NORWAY: Centre Party To Leave Gov't Over EU Energy Directives-NRK

Norway's public broadcaster NRK reports that the agrarian Centre Party (SP) is set to withdraw from the minority centre-left coalition gov't of PM Jonas Gahr Støre, citing disagreements over three directives from the EU's Fourth Energy Market Package. The withdrawal of the SP leaves Støre's centre-left Labour Party as the only party in gov't, with 48 seats in the 169-member Storting (parliament). Under the Norwegian constitution, a snap election is not possible meaning that the minority Labour gov't will continue to try to pass legislation on a vote-by-vote basis until the next general election due to take place on 8 September.

- NKR reports "While SP leaders Trygve Slagsvold Vedum and Marit Arnstad stated that it is not appropriate to link Norway more closely to the EU's energy policy, Støre said that the Labour Party believes it is in Norway's interest to introduce the three controversial EU directives."

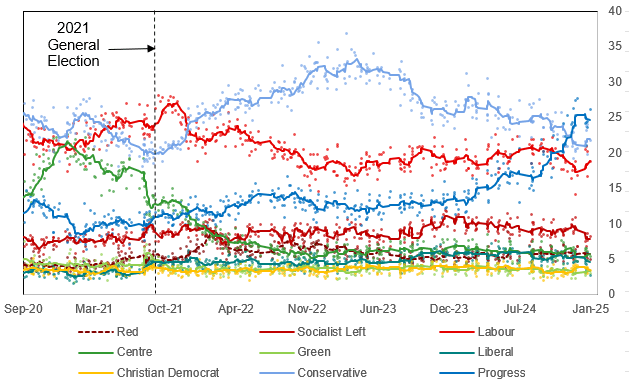

- With eight months to go until the election, the centre-right Conservatives of former PM Erna Solberg and the right-wing populist Progress Party are vying for first place in opinion polling. Unlike a number of other populist right parties in Europe that have seen a surge in support over the past decade, the Progress Party has supported or participated in governing coalitions on a number of occasions, starting in 1981 (albeit never at the head of gov't).

- The party takes a broadly pro-business libertarian stance on the economy, rather than the socially conservative, economically leftist stance that has increasingly been the hallmark of populist parties gaining support across Europe.

Chart 1. General Election Opinion Polling, % and 8-Poll Moving Average

Source: Opinion, Respons Analyse, Verian, Norfakta, Norstat, InFact, MNI

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURIBOR OPTIONS: Put ladder buyer

ERZ5 98.00/97.75/97.50p ladder, bought for flat in 2.25k total.

GILTS: Extending gains ahead of the close

- Overall it is a fairly decent move in Gilt, the contract continues to gain, the lower volume has been helping, but there's been a pick up in the past few minutes with just under 30 minutes left for the trading session.

- Around 2k cumulative lots have been bought in the past few minutes, multiple clips.

US TSYS: Yields Slip to 10D Lows Into Year End, Early Cash Close

- Treasuries added to Monday's rally overnight -- back near December 20 levels before drawing some sell interest in early London trade. Average to small year-end duration extensions: US +0.07Y, EU: +0.04Y, UK -.02Y (Bbg).

- The Mar'25 10Y contract trades 109-03 last (+4) vs. -06 high on modest year end volume of just over 135k. Tsy 10Y yield tapped 4.5027% low overnight, curves are looking modestly flatter: 2s10s .966 at 28.317, 5s30s -1.864 at 37.011.

- Projected rate cuts into early 2025 look steady to slightly higher vs. late Monday levels (*) as follows: Jan'25 steady at -2.8bp, Mar'25 -14.6bp (-13.6bp), May'25 -21.3bp (-19.5bp), Jun'25 -30.8bp (-28.8bp).

- Today's economic data (prior, est) limited to FHFA House Price Index MoM (0.7%, 0.4%) and S&P CoreLogic CS 20-City MoM SA (0.18%, 0.20%) at 0900ET, followed by Dallas Fed Services Activity (9.8, --) at 1030ET.

- Reminder: early cash Tsy close at 1400ET, futures at normal time of 1600ET.

- For next week: the NYSE Group markets will close on January 9 in observance of the National Day of Mourning for President Carter (New York Stock Exchange, NYSE American Equities, NYSE American Options, NYSE Arca Equities, NYSE Arca Options, NYSE Chicago and NYSE National), while the CME Group has opted for early close, link HERE. FI open outcry will close at 1300ET, GLOBEX shortly after at 1315ET next Thursday.