JGBS: Cash Bonds Holding A Twist-Steepener At Lunch

Apr-18 02:59

At the Tokyo lunch break, JGB futures are stronger, +21 compared to settlement levels, after a choppy morning session following the release of National CPI data.

- Headline CPI rose 3.6% y/y last month, driven in part by surging rice prices, lending support to the central bank's cautious approach to rate hikes. Meanwhile, core CPI-excluding fresh food-climbed 3.2% in March from a year earlier, in line with the median forecast of economists surveyed by Bloomberg.

- “Japanese Finance Minister Katsunobu Kato says in parliament that his expected upcoming meeting with US Treasury Secretary Scott Bessent will be conducted based on the shared understanding on currency reached during their meeting in January.” (per BBG)

- " Japan’s government isn’t considering compiling a fresh economic stimulus package to offset the impact of US tariffs, Prime Minister Shigeru Ishiba says Friday.” (per BBG)

- Cash US tsys are closed today for the Good Friday holiday after yesterday's bear-steepener.

- Cash JGBs have twist-steepened across benchmarks, pivoting at the 20-year, with yields 1bp lower to 3bps higher. The benchmark 10-year yield is 0.5bp lower at 1.311% versus the cycle high of 1.596%.

- Swap rates are 2bps lower to 1bp higher, with a steepening bias. Swap spreads are mixed.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA STOCKS: Korean Inflows Continue.

Mar-19 02:59

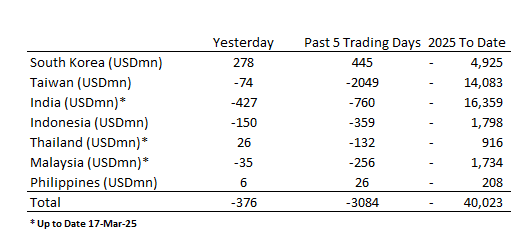

South Korea recorded a third successive day of inflows as outflows dominated elsewhere.

- South Korea: Recorded inflows of +$278m yesterday, bringing the 5-day total to +$445m. 2025 to date flows are -$4,925m. The 5-day average is +$89m, the 20-day average is -$172m and the 100-day average of -$113m.

- Taiwan: Had outflows of -$74m yesterday, with total outflows of -$2,049 m over the past 5 days. YTD flows are negative at -$14,083m. The 5-day average is -$410m, the 20-day average of -$590m and the 100-day average of -$208m.

- India: Saw outflows of -$427m as of the 17th, with a total outflow of -$760m over the previous 5 days. YTD outflows stand at -$16,359m. The 5-day average is -$152m, the 20-day average of -$288m and the 100-day average of -$197m.

- Indonesia: Posted outflows of -$150m yesterday, bringing the 5-day total to -$359m. YTD flows are negative at -$1,798m. The 5-day average is -$72m, the 20-day average is -$62m the 100-day average of -$35m.

- Thailand: Recorded inflows of +$26m yesterday, totaling -$132m over the past 5 days. YTD flows are negative at -$916m. The 5-day average is -$26m, the 20-day average of -$38m the 100-day average of -$19m.

- Malaysia: Experienced outflows of -$35m as of 17th, contributing to a 5-day outflow of -$256m. YTD flows stand at -$1,734m. The 5-day average is -$51m, the 20-day average of -$45m the 100-day average of -$33m.

- Philippines: Saw inflows of +$6m yesterday, with net inflows of +$26m over the past 5 days. YTD flows are negative at -$208m. The 5-day average is +$5m, the 20-day average of -$3m the 100-day average of -$7m.

MNI: MNI BOJ KEEPS OVERNIGHT CALL RATE AT 0.50%

Mar-19 02:25

- MNI BOJ KEEPS OVERNIGHT CALL RATE AT 0.50%

- BOJ: POLICY DECISION BY UNANIMOUS VOTE

AUSSIE BONDS: Slightly Cheaper, Subdued Ahead Of FOMC Decision & Jobs Data

Mar-19 02:24

ACGBs (YM -1.0 & XM -1.5) are slightly weaker, with dealings muted ahead of tomorrow’s FOMC decision (local time) and the February Employment Report.

- The Westpac leading index for February rose 0.07% m/m after 0.1% bringing the 6-month annualised rate to 0.8% from 0.6%, the highest in almost two years. The 6-month rate leads detrended growth by 3 to 9 months, thus it is signalling that at this point growth should gradually improve over the year consistent with RBA expectations.

- (AFR) Former top public servant Martin Parkinson has warned Labor and the Coalition they must stop lying to voters about the scale of the problems facing the country and develop coherent policies to get living standards growing again. (see link)

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session.

- Cash ACGBs are 1bp cheaper with the AU-US 10-year yield differential at +12bps.

- Swap rates are little changed.

- The bills strip is flat to -2.

- RBA-dated OIS pricing is flat to 3bps firmer across meetings today, with Dec-25 leading. A 25bp rate cut in April is given a 4% probability, with a cumulative 64bps of easing priced by year-end (based on an effective cash rate of 4.09%).