RENEWABLES: CWE Morning Solar Forecast 21 March 2025

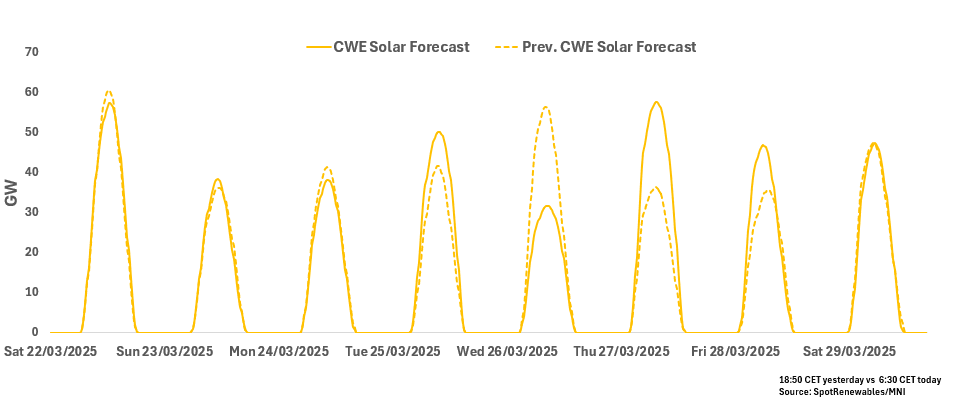

See the latest CWE solar forecast for base-load hours from this morning for the next seven days. CWE solar output is forecast to remain relatively low over the next seven days.

CWE Solar for 22-29 March

- 22 March: 17.02W

- 23 March: 10.77GW

- 24 March: 11.01GW

- 25 March: 15.2GW

- 26 March: 9.91GW

- 27 March: 17.88GW

- 28 March: 13.4GW

- 29 March: 13.72GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILT TECHS: (H5) Bullish Engulfing Candle Highlights A S/T Reversal

- RES 4: 95.57 High Dec 11 ‘24

- RES 3: 95.11 High Dec 12 ‘24

- RES 2: 94.75 76.4% retracement of the Dec 3 - Jan 13 bear leg

- RES 1: 93.71/94.35 High Feb 10 / 6 and the bull trigger

- PRICE: 92.61 @ Close Feb 18

- SUP 1: 92.31 Low Feb 12

- SUP 2: 91.96/91.52 Low Jan 29 / 24

- SUP 3: 91.10 Low Jan 20

- SUP 4: 89.68/88.96 Low Jan 15 / 13 and the bear trigger

A bull cycle in Gilt futures remains in play and recent weakness appears corrective for now. The climb on Feb 13 is a positive development and appears to be a bullish engulfing candle pattern. A continuation higher would open 94.35, the Feb 6 high and a bull trigger. Clearance of this level would open 94.75, the 76.4% retracement of the Dec 3 - Jan 13 bear leg. The next firm support to watch lies at 91.52, the Jan 24 low.

BUNDS: New Tariff Threats

- A far more subdued session for Bund overnight following two decent trading sessions Volume-wise, the German Yield will still be around that 2.50% Yield, we noted that this was circa 131.97 this past Week.

- The UK mixed CPI was initially worth a 10 ticks dip in Bund, but off the low post Cash open.

- US Treasuries have seen similar light, tight flow, with multi cross assets brushing aside the latest Tariff threats from President Trump, vowing to impose around 25% tariffs on Automobile, Semiconductor and Pharmaceutical imports, to be announced as soon as the 2nd April.

- As such, even the US Tnotes (TYH5) Trades in a super tight 3 big ticks range.

- Next support in Bund is still eyed at 131.62, although much better will be eyed at 131.00.

- We noted a small resistance moving down to 132.26 Yesterday, this remains untested after printing a 132.13 high Yesterday.

- A break through the latter, opens to 132.59 20-day EMA.

- With the UK CPI out of the way, there are no more Tier 1 Data left for the session, focus will be on Supply, and the FOMC today.

- SUPPLY: UK £4.25bn 2028 (Equates to 13k Gilt) should have limited impact on Gilt, German €4.5bn Bund (equates to 37k Bund) will weigh into the bidding deadline. US Sells $16bn of 20yr.

- SPEAKERS: Fed Jefferson, {eu} ECB Panetta.

UK DATA: Rather mixed outcome likely changes no ones view for the MPC meeting

Overall for the MPC this is a rather mixed release. The small downside surprise in services inflation (0.15ppt vs their Feb MPR forecast) will be a welcome surprise.

- The MPC has shown through its wider communications that it's not too concerned about energy CPI increasing later this year, but if food prices also increase and core goods prices settle at higher levels, that's going to make it harder to get headline CPI back to target without services coming in lower than pre-pandemic levels on a sustainable basis,

- For March this probably changes no one's view. And it's not a big enough surprise to get a bigger reading for the future yet. But it is more of the same with upside surprises to food and core goods.