OIL: Crude Falls Sharply On Ukraine Peace Prospects & US Stock Build

Feb-12 22:15

Oil prices fell on Wednesday driven by a larger-than-expected US crude inventory build and optimism that an agreement can be found to end the war in Ukraine. There appears to be an understanding for US President Trump and Russian President Putin to talk which may take place in Saudi Arabia. Peace in the region may allow for the easing of sanctions on Russia and therefore an increase in its oil exports.

- Crude trended lower through the European and US sessions on Wednesday leaving WTI down 2.9% to $71.21/bbl after a low of $71.17, above initial support at $70.43. This is also the bull trigger, while the bear trigger is at $70.43.

- Brent is 2.7% lower at $74.95/bbl following another break below $75. Despite the sell off, it remained above support at $74.10, 6 February low. The bull trigger is at $81.20. Moving average studies remain in a bull mode.

- Heightened geopolitical risks remain in the Middle East with negotiators working to ensure the Gaza ceasefire deal lasts and the WSJ reporting that US intelligence believes that Israel is looking at strikes on Iranian nuclear facilities this year.

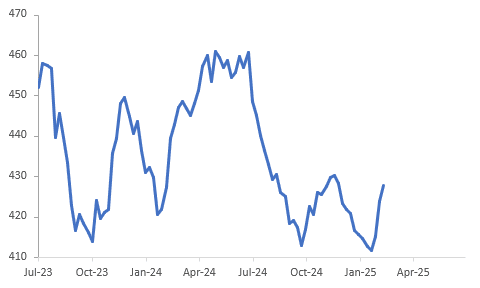

- The EIA reported a 4.07mn US crude inventory build last week driven by a sharp increase in Canadian flows to beat possible tariffs. US stocks are now 16.2mn barrels higher since Trump’s inauguration. Gasoline fell 3.04mn, its first decline since November, while distillate rose 0.1mn. Refining utilisation is up 0.5pp to 85% to be 4.4pp higher than the same time last year.

- The US’ EIA increased its expectations of excess supply in 2025 and 2026 and doesn’t expect sanctions on Russia to have a significant impact on output.

US EIA crude stocks ex SPR million barrels

Source: MNI - Market News/Refinitiv

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: USD Ticks Down On Potential Gradual Tariff Proposal

Jan-13 22:11

The USD has softened in early Asia Pac dealings, as headlines crossed from BBG which suggested the incoming Trump administration is discussing a gradual tariff hike plan.

- BBG notes: "Members of President-elect Donald Trump’s incoming economic team are discussing slowly ramping up tariffs month by month...One idea involves a schedule of graduated tariffs increasing by about 2% to 5% a month." Such a plan would be aimed at increasing negotiating leverage, whilst avoiding a spike in inflation, BBG note's (see this link for more details). Still, the report notes Trump hasn't reviewed or agreed to the plan.

- FX moves aren't dramatic so far, but markets continue to display sensitivity to tariff related headlines as we approach Trump's inauguration date.

- AUD/USD has ticked up to 0.6175/80, from the low 0.6160 region. NZD/USD is back to 0.5580/85. USD/CNH is back under 7.3500, off close to 50pips. USD/MXN is holding under 20.70. USD/CAD was last near 1.4370/75. Follow through has been limited.

AUDNZD: AUD/NZD Continues To Track Sideways

Jan-13 22:06

- The AUD/NZD closed unchanged on Monday, with the cross continuing to trade in very narrow ranges. There hasn't been much to mention over the past 3 month as the cross trades between 1.1000-1.1100, while the AU-NZ 2yr swap remains trading near its highest levels for the past year, although fell 4bps overnight.

- Initial resistance is 1.1100 (round number), with a break here opening a move to 1.1150 (July Highs), to the down side a break below 1.1056 (20-day EMA), would open a move to retest 1.1000 which has acted a key support for the past 3 months.

- RBNZ dated OIS currently pricing in 47bps of cuts at the Feb meeting, while RBA Dated OIS is pricing in a 67% chance of a 25bps cut in Feb.

- Today we have Westpac Australian Consumer Conf at 1030 AEST

NZD: NZD/USD Sees Small Bounce, Still Remains In Bearish Trend

Jan-13 22:05

- NZD/USD edged slightly higher on Monday, closing the session +0.22% at 0.5569, rebounding from multi-year lows but remaining under bearish pressure. The RSI at 31 signals persistent oversold conditions, while a weakening MACD suggests limited bullish momentum

- Technical indicators suggest bearish momentum, with spot trading below all key moving averages, the pair is at risk of testing the 13-year low of 0.5470 if it breaks below 0.5500. Initial support is 0.5543 (Jan 10 lows), while to the upside a break above 0.5643 (20-day EMA) before any sort of momentum change can occur.

- The NZ-US 2yr swap rose 6bps on Monday, closing at -87.5bps. On Friday it hitting a new yearly lows of -95.5bps just off all time lows of -100bps

- NZIER's Quarterly Survey of Business Opinion shows improved business confidence in Q4, with a net 16% of firms expecting economic improvement and 9% anticipating better trading in Q1. However, challenges persist, as 26% reported worse trading conditions in Q4, while 15% expect to raise prices in Q1.

- Leveraged funds raised their net short position on the NZD to 13,547 contracts a 15% jump from prior, the most in more than five years, while Asset managers saw 3% just in short positions, according to the latest Commodity Futures Trading Commission data for the week ended Jan. 7.

- No large nearby strikes Tues. Upcoming notable strikes: 0.5875 (NZD606m Jan. 15), 0.5885 (NZD453.7m Jan. 16), 0.6075 (NZD425.8m Jan. 15)

- The local calendar is empty today