way for a move towards major support at 0.8203, the Mar 7 ‘22 low and the lowest point of a multi-year range.

CHINA PRESS: PBOC Sends Stronger Signal To Stabilise Yuan

The People's Bank of China has sent a clearer and stronger signal on stabilising the yuan in its Q4 monetary policy meeting, emphasising “strengthening market management” whilst deleting “enhancing exchange rate flexibility” which appeared in its Q3 meeting, PBOC-run newspaper Financial News reported. The PBOC showed determination to maintain yuan stability by restoring its previous “three resolutes” statement, meaning to resolutely deal with market order-disrupting behaviors, prevent the formation of unilateral expectations and their self-realisation, as well as guard against the risk of exchange rate overshooting, the newspaper said.

SCHATZ TECHS: (H5) Fresh Cycle Low

- RES 4: 107.365 High Dec 12

- RES 3: 107.170 High Dec 20

- RES 2: 107.065 20-day EMA

- RES 1: 106.965 High Jan 3

- PRICE: 106.765 @ 06:14 GMT Jan 6

- SUP 1: 106.735 Intraday low

- SUP 2: 106.712 1.764 proj of the Dec 2 - 6 - 12 price swing

- SUP 3: 106.680 Low Nov 20 (cont)

- SUP 4: 106.645 Low NOv 18 (cont)

The current bear cycle in Schatz futures remains intact and recent weakness reinforces this theme, including today’s fresh cycle low. The Jan 3 sell-off confirmed a resumption of the bear leg and sights are on 106.712, a Fibonacci projection. Initial firm resistance is seen at 107.065, the 20-day EMA. A clear break of it would highlight a potential reversal. For now, short-term gains would be considered corrective.