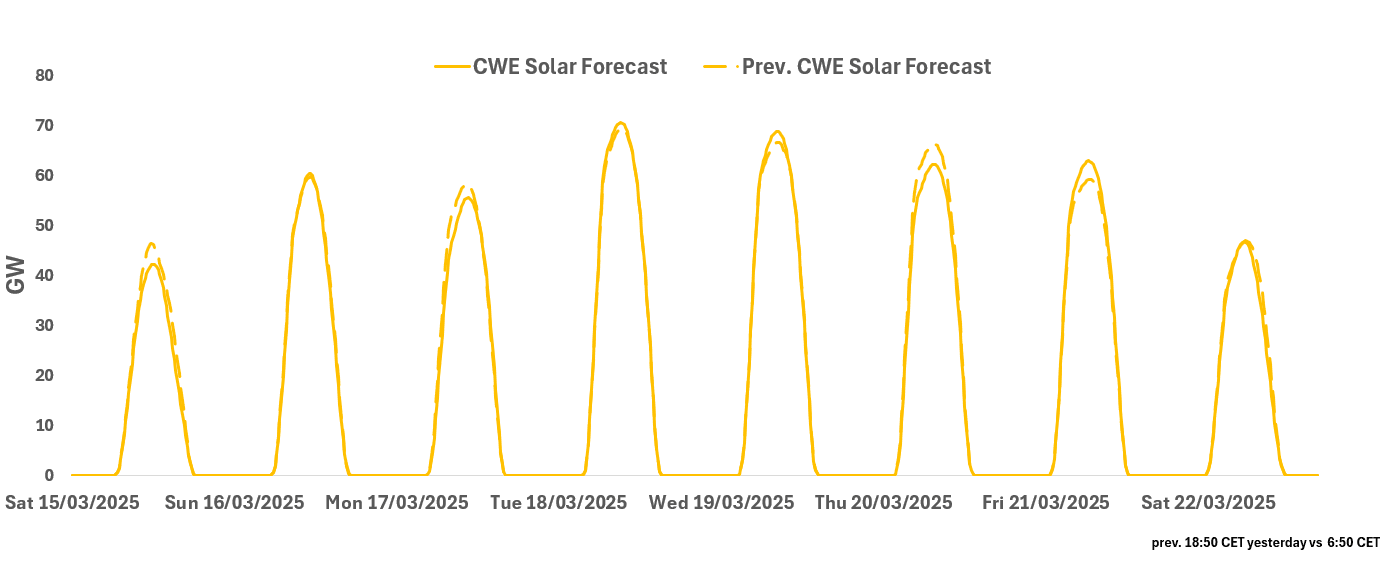

RENEWABLES: CWE Morning Solar Forecast

See the latest CWE Solar forecast for base-load hours from this morning for the next seven days.

- CWE Solar is forecast is expected to be relatively stable next week at 11-14% load factors over 17-21 March – with the highest amount of PV on 18 March.

- CWE Solar for 15-22 March

- 15 March: 11.87GW

- 16 March: 17.45GW

- 17 March: 16.98GW

- 18 March: 22.13GW

- 19 March: 21.65GW

- 20 March: 19.77GW

- 21 March: 19.85GW

- 22 March: 13.75GW

- CWE Solar for 15-22 March

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: US CPI is at the forefront

- Although Bund has seen a fairly limited range on low traded Volumes Overnight, US Tnotes is seeing ok early volumes going into the European session.

- Nonetheless, Bond Futures are still falling lower, initially on the heavy supply Yesterday, Tariff Risks concerns remain, and the Fed in no rush to adjust Rates.

- Next downside Bund target is now at 132.34 (gap), while resistance moves down to 133.13, followed by the big 133.86 level.

- Noted Yesterday that the US 10yr Yield 4.55% level, not a tech level equated to 108.26+, this has now been tested overnight.

- Next upside target in US Yield is at 4.60%, this level equates 108.16 Today.

- This morning sees the Italian IP and the Portugal final CPI, but these won't be market movers, with the main focus on the US CPI today.

- SUPPLY: UK £1bn 2045 linker (won't impact Gilt), German 2050, 2054 (equates combined to 15.9k Buxl) these could actually somewhat weigh into the longer end. Greece 2035, and Portugal 2034, 2042, 2052 won't impact Bund. US Sells $42bn of 10yr Notes.

- SYNDICATION: France 2056 Benchmark.

- SPEAKERS: ECB Elderson (at MNI), Nagel, BoE Greene, Fed Powell, Bostic, Waller, but don't expect anything new from Powell, only the Q&A can sometime differ.

BTP TECHS: (H5) Bull Phase Remains In Play

- RES 4: 123.34 High Dec 11

- RES 3: 122.85 High Dec 12

- RES 2: 121.88 76.4% retracement of the Dec 11 - Jan 13 bear leg

- RES 1: 120.98/121.00 61.8% of Dec 11 - Jan 13 bear leg / High Feb 7

- PRICE: 119.97 @ Close Feb 11

- SUP 1: 119.59 Low Feb 3

- SUP 2: 118.65/117.16 Low Jan 24 / 13 and the bear trigger

- SUP 3: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 4: 116.07 Low Jul 8 ‘24 (cont)

A bullish cycle in BTP futures remains intact and the latest pullback appears corrective. Price has recently breached both the 20- and 50- day EMAs. This signals scope for an extension of the upleg and sights are on 120.98 (pierced) and 121.88, Fibonacci retracement points. On the downside, initial key support to watch lies at 118.65, the Jan 24 low. Clearance of this price point would highlight a reversal and the end of the corrective bull cycle.

EURJPY TECHS: Corrective Gains

- RES 4: 162.70 High Jan 28

- RES 3: 162.49 High Jan 29

- RES 2: 161.09 50-day EMA

- RES 1: 159.93 20-day EMA

- PRICE: 159.12 @ 07:02 GMT Feb 12

- SUP 1: 157.90/155.61 Intraday low / Low Feb 10 and the bear trigger

- SUP 2: 155.15 Low Sep 16 ‘24

- SUP 3: 154.42 Low Aug 5 ‘24 and key medium-term support

- SUP 4: 153.87 Low Dec 14 ‘23

EURJPY is firmer today as the cross extends the rebound from Monday’s low. MA studies are in a bear-mode position and this suggests that the latest recovery is likely a correction. The move higher is allowing a recent oversold condition to unwind. Initial resistance to watch is 159.93, the 20-day EMA. Key short-term resistance is at 161.09, the 50-day EMA, where a break would highlight a stronger reversal. The bear trigger lies at 155.61, the Feb 10 low.