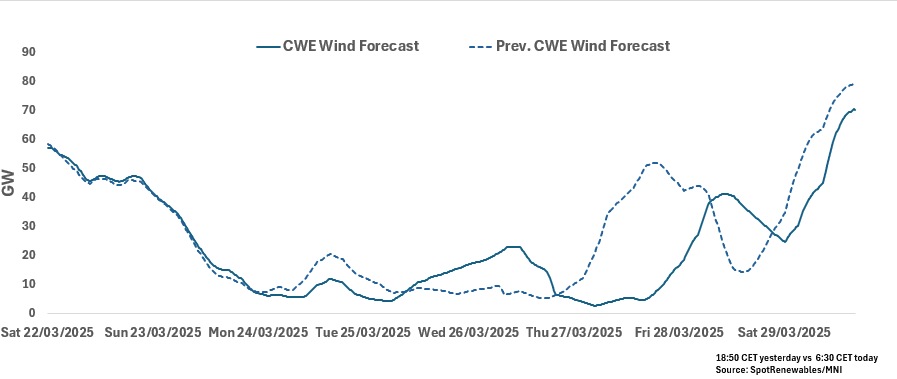

RENEWABLES: CWE Morning Wind Forecast 21 March 2025

See the latest CWE wind forecast for base-load hours from this morning for the next seven days. CWE wind output is forecast to be rise late next week, albeit revised lower on the day.

CWE Wind for 22-29 March

- 22 March: 48.93GW

- 23 March: 24.88GW

- 24 March: 7.93GW

- 25 March: 8.35GW

- 26 March: 18.36GW

- 27 March: 4.75GW

- 28 March: 28.14GW

- 29 March: 42.17GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

UK DATA: Rather mixed outcome likely changes no ones view for the MPC meeting

Overall for the MPC this is a rather mixed release. The small downside surprise in services inflation (0.15ppt vs their Feb MPR forecast) will be a welcome surprise.

- The MPC has shown through its wider communications that it's not too concerned about energy CPI increasing later this year, but if food prices also increase and core goods prices settle at higher levels, that's going to make it harder to get headline CPI back to target without services coming in lower than pre-pandemic levels on a sustainable basis,

- For March this probably changes no one's view. And it's not a big enough surprise to get a bigger reading for the future yet. But it is more of the same with upside surprises to food and core goods.

SCHATZ TECHS: Correct Tag: (H5) Corrective Cycle Extends

- RES 4: 107.045 High Feb 3 and a reversal trigger

- RES 3: 106.975 High Feb 10

- RES 2: 106.855 High Feb 12 and a key near-term resistance

- RES 1: 106.789 20-day EMA

- PRICE: 106.710 @ 07:22 GMT Feb 19

- SUP 1: 106.668 61.8% retracement of the Jan 15 - Feb 3 bull leg

- SUP 2: 106.600 Low Jan 31

- SUP 3: 106.515 Low Jan 30

- SUP 4: 106.435 Low Jan 15 and key support

A bull cycle that began Jan 15 in Schatz futures remains in play, and the pullback from the early February highs appears corrective - for now. However, the contract maintains a softer short-term tone and this highlights potential for a deeper retracement. A continuation lower would open 106.600 next, the Jan 31 low. For bulls, initial firm resistance to watch is 106.855, the Feb 12 high. A break would highlight an early bullish reversal signal.

RIKSBANK: (H5) Corrective Cycle Extends

- RES 4: 107.045 High Feb 3 and a reversal trigger

- RES 3: 106.975 High Feb 10

- RES 2: 106.855 High Feb 12 and a key near-term resistance

- RES 1: 106.789 20-day EMA

- PRICE: 106.710 @ 07:22 GMT Feb 19

- SUP 1: 106.668 61.8% retracement of the Jan 15 - Feb 3 bull leg

- SUP 2: 106.600 Low Jan 31

- SUP 3: 106.515 Low Jan 30

- SUP 4: 106.435 Low Jan 15 and key support

A bull cycle that began Jan 15 in Schatz futures remains in play, and the pullback from the early February highs appears corrective - for now. However, the contract maintains a softer short-term tone and this highlights potential for a deeper retracement. A continuation lower would open 106.600 next, the Jan 31 low. For bulls, initial firm resistance to watch is 106.855, the Feb 12 high. A break would highlight an early bullish reversal signal.