EM LATAM CREDIT: Brazil's Banco Bradesco Earnings: (BRADES; Ba1pos/BB/BB+neg)

“Bradesco 4Q Recurring Net Income Beats Estimates” – BBG

Neutral for spreads

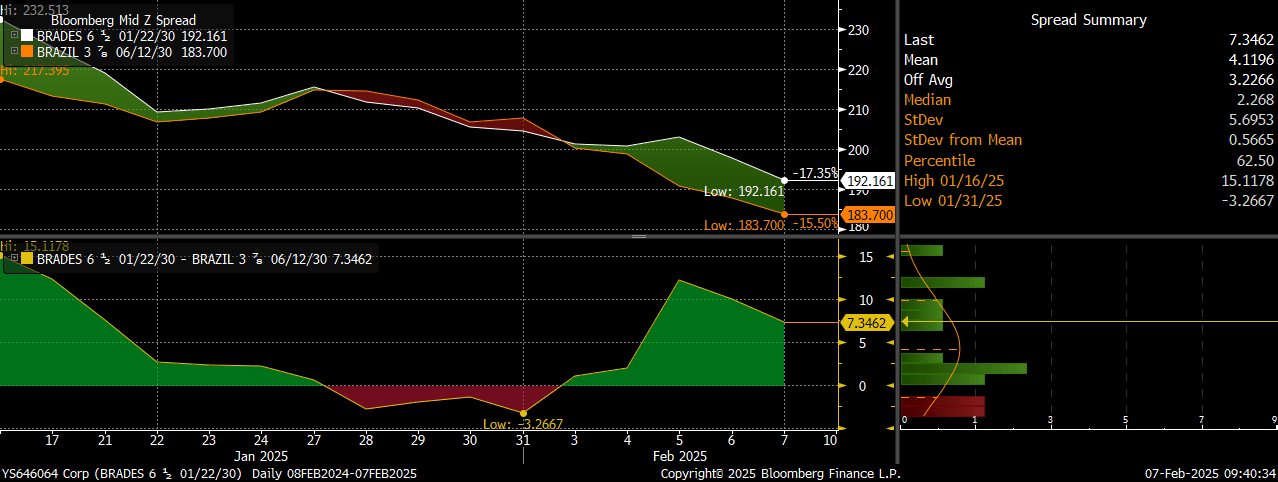

• Third largest Brazil bank by assets issued USD750mn of a senior unsecured five year note about three weeks ago that has tightened 40 bps, for the most part tracking the Brazil sovereign and driven by a huge rally in US Treasuries.

• Bradesco numbers looked good with a continuation of controlled growth emphasizing a lower margin but more stable secured loan portfolio. Net income was up 20% y/y while the loan portfolio grew 12% and fee income increased by 13.7%.

• Bradesco stock was down 3% in early trading as the market was a bit disappointed with guidance. Management expressed some concern about Brazil macroeconomic trends and presented what was perceived to be conservative guidance going forward. Worth noting from a bond holder perspective, Fitch rates Bradesco ‘BB+’, one notch above the sovereign, due to its stand alone business strength in terms of diversification of business lines, percentage of low cost stable core deposits, loan portfolio quality, reserves and capitalization.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: Best traded Volumes since Mid December in Bund to start 2025

- No surprises in seeing a decent start of the Year in Bund and EGB's given the Busy Week on the Data front and heavy supply.

- Risks Events and Trump have also provided further liquidity.

- This Week's volumes in Bund have been the best since the 12th December, and the contract has only seen 4 sessions for the December Expiry with higher volumes, but we still haven't had the US NFP on Friday yet.

STIR: Dec Hawkish Extreme In Year-End BoE Pricing Holds, Before Fade To 49bp

The hawkish repricing in Dec ’25 BoE-dated OIS stopped at the hawkish extreme seen in December, pricing ~44bp of cuts through year-end, before a fade back to ~49bp.

- These levels probably look enticing for those that have a received bias, although continued worry surrounding the UK fiscal situation could limit dovish moves.

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Feb-25 | 4.540 | -16.0 |

Mar-25 | 4.506 | -19.4 |

May-25 | 4.403 | -29.7 |

Jun-25 | 4.380 | -32.0 |

Aug-25 | 4.310 | -39.0 |

Sep-25 | 4.281 | -41.9 |

Nov-25 | 4.233 | -46.8 |

Dec-25 | 4.213 | -48.7 |

MNI:US NOV WHOLESALE INV -0.2%; SALES 0.6%

- MNI:US NOV WHOLESALE INV -0.2%; SALES 0.6%