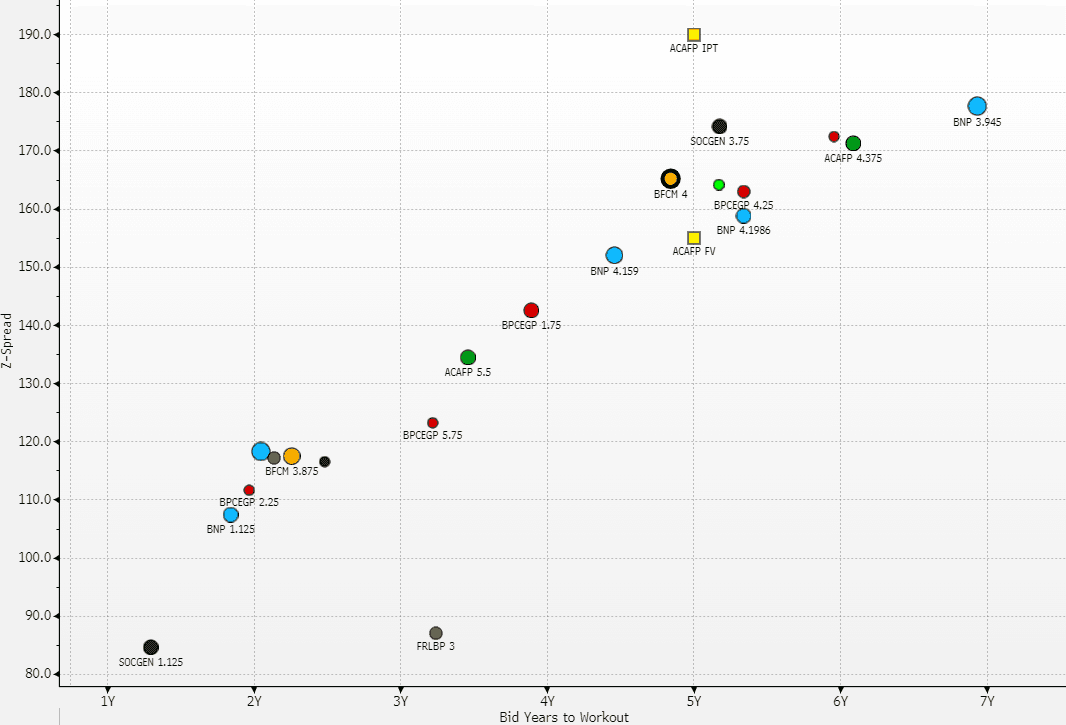

EU FINANCIALS: Credit Agricole - New Issue - €B'mark 10NC5 - FV

- IPT: MS+190

- FV: MS+155 - directly on the interpolated line between ACAFP 5.5% 2033 (adjusted down 2.5bps for the price) and ACAFP 4.375% 2036 .

- Exp. Ratings: Baa1/BBB+/A-

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROSTOXX50 TECHS: (H5) Trend Needle Points North

- RES 4: 5455.00 2.00 proj of the Nov 21 - Dec 9 - 20 ‘24 price swing

- RES 3: 5434.10 2.236 proj of the Dec 20 - Jan 8 - Jan 13 price swing

- RES 2: 5381.13 1.764 proj of the Nov 21 - Dec 9 - 20 ‘24 price swing

- RES 1: 5380.00 High Feb 11

- PRICE: 5377.00 @ 08:14 GMT Feb 11

- SUP 1: 5211.11 20-day EMA

- SUP 2: 5094.95 50-day EMA

- SUP 3: 4991.00 Low Jan 15

- SUP 4: 4931.00 Low Jan 13 and a key short-term support

Eurostoxx 50 futures are holding on to their recent gains and a bull cycle remains in play. Last week’s gains marked a resumption of the uptrend that started on Nov 21 ‘24. Moving average studies are in a bull mode set-up too, highlighting a dominant uptrend. The focus is on 5381.13 next, a Fibonacci projection. Initial firm support to watch lies at 5211.11, the 20-day EMA. The 50-day EMA is at 5094.95.

USDJPY TECHS: Oversold But Bears Remain In The Driver’s Seat

- RES 4: 155.89 High Feb 3

- RES 3: 154.70 50-day EMA

- RES 2: 153.72 Low Jan 27

- RES 1: 152.89 High Jan 6

- PRICE: 151.93 @ 08:26 GMT Feb 11

- SUP 1: 150.93 Low Feb 07

- SUP 2: 149.69 Low Dec 9

- SUP 3: 148.65 Low Dec 3 ‘24 and a key support

- SUP 4: 148.01 Low Oct 9 ‘24

A bearish theme in USDJPY remains intact and last week’s move down reinforces current conditions. 151.06, 76.4% of the Dec 3 - Jan 10 bull leg, has been pierced. A clear break of it would open 149.69, the Dec 9 low. Firm resistance is seen at 154.70, the 50-day EMA. Note that the pair has entered oversold territory. A recovery would be considered corrective and would allow the oversold condition to unwind.

EURGBP TECHS: Trading Below The Pivot Resistance

- RES 4: 0.8474 High Jan 20 and a key resistance

- RES 3: 0.8420 76.4% retracement of the Jan 20 - Feb 3 bear leg

- RES 2: 0.8388 61.8% retracement of the Jan 20 - Feb 3 bear leg

- RES 1: 0.8378 High Jan 6

- PRICE: 0.8349 @ 08:25 GMT Feb 11

- SUP 1: 0.8297/8248 Low Feb 4 / 3 and a bear trigger

- SUP 2: 0.8223 Low Dec 19 and a key support

- SUP 3: 0.8203 Low Mar 7 ‘22 and a lowest point of a multi-year range

- SUP 4: 0.8163 123.6% retracement of the Dec 19 - Jan 20 bull leg

EURGBP gains last week appear to have undermined a recent bearish threat, however, the pullback from last Thursday’s high does highlight a developing bearish threat, once again. 0.8378, the Jan 6 high, has been defined as a ley short-term resistance. Clearance of it would strengthen a bullish condition and signal scope for a stronger recovery. For bears, a continuation lower would open 0.8248, the Feb 3 low and bear trigger.