EU CONSUMER CYCLICALS: Consumer & Transport: Week in Review

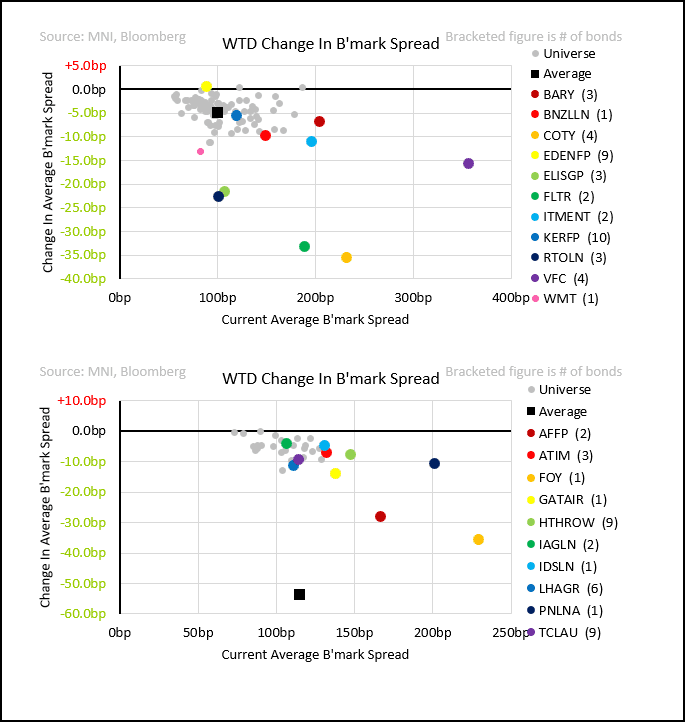

Blatant compression back as index rallies hard. Earnings may go unnoticed for now but please stay agile to underperformers; this week that was Kering, Edenred & Pluxee (regulation) and Mobico (asset sale). Equally, outperformers will look cheaper to rotate into as we compress back in – Philip Morris and Danone are our sector leader picks, both delivered solid results (PM in particular). Double-digit NIC was on offer again in HY, traded away in secondary. Electrolux, Lufthansa, Mobico, Air France, Woolworths and Whitbread (£) are some of the higher-beta names up next week in earnings.

• Walgreens Boots settles federal lawsuit with $300m payment, only $20m due immediately. The $-long end is showing incredible resilience as it eyes CoC at 101.

• Danone continues to deliver organic growth. It will have an M&A appetite. Question for investors is whether Yankee peers can invest to mimic its growth.

• Rentokil brings $1.25b as an inaugural issuer into USD markets. It was well received but our surprise is on the size of supply (net supply of $550m) given it should be deleveraging. Raters give it leeway as they comment post-issuance.

• Mobico sells its NA school business for only 5x earnings and keeps most of the cash on hand for now. Earnings will come at the bottom end of initial guidance and that excludes more provisions for losses on German Rail contracts.

• Kering continues to report double-digit sales falls and guides to 500bp 1H margin contraction on sticky Opex. We see it holding onto BBB+ ratings for now (but on negative outlook) as it guides to another €2b in RE disposals. When the falls in sales will end is more uncertain.

• Edenred & Pluxee fall 10-20% on reports Brazil is considering direct bank deposits to remove the middle-man. We see Brazil Food & Meal (the regulated segment) at 9.2% of group revenues for Edenred, with slightly higher for Pluxee. Their contribution to EBITDA is undisclosed but likely to be higher.

Primary (NIC in brackets)

• Lottomatica 5.7-NC-2 (22.5), Heineken 7.5y (0)

Rating Action

• Barry Callebaut moved to negative outlook at both S&P and Moody’s. It is saved from HY as raters continue to view situation as temporary. Reminder 29s lacks step-up protection. Thoughts unchanged from after earnings.

• Bunzl S&P stays put as expected after a guidance cut.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

NATO: "There Is No Alternative To NATO" - Sec Gen Rutte

NATO Secretary General Mark Rutte has stated in remarks in Warsaw that the United States and Europe must avoid the urge to “go it alone” despite “questions about the strength of the transatlantic bond.”

- Rutte says although there has been “tough rhetoric” and “difficult debates between Europe and America,” this is "not the time to go it alone. Not for Europe or for North America. The global security challenges are too great… There is no alternative to NATO.”

- Rutte adds, likely in reference to recent suggestions that France and the UK could provide a European nuclear deterrence: “Nothing can replace America’s nuclear umbrella.”

- Rutte says he is “absolutely confident” the US remains committed to NATO and Article 5, citing President Trump’s statements affirming his support and “strong bipartisan support” in the US Congress.

- Rutte's comments come amid unprecedented strain within the alliance, with the EU and Canada bracing for additional tariffs on April 2, and comments by Trump administration officials in a leaked Signal chat group suggesting deep animosity towards Europe.

- The New York Times reports that Europeans reacted “with a mix of exasperation and anger” to the Signal story, noting that Europe, “has been on alert" since Vance's speech in Munich last month questioned European values and its democracy.

- One point of tension may have been defused. Vance is expected to visit a US airbase in Greenland tomorrow but the trip has been scaled back following a forceful response from Copenhagen and Nuuk.

GILTS: /STIR: UK Markets Little Changed Vs. Pre-Spring Statement Levels

While there were two-way swings over the Spring Statement, Chancellor Reeves will be happy with the market outcome, as gilt yields, BoE pricing and GBP FX are roughly in line with levels seen ahead of the event.

- Benchmark gilt yields are 3-6bp lower, trading closer to the bottom of their intraday ranges (which vary from 8.5-12.5bp).

- The slightly lower-than-expected gilt remit/fiscal readthrough from today provides no impediments to further BoE easing, leaving the Bank’s gradualist preference to policy loosening in play, further aided by today’s CPI data.

- Elsewhere, while the restored fiscal headroom is limited, and subject to erosion from modest downside surprises to near-term economic growth outcomes, the market is viewing that as a problem for another day.

OPTIONS: Expiries for Mar27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E1.5bln), $1.0770-90(E719mln), $1.0800(E2.0bln), $1.0820-25(E1.4bln), $1.0850-65(E1.9bln)

- USD/JPY: Y150.00($684mln), Y155.00($902mln)

- GBP/USD: $1.2900(Gbp812mln)

- AUD/USD: $0.6220(A$717mln), $0.6450(A$771mln)

- USD/CNY: Cny7.2850($671mln)