OIL: China Crude Imports Recover Driven by Shandong Deliveries: Vortexa

Mar-14 13:30

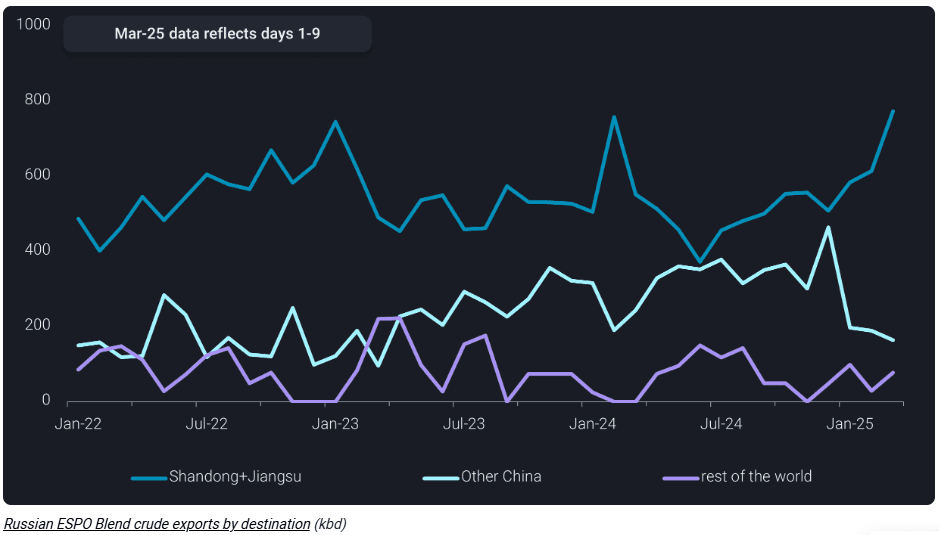

China’s seaborne crude imports rebounded in February, recovering from January’s low as cargo discharges into Shandong resumed, according to Vortexa.

- Total seaborne crude imports rose 7% m/m to 9.6mb/d in February but down 4% y/y amid ongoing weak demand from Shandong teapot refiners.

- Imports were previously disrupted by the Shandong Port Group’s shipping ban and OFAC sanctions to over 150 tankers involved in Russian and Iranian trades.

- Imports from Iran were the highest since October at nearly 1.5mb/d in February, supported by STS transfers onto non-sanctioned tankers, but are expected to decline in March amid subdued teapot demand.

- Some state-owned companies have completely halted Russian crude purchases in March after scaling back in February.

Source: Vortexa

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: US JAN CPI UNROUNDED M/M 0.467%, CORE 0.446%

Feb-12 13:30

- MNI: US JAN CPI UNROUNDED M/M 0.467%, CORE 0.446%

MNI: US JAN SUPERCORE CPI (CORE SERVICES EX-HOUSING) 0.760%

Feb-12 13:30

- MNI: US JAN SUPERCORE CPI (CORE SERVICES EX-HOUSING) 0.760%

MNI: US JAN CPI 0.5%, CORE 0.4%; CPI Y/Y 3.0%, CORE Y/Y 3.3%

Feb-12 13:30

- MNI: US JAN CPI 0.5%, CORE 0.4%; CPI Y/Y 3.0%, CORE Y/Y 3.3%

- US JAN ENERGY PRICES 1.1%

- US JAN OWNERS' EQUIVALENT RENT PRICES 0.3%