ASIA STOCKS: Asian Equity Flows Mixed As India Continues To See Heavy Selling

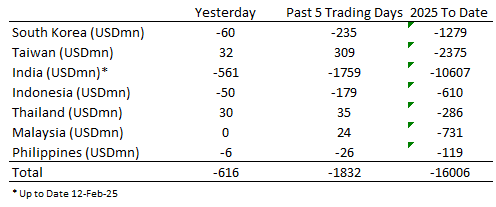

Muted flows on Thursday, Indonesia saw a slight increase in outflows above the recent averages, while India continues to see heavy outflows, with $10.6b of selling ytd.

- South Korea: Recorded -$60m in outflows yesterday, bringing the 5-day total to -$235m. YTD flows remain negative at -$1.28b. The 5-day average is -$47m, worse than the 20-day average of -$102m and the 100-day average of -$126m.

- Taiwan: Posted +$32m in inflows yesterday, bringing the 5-day total to +$309m. YTD flows remain negative at -$2.38b. The 5-day average is +$62m, better than the 20-day average of -$184m and the 100-day average of -$55m.

- India: Recorded -$561m in outflows Wednesday, bringing the 5-day total to -$1.76b. YTD outflows remain significant at -$10.61b. The 5-day average is -$352m, worse than the 20-day average of -$329m and the 100-day average of -$202m.

- Indonesia: Posted -$50m in outflows yesterday, bringing the 5-day total to -$179m. YTD flows are negative at -$610m. The 5-day average is -$36m, worse than the 20-day average of -$20m and the 100-day average of -$28m.

- Thailand: Saw +$30m in inflows yesterday, bringing the 5-day total to +$35m. YTD flows remain negative at -$286m. The 5-day average is +$7m, better than the 20-day average of -$8m and the 100-day average of -$17m.

- Malaysia: Registered $0m in inflows yesterday, bringing the 5-day total to +$24m. YTD flows are negative at -$731m. The 5-day average is +$5m, better than the 20-day average of -$26m, but in line with the 100-day average of -$26m.

- Philippines: Recorded -$6m in outflows yesterday, bringing the 5-day total to -$26m. YTD flows remain negative at -$119m. The 5-day average is -$5m, in line with the 20-day average of -$3m and the 100-day average of -$3m.

Table 1: EM Asia Equity Flows

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: ACGB Dec-34 Auction Result

The AOFM sells A$800mn of the 3.50% 21 December 2034 bond, issue #TB168:

- Average Yield (%): 4.6378 (prev. 4.4329)

- High Yield (%): 4.640 (prev. 4.4350)

- Bid/Cover: 2.8875x (prev. 2.8375x)

- Amount Allotted at Highest Accepted Yield as % of Amount Bid at that Yield (%): 49.1 (prev. 17.2)

- Bidders: 34 (prev. 34), 17 (prev. 19) successful, 10 (prev. 9) allocated in full

ASIA STOCKS: Foreign Investors Keep Selling Asian Equities To Start The Year

Outflows in all regions on Tuesday with Taiwan continuing to decent selling following chips restrictions being announced from the US, however, while Nvidia has announced they will plan to build a headquarters in Taiwan. India has had the worst start to the year with 2.6b of outflows so far.

- South Korea: Recorded outflows of -$148m yesterday, contributing to a 5-day total of -$287m. YTD flows are flat at $0. The 5-day average is -$57m, worse than the 20-day average of -$70m and the 100-day average of -$146m.

- Taiwan: Experienced outflows of -$352m yesterday, resulting in a 5-day total of -$3.87b. YTD flows are negative at -$2.57b. The 5-day average is -$773m, significantly worse than the 20-day average of -$188m and the 100-day average of -$126m.

- India: Posted outflows of -$495m yesterday, contributing to a 5-day total of -$2.06b. YTD flows are negative at -$2.62b. The 5-day average is -$411m, worse than the 20-day average of -$223m and the 100-day average of -$49m.

- Indonesia: Registered outflows of -$39m yesterday, with the 5-day total at -$94m. YTD flows are negative at -$244m. The 5-day average is -$19m, slightly better than the 20-day average of -$34m, but worse than the 100-day average of +$5m.

- Thailand: Recorded outflows of -$63m yesterday, resulting in a 5-day total of -$188m. YTD flows are negative at -$122m. The 5-day average is -$38m, worse than the 20-day average of -$11m and the 100-day average of -$6m.

- Malaysia: Posted outflows of -$55m yesterday, contributing to a 5-day total of -$203m. YTD flows are negative at -$261m. The 5-day average is -$41m, worse than the 20-day average of -$26m and the 100-day average of -$15m

- Philippines: Recorded outflows of -$15m yesterday, resulting in a 5-day total of -$38m. YTD flows are negative at -$52m. The 5-day average is -$8m, worse than the 20-day average of -$7m but equal to the 100-day average of $0m.

Table 1: EM Asia Equity Flows

JGBS: Futures Uptick, US Tsys Directionless Ahead Of CPI

In Tokyo morning trade, JGB futures are slightly stronger, +3 compared to settlement levels.

- M2 & M3 Money Stock 1.3% y/y and 0.8% y/y respectively in December.

- Overnight, US yields finished slightly mixed after US PPI printed softer than expected. They were lower at the front end but higher at the back end. The 10-year yield finished at 4.79%.

- Focus turns to tomorrow's headline CPI inflation data for December where rental inflation is expected to accelerate to an average figure that firmly rounds to 0.3% M/M in December. Core goods inflation will be closely looked at amidst heavy focus on potential tariffs under the second Trump administration but also with a further near-term dampening factor from continued US dollar appreciation. Fed Beige Book is released at 1400ET.

- Today, the local calendar will also see Machine Tool Orders data alongside BoJ Rinban Operations covering 1-10-year and 25-year+ JGBs.