EM ASIA CREDIT: Contemporary Amperex (CONAMP, A3/A-/NR) HK listing announced.

Feb-12 01:50

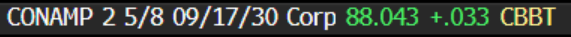

Contemporary Amperex (CONAMP, A3/A-/NR)

"*CATL FILES FOR HONG KONG LISTING" - BBG

- The listing has been in the pipes for several months now, therefore neutral for spreads.

- CATL stated in the filing it plans to use some of the funds to build its Hungary plant. Bloomberg earlier reported that the IPO could raise over $5bn.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Tsys Futures Edge Lower, Cash Trading Close

Jan-13 01:50

- Short-end Tsys futures are making new lows this morning, breaking below Friday's intraday lows although ranges are still narrow. TU is -00⅞ at 102-15+, while TY is -03 at 107-09+.

- The trend in Treasury futures is unchanged and remains bearish. Friday’s strong sell-off has confirmed a resumption of the downtrend. Price has traded through the 108-00 handle exposing 107-04 next, a Fibonacci projection. Note too that moving average studies remain in a bear-mode position highlighting a dominant downtrend. Key short-term resistance is seen at 108-21+, the 20-day EMA.

CNH: USD/CNY Fixing Steady, PBoC Vows Stable Yuan/Tweaks Capital Rule

Jan-13 01:25

The USD/CNY fixing printed at 7.1885, versus 7.3450 as per the Bloomberg market consensus.

- This puts the error term for the fixing at -1565pips, fresh wides since April 2024.

- USD/CNH is lower, last near 7.3550, around 0.10% stronger in CNH terms.

- headlines have filtered out from a FX meeting held in Beijing. The PBoC stating that the yuan will stay at a reasonable, balanced level. (per BBG). The central bank also raised the cross border macro adjustment parameter from 1.50 to 1.75, effective today.

- This is designed to boost offshore borrowing by local companies.

AUSSIE BONDS: Heavy & At Session Cheaps After Today’s Local Data Dump

Jan-13 01:23

ACGBs (YM -15.0 & XM -8.0) have extended morning weakness to be sharply cheaper and at the Sydney session's worst levels.

- The Melbourne Institute Inflation Index rose 0.6% m/m in December versus +0.2% in November. The index rose 2.6% y/y versus +2.9% in November.

- ANZ-Indeed job advertisements rose 0.3% from a month earlier (-12.5% y/y) in December.

- There have been no cash dealings in US tsys in today’s Asia-Pac session with Japan out for a holiday. TYH5 is, however, slightly weaker at 107-11, -0-01+ from NY closing levels.

- Cash ACGBs are 8-14bps cheaper, led by the short end.

- Swap rates are 7-12bps higher, with the 3s10s curve flatter.

- The bills strip has bear-steepened, with pricing -3 to -13.

- RBA-dated OIS pricing is 2-14bps firmer across meetings today. A 25bp rate cut is still more than fully priced for April (105%), with the probability of a February cut at 69% (based on an effective cash rate of 4.34%).

- AOFM Bond issuance will resume this week, with A$800mn of the 3.50% 21 December 2034 bond to be sold on Wednesday and A$700mn of the 2.75% 21 November 2027 bond to be sold on Friday.