NEW ZEALAND: Consumers Subdued But April Sentiment Rises Despite Global Events

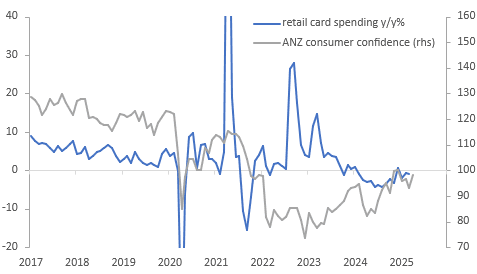

There was a broad-based pick up in ANZ consumer confidence with it rising 5.5% to 98.3 in April boosted by another 25bp of monetary easing during the month and despite heightened global uncertainty around US trade policy. It has resumed its uptrend and printed at its highest since December. Both current and future conditions improved.

- ANZ noted that consumer inflation expectations rose 0.5pp to 4.7%, the highest since July 2023, and may have been driven by the uncertainty around tariffs. Price/cost indicators in its business survey have also begun rising again and inflation expectations have stopped moderating.

- Future conditions rose to 105.2 in April from 100.7, despite the major US tariff announcements and subsequent market volatility during the month. The series has been above the breakeven-100 mark since August. The 12-month ahead economic outlook improved 4 points but was still negative at -16%.

- Current conditions rose 6 points to 88 boosted by an 8 point rise in personal finances, likely helped by 200bp of easing in less than a year.

- The time to buy a major household item improved 5 points but remained negative at -11 signalling that private retail spending is likely to stay lacklustre.

NZ ANZ Roy Morgan consumer confidence

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: US Tsys Weigh On Futures Overnight, BoJ Minutes For Jan MPM

In post-Tokyo trade, JGB futures closed weaker, -14 compared to settlement levels, following a heavy NY session for US tsys.

- Expectations that the April 2 reciprocal tariffs would be flexible, with breaks to countries and sectors as suggested Friday, and would not be as onerous as the more sweeping measures initially threatened underpinned US equities. Indeed, stocks took in their stride with other comments from President Trump about expecting auto tariffs.

- Beliefs that the worst may be over for stocks added to the buying momentum, as did the better-than-expected rise in the S&P Global Services PMI.

- Stocks surged, extending Friday's rally, with NASDAQ's 2.25% jump leading the way. The S&P 500 was 1.75% higher, with the Dow ~1.5% higher.

- The strong risk-on move weighed heavily on US tsys. Concession building ahead of the $183bn in auctions this week added to the selloff, as did the somewhat hawkish comments from the Fed's Bostic, though he is not a voter.

- US 2- and 10-year yields were up 9 bps to 4.03% and 4.33% respectively.

- Today, the local calendar will see the BoJ Minutes for January MPM and Department Sales data alongside an auction for Enhanced-Liquidity 5-15.5-years.

AUSSIE 10-YEAR TECHS: (H5) Reverses Off First Resistance

- RES 3: 96.501 - 76.4% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 2: 96.207 - 61.8% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 1: 95.740/851 - High Mar 4 / High Dec 11

- PRICE: 95.515 @ 16:42 GMT Mar 24

- SUP 1: 95.420/95.300 - Low Feb 13 / Low Jan 14

- SUP 2: 95.275 - Low Nov 14 (cont) and a key support

- SUP 3: 94.640 - 1.0% 10-dma envelope

Aussie 10-yr futures have faded sharply off last week’s mid-week high, opening a small gap with first resistance. For bulls, a confirmed reversal and a breach of 95.851, the Dec 11 high, would instead reinstate a bull cycle and refocus attention on resistance at 96.207, a Fibonacci retracement point. A stronger bearish theme would expose 95.275, the Nov 14 low and a key support. Clearance of this level would strengthen a bearish condition.

AUSSIE BONDS: Cheaper With US Tsys As Risk-On Weighs

ACGBs (YM -4.0 & XM -6.0) are weaker following a heavy NY session for US tsys.

- Expectations that the April 2 reciprocal tariffs would be flexible, with breaks to countries and sectors as suggested Friday, and would not be as onerous as the more sweeping measures initially threatened underpinned US equities.

- Concession building ahead of the $183bn in auctions this week added to the selloff, as did the somewhat hawkish comments from the Fed's Bostic, though he is not a voter.

- US 2- and 10-year yields were up 9 bps to 4.03% and 4.33% respectively.

- Cash ACGBs are 3-5bps cheaper with the AU-US 10-year yield differential at +12bps.

- Swap rates are 3-4bps higher.

- The bills strip is -2 to -4 across contracts.

- RBA-dated OIS pricing is slightly firmer across meetings today. A 25bp rate cut in April is given a 3% probability, with a cumulative 66bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- RBA Assistant Governor (Financial System) Jones participates in a fireside chat at 1010 AEDT at the Australian Payments Plus Beyond Tomorrow event. The FY26 budget is.

- Today we will see the Federal Budget presented around 1930 AEDT.

- The key data item for the week is tomorrow’s February CPI data.