EU CONSUMER CYCLICALS: Avolta: Moody's stays unch after earnings

Mar-19 16:35

(DUFNSW; Ba2/BB+: Stable)

- Moody's has adj. gross leverage around 4.0x vs. rating threshold of 3.0-4.0x.

- company reported net 2.1x vs. target 1.5-2.0x (pre-IFRS/leases)

- Notes no issue on cash generation and expects CHF300m/yr after dividends

- This is NOT a rising star - it has reaffirmed last week it has no interest in IG rating (i.e. taking leverage towards 1.5x)

- co's capital allocation used to be 1/3 to each of capex, dividends & deleveraging. But now it is in target it is sending excess to equity holders (in FY24 72% of E-FCF).

- co's capital allocation used to be 1/3 to each of capex, dividends & deleveraging. But now it is in target it is sending excess to equity holders (in FY24 72% of E-FCF).

- 1/2 exposed to EMEA, 1/3 exposure to US.

- Latter is facing travel weakness (Avolta + US airlines reporting this)

- Group seems to be doing fine with +6% organic growth (net +9.5%) in first 2 months of this year

- Keep in mind some airlines are reporting deterioration into March

- FY25 Guidance is the medium-term target (+5-7%, with +20-40bp EBITDA expansion)

We don't expect supply; front maturity includes the CHF300 senior and CHF500m convertible both due in '26 - unclear if it will refi in CHF. Levels are tad un-interesting outside the shortest 27s (at OAS+130/3.5%) with flat rotations into Air-France and pick-up into Carnival 30s and Finnair 29s.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GERMAN DATA: Weekly Activity Continues Recovery Amidst Less Restrictive Policy

Feb-17 16:21

- ECB officials have been looking to downplay neutral rate deliberations, with the deposit rate at 2.75% and staff research pointing to neutral range of 1.75-2.25% (which the market sees reaching the top of this band in June and mid-point in October).

- ECB President Lagarde, whilst aligning herself to this 1.75-2.25% range, has been keen to point out that this hasn’t been meaningfully discussed in Governing Council meetings, being “entirely premature” for debate whilst policy is currently restrictive (a term our policy team sees remaining in place - see MNI SOURCES: ECB Likely To Tweak Language, Keep "Restrictive" - Feb 4).

- However, with Lagarde pledging the bank “will be looking out of the window” as part of its clear data dependent stance, we watch for high frequency metrics that suggest policy could be starting to be less restrictive.

- Germany is a good starting point here, clearly underperforming its major Eurozone country counterparts for some time now (not least Q4 real GDP growth at -0.2% Y/Y vs 0.9% for the Eurozone, with Spain 3.5% Y/Y, France 0.7% Y/Y and Italy 0.5% Y/Y).

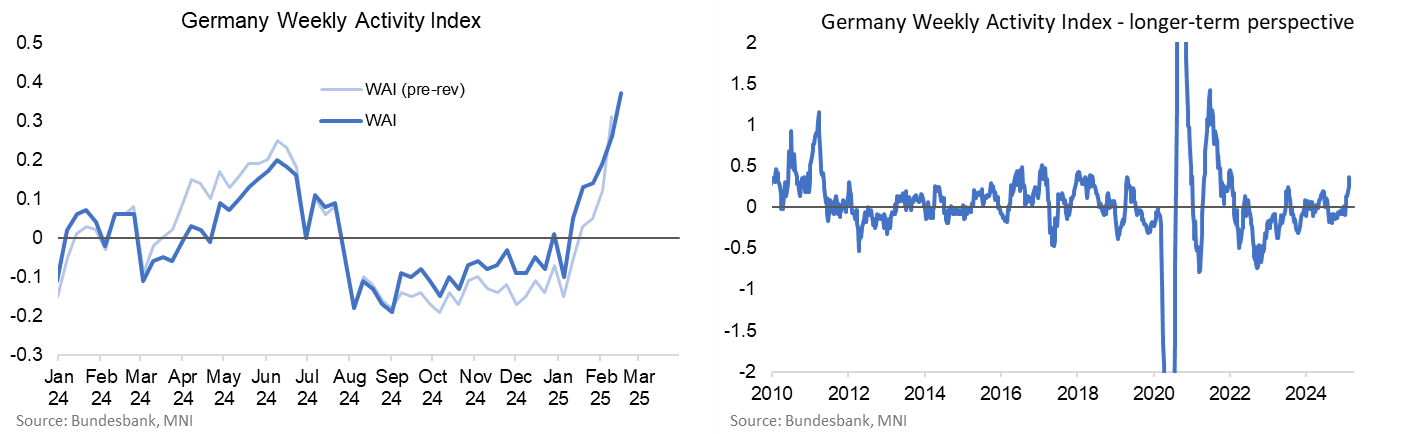

- To this end, we note an impressive increase in the Bundesbank’s weekly activity index since January, an indicator that collates a range of non-traditional inputs.

- Rising to 0.37 in today’s weekly update from a downward revised 0.26 (initial 0.31), it set a fresh high since early 2022. It indicates trend-adjusted economic activity in the 13 weeks to Feb 16th was 0.4% higher than in the preceding 13 weeks, translating to quarterly GDP growth of 0.9% per the press release.

- We caution putting too much weight on this measure, not least because of its wide-ranging revisions (see chart) and GDP tracking (see press release), but it nevertheless bears watching other more traditional releases for a similar improvement in the months ahead.

OPTIONS: Larger FX Option Pipeline

Feb-17 16:15

- EUR/USD: Feb19 $1.0500(E1.6bln); Feb20 $1.0400-10(E2.7bln), $1.0430-35(E3.0bln), $1.0520-25(E1.5bln); Feb21 $1.0400(E1.5bln)

- USD/JPY: Feb19 Y155.00-20($1.7bln); Feb20 Y154.00($3.0bln)

- NZD/USD: Feb19 $0.5450(N$1.7bln)

- USD/CAD: Feb21 C$1.4500($1.2bln), C$1.4600($1.7bln)

- USD/CNY: Feb20 Cny7.2000($1.9bln), Cny7.2500($1.4bln), Cny7.3700($1.3bln)

STIR: SONIA / Euribor Z5 Spread Tightens In Tandem With The Long End

Feb-17 16:00

The SONIA / Euribor Z5 implied yield spread has tightened 2.5bps today to 186bps, mirroring moves in the long-end.

- After opening up to 5.0 ticks lower at the open, SONIA futures are now little changed on versus Friday’s settlement levels. Euribor futures are -1.0 to -3.5 ticks through the blues, with the strip steepening a little.

- ECB-dated OIS price 77bps of easing through year-end, corresponding to an implied deposit rate of 1.98%. Meanwhile, BOE-dated OIS price 57bps of easing through December, implying a Bank Rate of 3.93%.

- Earlier this morning, BOE Governor Bailey said the slightly stronger-than-expected flash Q4 GDP print does not alter the general story for the UK economy, while re-iterating the Bank’s gradual and careful approach to rate cuts.

- Tomorrow’s data calendar is headlined by the UK December/January labour market data. MNI’s full inflation/labour market preview will be released later today.

- ECB Executive Board Member Cipollone will also speak on the ECB’s balance sheet at an MNI Event at 1400GMT/1500CET (sign up here).