EM ASIA CREDIT: Cikarang Listrindo (CIKLIS, Ba1/BBB-/NR) - 10Y $ deal FV

Cikarang Listrindo (CIKLIS, Ba1/BBB-/NR)

"*IPT: CIKARANG LISTRINDO $350M (CAPPED) 144A/REGS 10Y AT 6.125%" - BBG

New Issue: $350m 10Y

Tender: $500m 9/26 bond

IPT: 6.125%

FV: 5.875%

The Indonesian power company, Cikarang Listrindo, is launching a new 10y $350m deal. The proceeds, along with cash on hand, will be used to refinance the $500m 9/26 bond which is callable in march.

Cikarang Listrindo was recently upgraded to investment grade by S&P (BBB-), and the expectation is that Moody's will do the same soon after the refinancing is complete. The rating at Moody's is currently Ba1, watch positive. The Moody's upgrade will make the new deal IG index eligible.

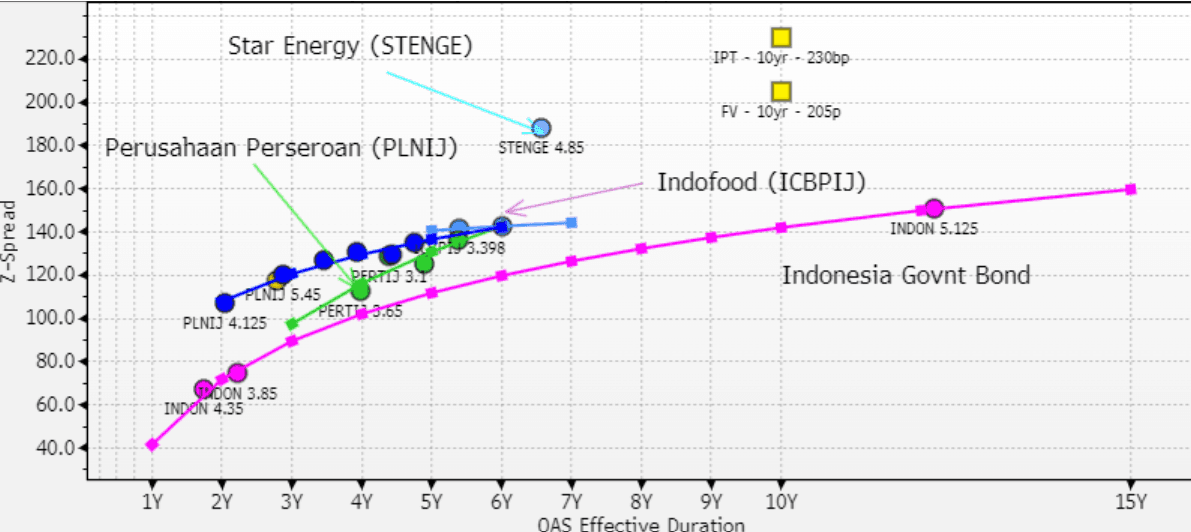

In terms of fair value, we take into consideration Indonesian state owned electricity producer Perusahaan Perseroan (PLNIJ Baa2/BBB), Star Energy Geothermal (STENGE, Baa3/BBB-), Indonesia's largest geothermal energy producer, and Indofoods (Baa2/BBB- pos.), Indonesia's largest food processing company. We also include the Indonesia (INDON, Baa2/BBB/BBB) $ government curve.

We think that Cikarang Listrindoa, a low BBB, privately owned company, will trade around 60bp wide of the Indonesia curve at the 10yr point, more or less in line with STENGE, also low BBB energy. FV therefore Z+205bp, T+165bp (yield 5.875%)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: CAIXIN PMIs Weaker than Expected.

- There may be little to take away from today’s January Caixin PMI as it will be directly impacted by China’s Lunar New year holiday period, but it may also point to the impact of the impending trade war between the US and China.

- The CAIXIN PMI for January came in at +50.1 down from +50.5 in December.

- The Caixin China General Services PMI is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private service sector companies.

- The Caixin therefore provides a real time insight how private companies are at present and the data suggests that worrying trends could be evolving.

- That said, this year’s Lunar New Year celebrations are earlier than usual so it is likely that this data release may be looked through by authorities before considering their next move to support the economy.

ASIA: Indonesia & Philippines Bright Spots For ASEAN Manufacturing

The S&P Global ASEAN manufacturing PMI fell to 50.4 in January from 50.7 remaining just in growth territory but slowest in almost a year. Indonesia was the only country to post a material increase in the PMI and Indonesia and the Philippines were the only ones to report growth in industrial activity. Output and orders increases slowed but so did price/cost pressures, while the labour market “stabilised”. Despite this capacity pressures are showing with backlogs up for the eleventh straight month. With the US imposing tariffs, the outlook for the region remains highly uncertain, although January business confidence was unchanged.

- Indonesia’s manufacturing PMI rose to 51.9, highest since May, from 51.2 to be 3 points above the August low, driven by an increase in output, orders and employment growth, which boosted stockbuilding. There was a second straight rise in “new export business”.

- Despite a pickup in costs driven by raw materials, selling price inflation rose by less as firms narrowed margins in order to increase sales.

- In contrast Thailand’s manufacturing sector contracted slightly in January with the PMI falling to 49.6 from 51.4, the lowest since April 2024. Output and orders were down on the month and thus inventories too, while staffing was stable but confidence re the outlook improved and is above average. There were capacity pressures though with backlogs rising.

- Cost inflation rose for the third consecutive month to be its highest in almost a year but selling prices remained subdued.

- The Philippines was the other country to post a PMI above 50 and remains the strongest in ASEAN but it fell 2 points in January to 52.3 as output and orders growth slowed and employment was steady. Confidence remained positive but below average.

ASEAN S&P Global manufacturing PMIs seasonally adjusted

OPTIONS: Highest FX Volumes So Far For EUR, CAD & SGD

Total FX option volumes transactions rest a little over $5.1bn so far in Monday trade. EUR/USD has near $1.8bn, USD/CAD close to $1.3BN, USD/SGD near $600mn in terms of volumes.

- For EUR/USD, some of the larger ticket sizes have gone through at higher spot levels than current spot (1.0325, 1.04) and have been for EUR calls. This may reflect risk reversals going through though, as we have some larger transactions for EUR puts sub the parity level, which have also gone through.

- Trump made earlier remarks, threatening tariffs on the EU soon.

- For USD/CAD, the larger transactions are more clearly skewed to topside strikes for the pair, and against CAD. There have been a few go through with strikes above 1.5000, with the highest 1.57.

- For USD/SGD, again the focus is on upside strike levels relative to current spot and a bias towards USD calls. Some of the larger transactions have gone through between the 1.3800-1.4000 strike levels (current spot is 1.3680/85).

- We don't usually see USD/SGD this high in terms of the volumes for options transactions at this time of the Asia Pac session, but with renewed fears around tariff conflicts may be driving greater interest this morning.