EU CONSUMER STAPLES: Barry Callebaut; 1H follow up thoughts

(BARY; Baa3 Neg now/BBB- Stable)

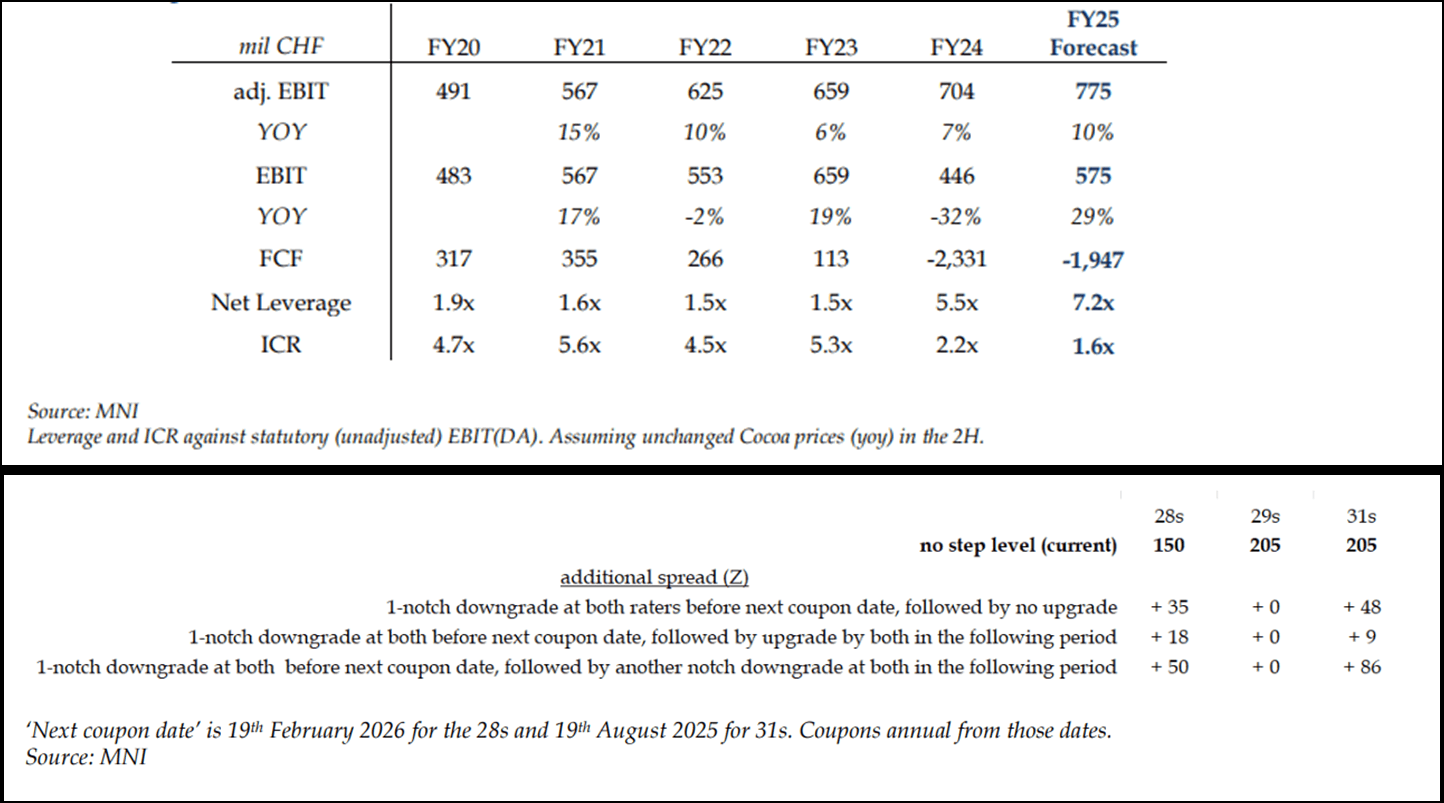

Updated numbers we see on leverage post 1H update here. Moody's is giving it runway and is likely looking at Cocoa that is now down yoy as support for that. The two takeaways from us would be firstly Cocoa prices remains in the driver seat and secondly we struggle to see value on the non-step 29s - when the curve is this wide, all lines will rally/roll down if no downgrade occurs but downside protection only exists on 28/31s - the premium, particularly on the 31s, looks under-priced on that insurance.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: March Economic Projections: Higher Inflation, Weaker Growth, Same Rates

The MNI Markets Team’s expectations for the updated Economic Projections in the March SEP are below.

- The unemployment rate is likely to rise slightly for 2025 alongside a downgrade in GDP growth, while the 2025 core and headline PCE inflation projections are set to rise again. Changes to later years will likely be limited, however.

- More detail on the shift in Fed funds rate medians is in our meeting preview - we will add more color next week.

FED: Market Pricing Nearly 3 2025 Cuts As Conditions Tighten

Amid rising government policy uncertainty, sentiment among businesses and consumers has fallen sharply since the start of the year, while equities and the dollar have reversed their post-election rise. Overall, financial conditions have tightened, even if stress is not yet mounting, e.g. no major widening of credit spreads (the accompanying chart shows the Fed’s financial conditions impulse index but only through January).

- Combined with growth fears, this has affected expectations for the Fed’s rate path, with around 18bp more cuts expected in 2025 compared with what was seen after the January FOMC. 65bp of cuts are priced for the year as a whole. 2025 cut pricing reached 71bp before the February inflation data and 76bp before the February payrolls report.

- A rate cut is seen with near zero probability for March’s meeting, but the first full cut is just about priced for June, with a second nearly priced by September.

- Chair Powell has no reason to endorse or refute these expectations – he’s likely to be happy with a press conference that ends with little discernable change in pricing.

CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX

- CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX