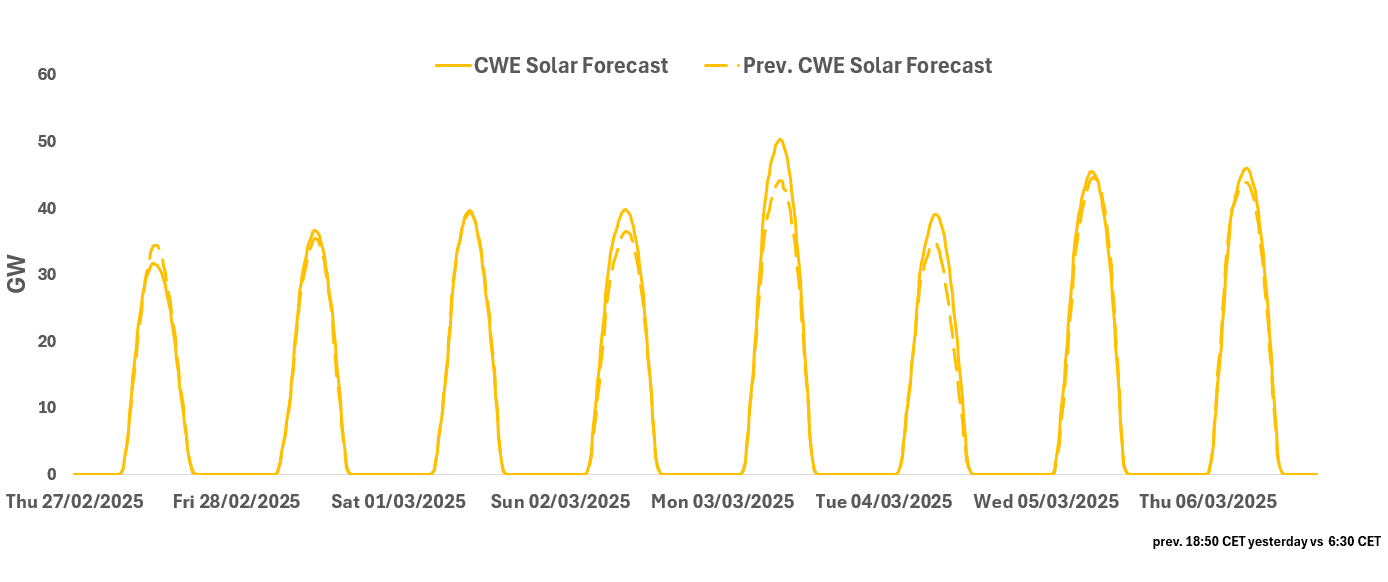

RENEWABLES: CWE Morning Solar Forecast

See the latest CWE Solar forecast for base-load hours from this morning for the next seven days. CWE Solar is expected to range between 4-9% load factors over 3-7 March, with the highest amount on 3 March and 5-6 March at 9% load factors.

CWE Solar for 27 Feb-6 March

- 27 February: 8.71GW

- 28 February: 9.64GW

- 1 March: 10.52GW

- 2 March: 11.27GW

- 3 March: 13.98GW

- 4 March: 10.65GW

- 5 March: 12.90GW

6 March: 13.14GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD TECHS: Sights Are On The All-Time High

- RES 4: 2817.6 - 1.236 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 3: $2800.0 - Round number resistance

- RES 2: $2790.1 - Oct 31 ‘24 all-time high

- RES 1: $2786.0 - HIgh Jan 24

- PRICE: $2752.9 @ 07:21 GMT Jan 27

- SUP 1: $2698.2/2668.8 - 20- and 50-day EMA values

- SUP 2: $2614.8/2583.6 - Low Jan 6 / Low Dec 19

- SUP 3: $2564.4 - Low Nov 18

- SUP 4: $2536.9 - Low Nov 14 and a key support

Gold traded higher last week. A bull cycle remains in play and the recent breach of resistance at 2726.2, the Dec 12 high, reinforces current conditions. Sights are on $2790.1, the Oct 31 all-time high. A break of this hurdle would confirm a resumption of the primary uptrend. On the downside, the first key support to watch is $2668.8, the 50-day EMA. A reversal lower and a breach of this average would reinstate a bearish threat.

BUNDS: A busy start ahead of a very busy Week

- It's a busier start for Bund Overnight as Risk Off dominated the session, already over a 30 ticks range ahead of a very busy Week, full of Data, Central Banks, and Month End to end the Week.

- The German Contract has gapped higher overnight, and stays underpinned/bid going into the Cash session, now breaking through 131.75, Friday's high.

- Note that the Tnotes (TYH5) has already fully cleared the Friday's high overnight, and the next immediate resistance is seen at 108.28+.

- For Bund a full clearance of 131.75, would open to 132.15 (20 day EMA), but better is seen at 132.22 and 132.57 initially.

- The opening gap would be down to 131.33.

- Today only sees the German IFO on the Data front.

- SUPPLY: Main focus will be on the heavy US Supply today, the US sells $69bn of 2yrs, and $70bn of 5yrs Notes.

- SPEAKERS: ECB Lagarde, Holzmann, Kazimir, Vujcic. Lagarde will be a pre-recorded message on receiving a prize, and we are unlikely to hear anything new ahead of the ECB this Week.

BTP TECHS: (H5) Resistance Hold For Now

- RES 4: 122.85 High Dec 11

- RES 3: 120.98 61.8% retracement of the Dec 11 - Jan 13 bear leg

- RES 2: 120.45 High Jan 2

- RES 1: 119.81 50-day EMA

- PRICE: 118.86 @ Close Jan 27

- SUP 1: 118.27/117.16 Low Jan 16 / 13 and the bear trigger

- SUP 2: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 3: 116.07 Low Jul 8 ‘24 (cont)

- SUP 4: 115.45 Low Jul 3 ‘24 (cont)

The latest rally in BTP futures highlights a corrective phase. The 20-day EMA has been breached and this exposes the next firm resistance at 119.81, the 50-day EMA. Clearance of the 50-day average would strengthen a bullish condition. The medium-term trend condition remains bearish and the pullback from Wednesday’s high may be an early reversal signal. The bear trigger has been defined at 117.16, the Jan 13 low.