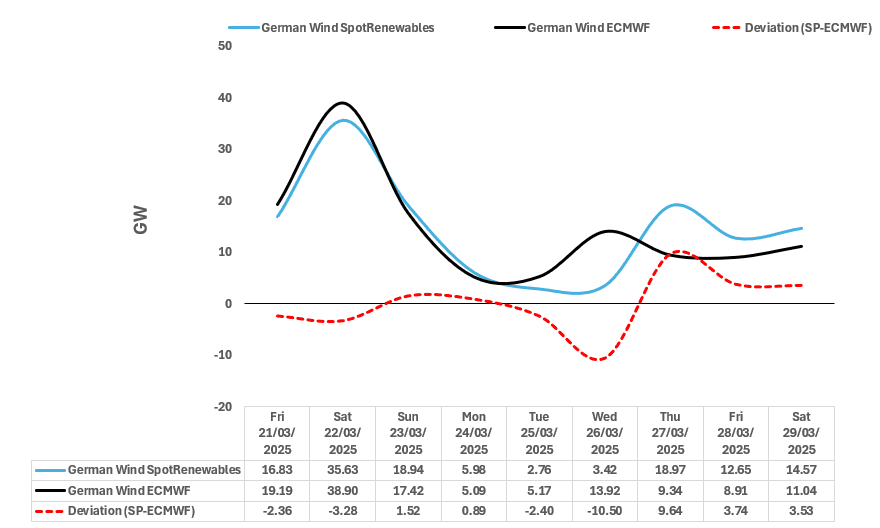

RENEWABLES: German Wind Output Forecast Comparison

See the latest German wind output forecast for base-load hours from SpotRenewables vs Bloomberg’s ECMWF model for the next seven days as of Thursday afternoon.

- Both models have similar wind forecasts for this week and the start of next week.

- The largest deviation is seen mid-and end-next week with Bloomberg’s ECMWF model suggesting German wind output will peak on Wednesday next week at 13.9GW, while SpotRenewables model suggests output to peak on Thursday at 18.97GW.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US: SFR Call Condor buyer

0QH5 95.93/96.06/96.18/96.43c condor, bought for 3.5 in another 5k, total 10k screen and pit.

ECB: Cipollone Q&A: Non-Linear QT and Mon Pol Equivalence

Q: How shall we translate/compare the impact of QT with policy rate changes? Is this linear/does this change with time?

A: It's not linear. It will become less and less strong as we move forward. In some sense, QT and rate cuts do not contradict each other because we have been in a restrictive territory. So the two instruments moved in the same direction. It will become interesting when the two instruments start to diverge.

Q: Will the policy rate still be restrictive if cut to 2.50% in March?

A: We live in a world of tremendous uncertainty. I cannot say whether we will be in restrictive territory or not in a months time.

MNI: US NAHB HOUSING MARKET INDEX 42 IN FEB

- MNI: US NAHB HOUSING MARKET INDEX 42 IN FEB

- US NAHB FEB SINGLE FAMILY SALES INDEX 46; NEXT 6-MO 46