OIL PRODUCTS: China’s 2025 Refined Product Demand Outlook Revised Down: OilChem

Apr-24 12:46

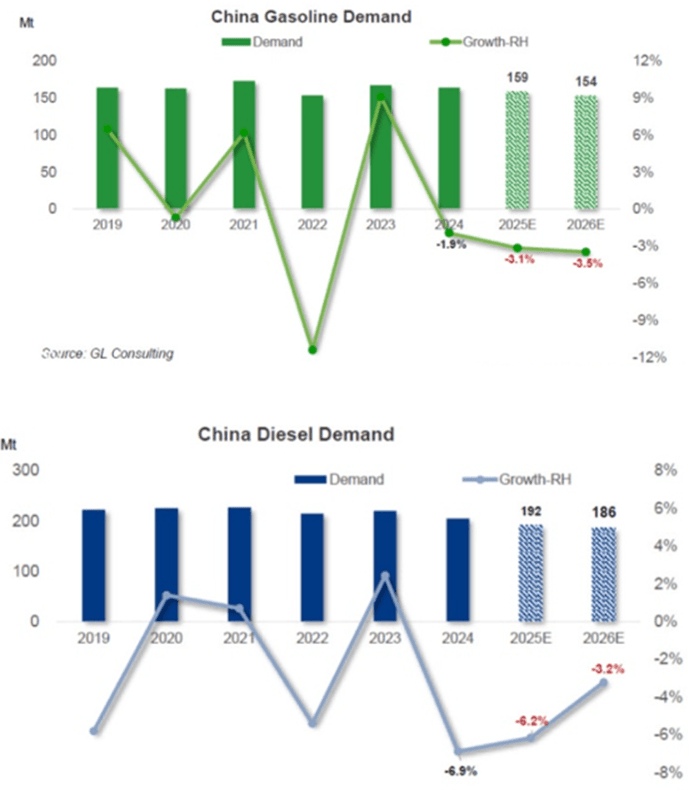

OilChem/GL Consulting has revised down its 2025 outlook for China’s gasoline and diesel consumption.

- Gasoline demand is now projected to fall 3.1% on the year, a 0.4 percentage point downgrade from the March forecast.

- Diesel demand is expected to decline 6.2%, a 0.6 percentage point downward revision.

- However, the forecast for jet fuel demand in 2025 remains unchanged.

- GL Consulting estimates that a further 50% US tariff hike on Chinese goods could cut China’s GDP growth by a further 1.0-2.5 percentage points.

- This would further dampen downstream refined product and petrochemical demand, of which diesel is likely to bear the brunt, given its link to industrial activity, GL Consulting said.

- The Chinese government is expected to step up policy support in infrastructure investment, consumption, and other sectors.

- This could provide marginal support to construction-related diesel demand and partially offset negative effects of weaker exports, GL Consulting added.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: Belgium 10-year USD benchmark: IPTs

Mar-25 12:43

- Kingdom of Belgium USD 10-year Benchmark – IPT @ MS+67A $$$

- Size: USD benchmark

- Maturity: 2 April 2035 (10Y)

- Settlement: 2 April 2025 (T+5)

- Coupon: Fixed, SA 30/360

- Spread: MS+67bps Area (currently equivalent to ~CT10+24.8 bps)

- Bookrunners: CITI(DM/B&D)/JPM/MS

- ISINs: RegS: BE[] / 144A: BE[]

- Timing: Taking IOIs, tomorrow’s business

From market source

US TSYS: Early SOFR/Treasury Option Roundup: Short Sep SOFR Puts

Mar-25 12:38

Heavy SOFR put volume reported in the leadup to the NY session, large buying in Sep'25 95.50 midcurve put recently. Tsy option volumes more muted but leaning towards low delta puts & spds with underlying futures trading lower, curves bear steepening. Projected rate cuts through mid-2025 cool slightly vs. late Monday levels (*) as follows: May'25 at -3.9bp, Jun'25 at -16.3bp (-16.7bp), Jul'25 at -27bp (-28bp), Sep'25 -41.5bp (-42.7bp).

- SOFR Options:

- over 64,600 0QU5 95.50 puts, 4.5 ref 96.42 (45.5k piece followed by smaller lots)

- 6,000 SFRJ5 95.75 puts ref 95.865

- 2,000 SFRZ5 95.62/95.87/96.06 broken put flys ref 96.23

- Block, 4,000 SFRU5/SFRZ5 95.68/95.81 put spd spds, 0.25 adds to 23k on Monday

- 4,000 SFRM5 96.00/96.12/96.37/96.50 3x2x2x2 call condors ref 95.855

- 8,000 SFRM5 95.62/95.75 put spds ref 95.855

- 3,000 SFRZ5 96.62/97.12 call spds ref 96.23

- 2,000 0QK5 95.75/96.00 put spds ref 96.425

- 2,000 SFRN5 95.62/95.75 put spds ref 96.09

- Treasury Options:

- 4,600 TYM5 107.5/109 3x2 put spds ref 110-11

- 2,000 TUK5 103.12 puts ref 103-11

- 1,800 TYK5 109/109.5 put spds

- over 5,200 TYK5 112.5 calls, 13 ref 110-11

- 1,200 TYM5 113/115/117 call flys, ref 110-12

FOREX: USDJPY Finds Solid Resistance at the 50-Day EMA

Mar-25 12:36

- Following yesterday’s punchy USDJPY rally on the back of renewed optimism for major US equity indices, the pair has had a notable pullback on Tuesday, declining around 90 pips from the overnight highs. Today’s peak print of 150.94 closely matched a firm resistance for the pair, respecting both the Feb 07 low and the 50-day EMA. A clear break of this area would signal scope for a stronger rally.

- Overall, the primary trend direction is down, and recent gains are considered corrective. A resumption of weakness would refocus sights on initial support at 148.18, the Mar 20 low. Further out, key support and the bear trigger remain at 146.54, the Mar 11 low, of which clearance would resume the technical downtrend.

- According to a latest exclusive policy piece by MNI, Bank of Japan officials are increasingly confident that cost increases are being passed on to consumers, as shown in recent Final Demand-Intermediate Demand (FD-ID) price index results, potentially strengthening the case for a rate hike on May 1, MNI understands. Tokyo CPI data is due during Friday’s APAC session.

- On the US side, focus will be on PCE on Friday, expected to show a recovery in personal spending in February, although it should look much less impressive in real terms.