OIL: China’s Teapots Continue Iranian Crude Buying: Platts

Apr-11 12:12

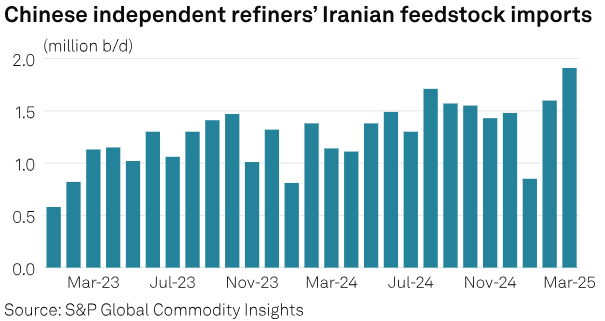

China’s teapots continue to buy Iranian crudes at high levels, despite ecent US sanctions on the country, sources told Platts.

- The US Department of the Treasury sanctioned nearly 30 oil tankers involved in shipping Iranian crudes.

- Some new builds have joined the dark fleet, helping to maintain the overall flow of shipments from Malaysia to China (these are often re-branded Iranian barrels).

- Meanwhile, the China-based Guangsha Zhoushan oil storage terminal is the second Chinese terminal sanctioned since March for handling Iranian cargoes.

- Small-sized independent refineries are continuing to buy Iranian crudes due to their relatively lower cost compared with alternatives.

- There are some imports of Brazilian crudes, although they are too expensive for most Teapots to take.

- Chinese Teapots’ Iranian crude imports reached an all time high of 1.91m b/d in March, up 1.9% from the previous high of 1.71m b/d in August, Platts data showed.

- Iranian Light discounts to Brent are around $1.50-1.60/bbl DES Shandong, unchanged on the previous week.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB OPTIONS: Bobl put fly

Mar-12 12:07

OEJ5 116.5/116/115.5p fly, bought for 9.5 in 5k.

FOREX: GBP Outperforming, Attention on US Election Highs for Cable

Mar-12 12:06

- Despite some moderate outperformance for the greenback on Wednesday, GBP’s relative strength against G10 peers is standing out as we approach the US data, with cable consolidating close to its recovery highs of 1.2966. This leaves the pair within 50 pips of the psychological 1.3000 mark, and places growing attention on the US election (Nov 06) high at 1.3048, an important technical point on the chart. Moving average studies are highlighting a dominant uptrend.

- Goldman Sachs think GBP-outperformance last week was mainly a function of the currency’s relative resilience to tariff risks, and they think that can continue to support Sterling versus other European currencies as EU tariffs come into reality.

- Separately, Rabobank said the combination of this week’s release of monthly January UK GDP data and political bickering about the welfare budget will serve as a reminder of both the poor growth backdrop and tight fiscal position. They expect EUR/GBP to hold around the 0.84 area in the weeks ahead.

- Aside from the monthly activity print on Friday, we remain unlikely to hear anything from the Bank of England’s MPC (as we have entered the blackout period).

OUTLOOK: Price Signal Summary - Bear Threat In Bunds Still In Play

Mar-12 12:03

- In the FI space, Bund futures are in consolidation mode and the contract is trading closer to its recent lows. A bearish theme remains intact. Last week’s impulsive sell-off signals scope for an extension towards 126.28 next, a 2.618 projection of the Feb 5 - 19 - 28 price swing. Further out, 126.00 is also within range. Note that the contract is in oversold territory, a recovery would allow this condition to unwind. Initial firm resistance to watch is seen at 129.41, the Jan 14 low.

- The short-term trend outlook in Gilt futures is unchanged, it remains bearish. Recent gains are considered corrective. Last week, the contract traded through a key support at 91.79, the Feb 20 low. This level also represented a bear trigger and the breach signals scope for a continuation down, with sights on 90.49 next, a 1.618 projection of the Feb 6 - 20 - Mar 4 price swing. The downtrend is oversold, the latest bounce has allowed this set-up to unwind. Initial resistance is 92.63, Mar 5 high.