EM ASIA CREDIT: Bank of Thailand to support property sector

"*BANK OF THAILAND TEMPORARILY EASES LOAN-TO-VALUE MORTGAGE RULES" - BBG

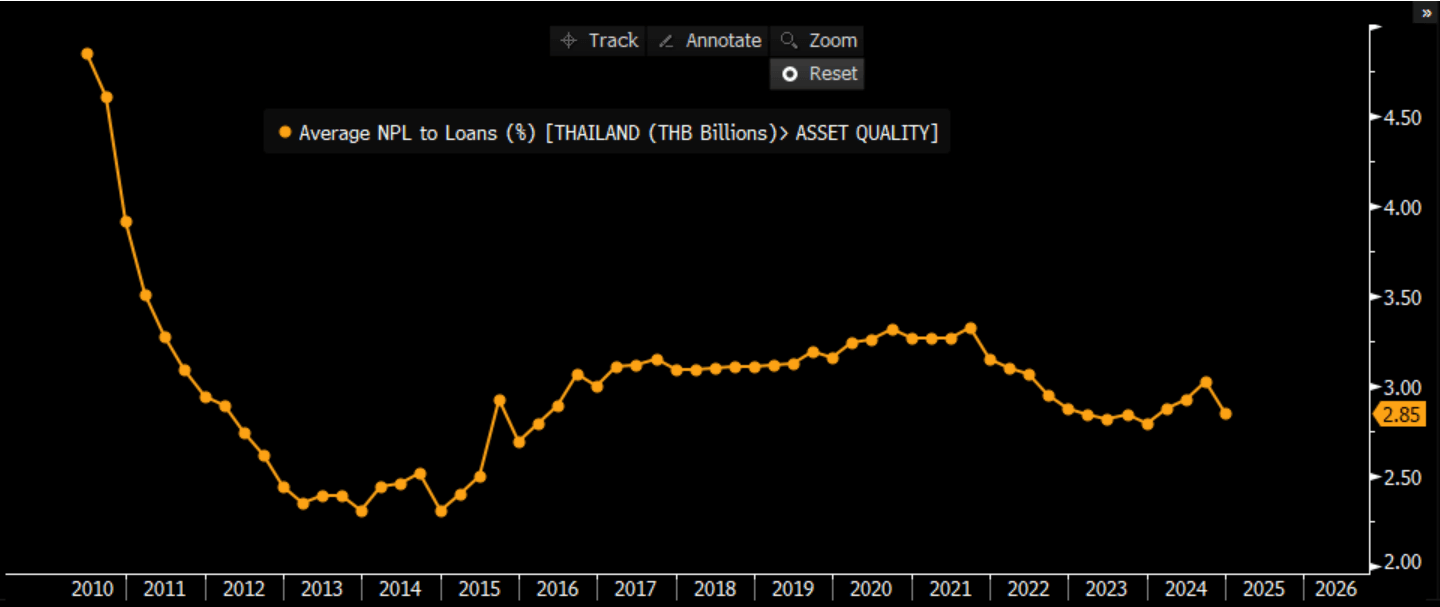

* In principle, relaxing LTV for mortgages can drive volumes as well as profits, but asset quality will be key. According to Bank of Thailand statistics, average non-performing loans to outstanding loans were at 2.85% end 2024, close to the lows.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: A very busy overnight session

- It is another very busy overnight session for Bund, decent traded volumes and already a 44 ticks range, looking where futures is, this will mean that the 10yr Yield will be quoted above 2.50% post Cash open.

- Weaker JGB 20yr Auction, Ukraine Defence spending talks, Tariffs risks, Hawkish Fed Waller "Latest Data supports rates on Hold" have helped keep the pressure on Core Govies.

- The small beat in the UK data had not impact in Bund, on the contrary it is finding a small base, cash flow led buying.

- Next immediate support in Bund is at 131.62, followed by 131.00.

- Resistance moves down to 132.59 20-day EMA.

- It is another light day on the Data front with the main focus on Friday's PMIs this week.

- Today sees, German ZEW and for North America, the Canadian CPI.

- SUPPLY: UK £1.75bn 2063 (Equates to 27.5k Gilt) should weigh, Germany €4.5bn Schatz (equates to 47.9k Schatz) will weigh, Finland 5s, 10s (won't impact Bund).

- SPEAKERS: ECB Holzmann, Cipolonne (at MNI), BoE Bailey, Fed Daly, Barr.

UK DATA: First glance a mixed data set, tilting towards better than expected

- Private regular AWE a touch lower than expected, whole economy regular AWE broadly in line, whole economy inc bonus marginally higher than exp.

- PAYE payrolls revised significantly (again). +20.7k in Jan and -13.9k in Dec (rather than -47k in Dec)

- LFS unemployment rate at 4.4% (rounded). BOE looked for 4.45%, consensus 4.5% (rounded).

- More to follow.

AUDUSD TECHS: Bulls Remain In The Driver’s Seat

- RES 4: 0.6471 High Dec 9 ‘24

- RES 3: 0.6429 High Dec 12 ‘24

- RES 2: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 1: 0.6384 High Dec 13

- PRICE: 0.6360 @ 07:03 GMT Feb 18

- SUP 1: 0.6305/6231 50-day EMA / Low Feb 10

- SUP 3: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.6000 Round number support

AUDUSD is trading at its recent highs and a bull theme remains intact. The pair has cleared 0.6331, the Jan 24 high and a key short-term resistance. The breach highlights a stronger reversal and paves the way for gains towards 0.6414, a Fibonacci retracement. Note that moving average studies remain in a bear-mode position. This suggests the latest recovery is a correction. Initial firm support to watch is 0.6231, the Feb 10 low.