CHILE: BCCh Publishes December Monetary Policy Report

- The BCCh has published its December monetary policy report here.

- "*CHILE CENBANK SEES END-2024 INFLATION AT 4.8%; WAS 4.5% BEFORE"

- "*CHILE CENBANK SEES END-2025 INFLATION AT 3.6%; WAS 3.6% BEFORE"- BBG

- "*CHILE CENBANK SEES '24 GDP GROWTH AT 2.3%; WAS 2.25% TO 2.75%"

- "*CHILE CENBANK SEES '25 GDP AT 1.5% TO 2.5%; WAS 1.5% TO 2.5%" - BBG

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ECB: Weekly ECB Speak Wrap (Nov 11 – Nov 18)

The potential impact of US tariffs and the weak Eurozone growth outlook have once again been prevalent in the past week’s ECB-speak. Concerns around the negative growth impact of US trade policy prompted further dovish repricing in ECB-dated OIS, though short-end pressure this morning (Nov 18) has reversed a good portion of those moves. ECB-dated OIS currently price 139bps of easing through December 2025, down from ~145bps at Friday’s close but still above the 135bps seen on November 8.

Overall, the conclusions from the MNI Policy Team’s latest sources piece on November 7 continue to hold: A 25bps cut is almost assured at the December meeting (consistent with market pricing), while the ECB is set to retain its meeting-by-meeting and data-dependent approach (consistent with Schnabel’s remarks on forward guidance).

In the following PDF, we provide a summary of ECB-speak from November 11 to November 18 and summarise commentary since the October meeting by speaker and topic: 241118 - Weekly ECB Speak Wrap.pdf

STIR: BLOCK: Mar'25 SOFR Put Tree

- -10,000 SFRH5 95.37/95.50/95.62 put trees, 1.0 net ref 95.785 at 0651:21ET

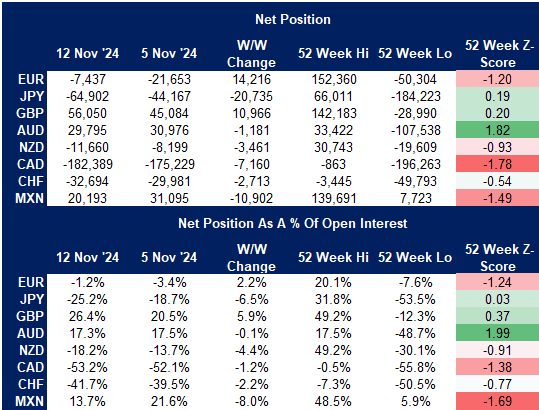

CFTC: Markets Built USD Exposure, Trim MXN Long in Wake of Election

- Markets aggressively trimmed MXN exposure in the wake of the election results, with the week-ending 12 Nov showing the net long MXN position dropping by 11k contracts to put the net position at 13.7% of open interest, and not too far off 5.9%, the 52w low. This puts the positioning Z-score at -1.69, the lowest among all currencies surveyed.

- Elsewhere, markets built the GBP net long, while building the net short JPY, NZD, CAD and CHF position, meaning markets built their exposure to the USD alongside the broad greenback rally that accompanied the election results.

Full dataset here: