EM LATAM CREDIT: Colombia (COLOM; Baa2neg/BB+neg/BB+neg): Diesel Price Hikes

“COLOMBIA NEEDS TO INCREASE DIESEL PRICES, AVILA SAYS” – BBG

Neutral

• Trucker strike and road blockade initiated last year after the government announced an end to diesel fuel subsidies that would lead to higher diesel prices.

• The strike ended in September 2024 after the government announced a smaller increase in diesel fuel prices to be phased in gradually.

• Proposing to increase diesel prices may lead to another truckers strike which would be damaging for the economy.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: Spain long 15-year Obli: Priced

- Reoffer price 99.824 to yield 3.515%

- Spread set earlier at 3.90% Jul-39 Obli (mid) + 9bps (Guidance was +11bps area)

- Size: E7bln (MNI expected E5-10bln)

- Books closed in excess of E93bln (inc. E7.5bln JLM interest)

- Maturity: 31 January 2041

- Coupon: 3.50%. Short first to 31 January 2026

- Settlement: 4 March-2025 (T+5)

- ISIN: ES0000012O75

- Bookrunners: BARCLAYS / CACIB (B&D/DM) / GSBE SE / HSBC / NOMURA / SG

- Timing: FTT Immediately

From market source / BBG

GILT AUCTION PREVIEW: On offer next week

The DMO has announced it will be looking to sell GBP2.25bln of the 4.375% Jul-54 Gilt (ISIN: GB00BPSNBB36) at its auction next Tuesday, March 4.

US DATA: Consumer Confidence Drops With Inflation Expectations Jumping

Yet another survey conducted in February shows a deterioration in private setor confidence: the Conference Board's consumer confidence composite fell to 98.3 from 105.3 prior (102.5 expected), led by a drop in expectations to 72.9 from 82.2. The "present situation" composite edged lower for a 2nd consecutive month, to 136.5 (139.9 prior).

- This was the 4th-worst monthly composite reading since the start of 2021, and represented the largest monthly decline since Aug 2021.

- According to the report, the Expectations index "was below the threshold of 80 that usually signals a recession ahead" (though we would note that this index was below 80 through most of 2022-2024 without recession hitting).

- 12-month inflation expectations jumped: average hit 6.0% from 5.2% prior, highest since May 2023, with median to 4.8% from 4.2% prior, highest since Nov 2023.

- Only one of the five components of the composite Index rose: assessment of present business conditions.

- As with other February surveys, policy uncertainty was a major theme - the report notes: "There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.”

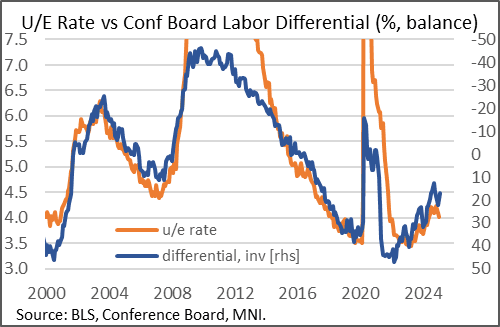

- Notable on the labor market front: the differential between jobs "plentiful" minus "hard to get" fell to 17.1, the 2nd monthly drop and the lowest figure in 4 months. A resumption of this downtrend would be consistent with an increase in the unemployment rate from its current level of 4.0%.