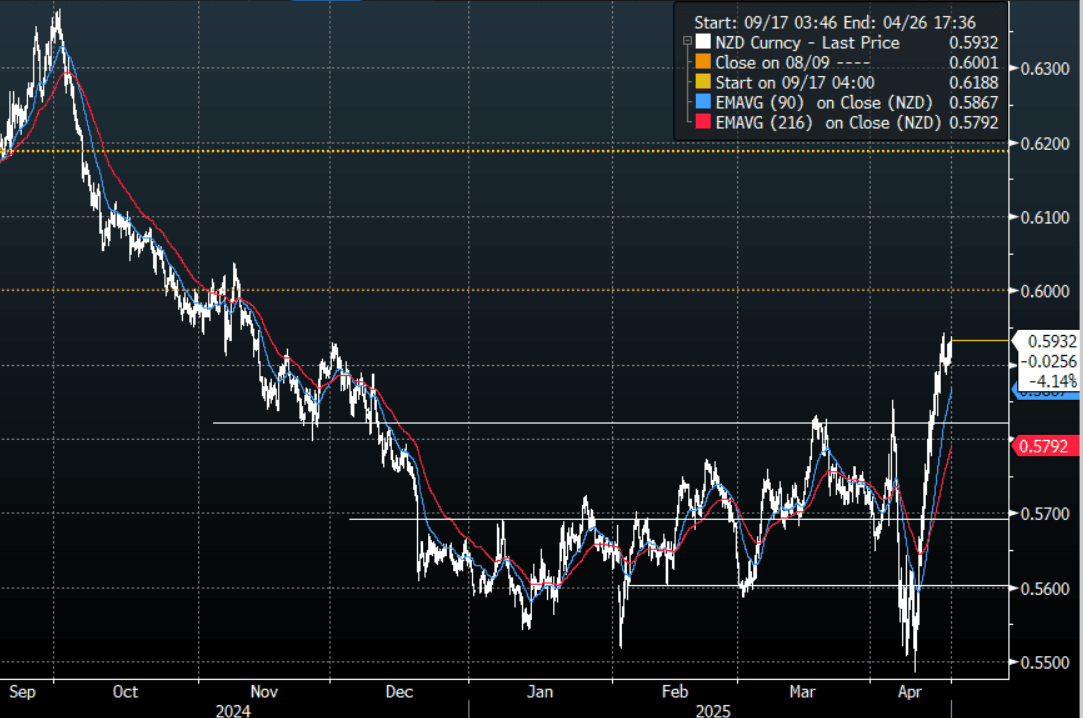

NZD: Consolidating Near Recent Highs, CPI Due Shortly

The NZD had an overnight range of 0.5900 - 0.5937, Asia is dealing near the highs as both US stocks and the USD came off.

- Jerome Powell crushed the hopes of any traders still expecting the Fed to rescue them with cuts. Signaling a wait and see approach and tipping price stability over employment.

- ANZ Bank now expects the RBNZ will cut the Official Cash Rate more than previously expected because of a weaker economic recovery, they see the RBNZ cutting th cash rate to 2.5%, was previously projecting a base of 3%.(per BBG)

- The CPI today will help shape the RBNZ thinking going into its next meeting on May 28. Traders will be watching for any downside surprise that might signal potential deeper cuts.

- The NZD once again found support as risk came under pressure, this is a new phenomenon and points to traders still dumping US assets.

- There is still a view that weak global growth and pressure on the Chinese economy will ultimately weigh on the NZD. Those expressing this view though have been challenged over the last week.

- NZD could not make new highs though above 0.5950 and some consolidation might be healthy. The price action does suggest that dips will probably find demand, first support is 0.5800/30 then 0.5730/60.

- Data : NZ CPI

Fig 1: NZD/USD Spot Hourly Chart

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Modestly Weaker, RBA Hunter Speech Due

ACGBs (YM -3.0 & XM -1.0) are slightly weaker after a modest twist-flattener by US tsys on Monday.

- US tsy yields rose to their daily highs after Retail Sales data was released, with the market focusing more on the stronger control group sales, but the move wasn’t sustained and yields subsequently tracked lower.

- Headline advance retail sales were much weaker than expected in February at 0.2% M/M (0.6% expected, -1.2% prior rev from -0.9%), but this was offset by strong performances in core categories. But the control group sales rose 1.0% vs the 0.4% expected, more than offsetting the downward revision to Jan (-1.0% vs -0.8% prelim).

- The headline manufacturing index slipped -20 (cons -2) in March from +5.7. It was the lowest since Jan 2024.

- Cash ACGBs are 1-2bps cheaper with the AU-US 10-year yield differential at

- Swap rates are 1-3bps higher, with the 3s10s curve flatter.

- The bills strip is -3 to -4.

- RBA-dated OIS pricing is flat to 2bps firmer across meetings today.

- Today, Assistant RBA Governor Hunter (Economic) will give a speech at the AFR Banking Summit.

- However, the highlight of the week is likely to be Thursday’s jobs data for February.

US TSYS: Futures Little Changed, US Retail Sales Data Mixed

In today's Asia-Pac session, TYM5 is 110-18+, -0-01 from closing levels.

- US tsys finished the NY session showing a twist-flattening, with yields 3bps higher to 3bps lower, pivoting at the 7-year.

- US tsy yields rose to their daily highs after Retail Sales data was released, with the market focusing more on the stronger control group sales, but the move wasn’t sustained and yields subsequently tracked lower.

- Headline advance retail sales were much weaker than expected in February at 0.2% M/M (0.6% expected, -1.2% prior rev from -0.9%), but this was offset by strong performances in core categories. But the control group sales rose 1.0% vs the 0.4% expected, more than offsetting the downward revision to Jan (-1.0% vs -0.8% prelim).

- Headline manufacturing index slipped -20 (cons -2) in March from +5.7. It’s the lowest since Jan 2024 having been at its strongest reading since a particularly strong 20.2 in Nov and before that Apr 2023.

OIL: Oil Carefully Building A Geopolitical Risk Premium Again As Tensions Rise

Oil prices were moderately higher on Monday as tensions increased in the Middle East as the US struck the Iran-backed Houthi rebels after they said they would resume attacks on Red Sea shipping. The US has now added that Iran will be accountable for any further Houthi strikes, increasing the possibility of an escalation. The US will continue to target the rebel group until it stops attacking vessels.

- WTI was 0.5% higher at $67.48/bbl off the intraday low of $67.25. It has started Tuesday slightly lower at $67.34. The recent recovery is corrective and conditions remain bearish. Moving average studies are in a bear-mode position highlighting a dominant downtrend. Initial support is at $65.22, while resistance is $68.37.

- Brent is up 0.6% to $70.98/bbl after falling to $70.68. The benchmark is still down 2.5% this month driven by global growth worries following increased trade protectionism. Technicals still suggest a downtrend with initial support at $68.33, 5 March low. Pivot resistance and the 50-day EMA are at $73.15.

- The market has been concerned about the strength of demand for China for some time. It has been buoyed by recent plans to support the consumer and stabilise the troubled property market.

- The Trump administration has committed to increasing US oil output and today Energy Secretary Wright said that many new pipelines would be built.

- US president Trump is due to speak to Russia’s president Putin today about a Ukraine ceasefire deal. There seems a long way to go before there will be an easing of sanctions on Russian fossil fuel.