AMERICAS OIL: Canadian Crude Outlook Remains Bullish: Kpler

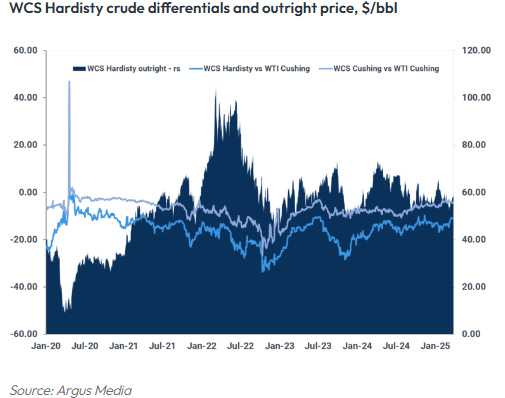

Canadian crudes look set to continue receiving support as USGC buyers are forced to find alternatives to Venezuelan barrels, Kpler said.

- The USGC typically receives around 200k b/d of heavy sour barrels from Venezuela.

- Alternative grades in the Americas could be the likes of Canada’s Cold Lake Blend.

- US refinery runs are seen rising further in the coming weeks, while Venezuelan flows will find increasing pressure, likely to support WCS Hardisty prices in the near term.

- Further upside will emanate from seasonally declining crude supply in Alberta, as well as continued tight inventories in Western Canada, Kpler said.

- Canadian grades also look set to avoid tariffs into the US, which had been a concern for both Alberta’s producers and for US refiners.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

INTERNATIONAL TRADE: Trump-"If Companies Move To US, There Are No Tariffs"

Posting on the Truth Social platform, US President Donald Trump says, "IF COMPANIES MOVE TO THE UNITED STATES, THERE ARE NO TARIFFS!!!".

- Reports in recent months have raised the trend of both US-owned firms with production based overseas or foreign firms that rely strongly on the US market for demand, contemplating shifting production to the US to avoid being targeted by the Trump administration.

- On 3 March, Anadolu Agency wrote "Major South Korean companies are assessing ways to minimize the impact of new US tariffs on imports from Canada and Mexico, with some considering relocating production to the United States, officials said Sunday. [...] South Korean electronics giants LG Electronics and Samsung Electronics, which have manufacturing operations in the affected countries, are exploring options to bypass the tariffs."

In January, CNBC reported that a "record share of U.S. companies in China are accelerating their plans to relocate manufacturing or sourcing, according to a business survey [...]. About 30% of the respondents considered or started such diversification in 2024, surpassing the prior high of 24% in 2022, according to annual surveys from the American Chamber of Commerce in China."

STIR: BLOCK: Dec'25 SOFR Ratio Put Spread

- 5,000 SFRZ5 96.12/96.50 3x2 put spds, 18.5 net ref 96.44 to -.435 from 1043-1046ET

US STOCKS: BLOCK: June'25 2Y Buy

- +7,000 TUM5 103-22.5, post time offer at 1039:47ET, DV01 $257,000. The 2Y contract trades 103-22.38 last (+6)