EU BASIC INDUSTRIES: CRH (CRHID Baa1/BBB+/BBB+): 4Q24 Results

Feb-27 12:16

Credit neutral.

- CRH reported revenue 4% below consensus while expanding 1% organically.

- Adj. EBITDA was in line thanks to margins at 20%, 90bp better than expected. Pricing and efficiencies contributed to that.

- We see FY FCF of $2.7bn, close to consensus. We see adj. net leverage little changed QoQ at 1.8x.

- IT sees positive demand for this year, underpinned by public infrastructure. FY25 adj. EBITDA guidance aligns with consensus. Capex guidance is $2.8-3bn with consensus at $2.3bn.

- Webcast 13.00 GMT https://events.q4inc.com/attendee/733509748/guest.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

UK: PM Claims Economy 'Turning Around' Ahead Of Chancellor's High-Profile Speech

Jan-28 12:16

Speaking to Bloomberg TV, PM Sir Keir Starmer has claimed that the British economy is showing signs of a positive turn-around. Starmer's comments come a day ahead of a major speech from Chancellor of the Exchequer Rachel Reeves, who is expected to back major planning reforms and infrastructure projects as part of the gov'ts 'strategy for growth'.

- Earlier Starmer claimed “We have to get our economy working. I think we’re beginning to see how that’s turning around,” saying that his gov't would “strip away regulation, strip away the inhibition of planning and use AI to take us forward". Weak economic expansion and declining business confidence have dealt a blow to the Starmer gov'ts claims that "The number one priority of this Labour government is growth: growth, growth, growth.”

- Seemingly still no set time for Reeves' address to be delivered in Oxford, with The Telegraph reporting a window for the address as "Wednesday morning."

- The most eye-catching headlines from Reeves' speech could centre on the gov'ts support for the expansion of three major London-adjacent airports: Heathrow, Gatwick and Luton. This change in stance - Starmer previously opposed a third runway for Heathrow - could risk rifts in Cabinet with Energy Secretary Ed Miliband seen as a staunch opponent of expanding airports.

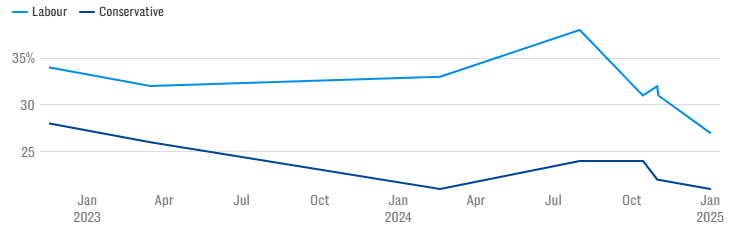

- Public trust in Labour's ability to manage the economy continues to slide, with the latest poll from Ipsos showing 27% of respondents choosing the party as their most trusted. While this is still ahead of the main opposition centre-right Conservatives on 21%, the gap between the two is the narrowest since late 2022.

Chart 1. Opinion Poll 'Party most trusted to manage Britain's economy', %

Source: Ipsos, Daily Telegraph

SONIA: Calendar call spread trades for more

Jan-28 12:10

SFIJ5/M5 95.95/96.05cs calendar spread, bought the June for 1 in 8k total.

OUTLOOK: Price Signal Summary - Corrective Cycle In WTI Remains In Play

Jan-28 12:05

- On the commodity front, despite yesterday’s pullback in Gold, the yellow metal is trading closer to its recent highs. A bull cycle is in play and the breach of resistance at 2726.2, the Dec 12 high, reinforces current conditions. Sights are on $2790.1, the Oct 31 all-time high. A break of this hurdle would confirm a resumption of the primary uptrend. The first key support to watch is $2671.6, the 50-day EMA. A reversal lower and a breach of this average would reinstate a bearish threat. The 20-day EMA is at $2702.2.

- In the oil space, Monday’s move lower in WTI futures marks an extension of the current corrective cycle. The 20-day EMA has been breached and attention turns to support around the 50-day EMA, at $72.16. A clear break of the 50-day average would suggest scope for a deeper retracement. On the upside, a reversal higher would focus attention on $79.48, the Apr 12 ‘24 high and a key resistance.