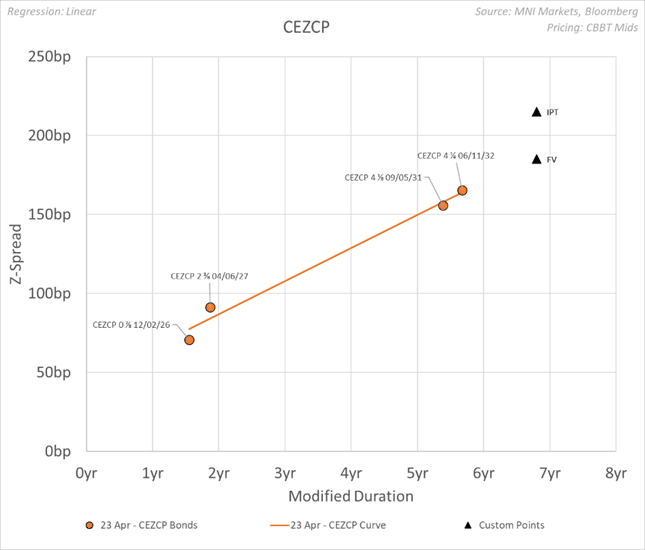

EM CEEMEA CREDIT: CEZCP: EUR BM SLB 8Y - FV

CEZ (CEZCP: Baa1neg/ A-/)

New Issue: EUR BM SLB 8Y

IPT: MS+215bp

FV: Z+180bp

CEZ issuing a EUR 8Y sustainable linked bond. CEZ has a 4.125 May31 bond outstanding and also a 4.25 Jun32 bond, both of which are sustainability linked. Using these bonds as anchor points and extending for maturity we estimate a FV of 180bp.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: EZ MARCH FLASH MANUF PMI 48.7 (FCAST 48.2, FEB 47.6)

- MNI: EZ MARCH FLASH MANUF PMI 48.7 (FCAST 48.2, FEB 47.6)

- MNI: EZ MARCH FLASH SVCS PMI 50.4 (FCAST 51.1, FEB 50.6)

STIR: Light Dovish Repricing In EUR Rates On Soft German Services PMI Details

The soft details of the German flash March services PMI has prompted a light dovish repricing in EUR rates, though ECB-dated OIS continue to assign a ~60% implied probability of a 25bp cut in April.

- OIS price 52bps of easing through year-end, up from 50bps before the PMI data.

- Euribor futures are now back to little changed through the blues.

- Although services activity remains subdued in Germany and France, there was a notable uptick in the manufacturing components in both PMIs. In Germany, this is likely to partly be a function of recent fiscal developments.

- MNI’s rough calculations suggest the Eurozone-wide flash manufacturing PMI, due at 0900GMT, could print close to neutral (i.e. 50) territory in March (vs 48.2 cons, 47.6 prior). That assumes countries excluding France and Germany also see an average ~2.5 point uptick relative to February. If the ex-France and Germany average manufacturing PMI was instead flat at 49.2, the Eurozone-wide PMI tracks at 48.8.

- Assuming the ex-France and German average PMI is unchanged at 53.9, we track the Eurozone-wide services flash unchanged at 50.6 (vs 51.1 cons).

COMMODITIES: Gold Holding Onto Recent Gains, Sights on $3079.20 Next

Despite holding on to its recent gains, a bearish condition in WTI futures remains intact and the latest recovery appears corrective. Key pivot resistance to watch is $69.12, the 50-day EMA. A resumption of the downtrend would signal scope for an extension towards $63.73 next, the Oct 10 ‘24 low. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. A clear uptrend in Gold is intact and last week’s resumption of the bull cycle reinforces current conditions. The yellow metal is holding on to the bulk of its recent gains. Last Thursday’s fresh trend high reinforces the bull theme and sights are on $3079.2 next, a Fibonacci projection. Note that moving average studies are in a bull-mode position, highlighting a dominant uptrend and positive market sentiment. Support is at $2962.0, the 20-day EMA.

- WTI Crude down $0.2 or -0.29% at $68.15

- Natural Gas down $0.04 or -0.88% at $3.948

- Gold spot up $5.95 or +0.2% at $3027.73

- Copper up $6.7 or +1.31% at $517.9

- Silver up $0.23 or +0.71% at $33.27

- Platinum up $3.53 or +0.36% at $983.51