OIL: China Cutting Saudi Crude Buying in March: Kpler

Feb-20 12:30

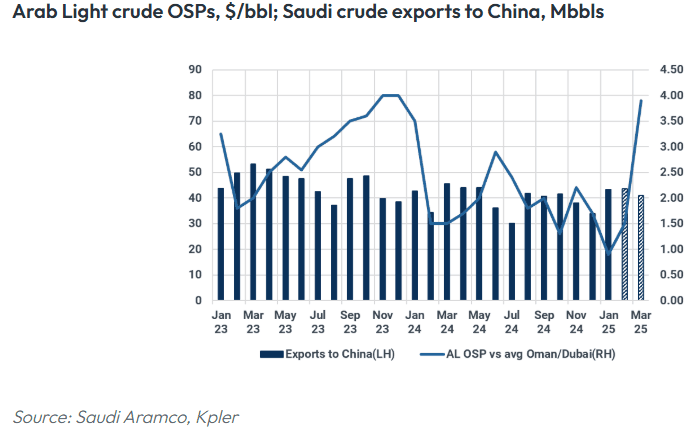

China is expected to receive around 1.32m b/d of March-loading Saudi crude, down 15% on the month, Kpler said.

- China’s demand has been squeezed by heavy spring refining maintenance, with top refiner Sinopec set to cut imports.

- At least six Sinopec refineries, totalling around 1m b/d of capacity have planned maintenance by April.

- However, PetroChina, which has less intensive refining scheduled for the month, is seen boosting its Saudi crude imports, Kpler said.

- Declining demand has been excacerbated by higher prices after Aramco increased its OSPs, driving the Arab Light to Asia price to its highest since Dec. 2022.

- Aramco raised OSPs amid a buying frenzy from China and India who were looking to secure alternatives to sanctioned Russian barrels in January.

- However, as Russian crude flows appear more robust than anticipated and with the Dubai-Brent spread narrowing, Saudi OSPs will likely fall next month, Kpler added.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OUTLOOK: Price Signal Summary - Corrective Cycle In Gilts Still In Play

Jan-21 12:30

- In the FI space, the Jan 15 rally in Bund futures highlighted a short-term reversal signal - a bullish engulfing candle. It suggests scope for a continued corrective phase that is also allowing an oversold trend condition to unwind. A continuation higher would open 132.41, the 20-day EMA. The medium-term trend is unchanged, it remains bearish. The bear trigger has been defined at 130.28, the Jan 15 low. A break of it would resume the downtrend.

- The medium-term trend condition in Gilt futures is unchanged, the direction remains down. However, strong gains last week highlight a corrective phase and if correct, signals scope for a continuation higher near-term. Attention is resistance at the 20-day EMA, at 91.55. This average has been breached, a clear break would suggest scope for a stronger retracement, towards 92.75, the 50.0% retracement of the Dec 3 - Jan 13 bear leg. On the downside, the bear trigger has been defined at 88.96, the Jan 13 low. First support lies at 90.68, the Jan 16 low.

EGB SYNDICATION: 5/15-year LITHUN EMTN: Final Terms

Jan-21 12:24

May price today.

- EUR Benchmark 5Y Fixed (Jan. 28, 2030) at MS+60.

- Revised guidance was MS+60-65 area, initial guidance MS+70 area

- Books above EU2.3b (excluding JLM interest): Leads

- Coupon: Annual, act/act ICMA

- EUR Benchmark 15Y Fixed (Jan. 28, 2040) at MS+125

- Revised guidance was MS+125-130 area, initial guidance MS+145 area

- Books above EU2.7b (excluding JLM interest): Leads

- Coupon: Annual, act/act ICMA

- Settlement: Jan. 28, 2025

- Bookrunners: BNPP (B&D), BofA, JPM

- Co-Lead (no books): SEB Lithuania

- Timing: May price today

Details as per Bloomberg

OPTIONS: Larger FX Option Pipeline

Jan-21 12:19

- EUR/USD: Jan22 $1.0345-50(E1.6bln), $1.0500(E1.1bln); Jan23 $1.0295-00(E2.7bln), $1.0400(E1.8bln), $1.0435-40(E1.0bln); Jan24 $1.0350(E1.4bln)

- USD/JPY: Jan22 Y155.50($1.2bln); Jan23 Y155.00($1.5bln)

- AUD/USD: Jan22 $0.6210(A$2.1bln)

- USD/CAD: Jan23 C$1.4450($1.1bln); Jan24 C$1.4380($1.4bln)

- USD/CNY: Jan23 Cny7.5000($1.9bln); Jan24 Cny7.4500($1.4bln)