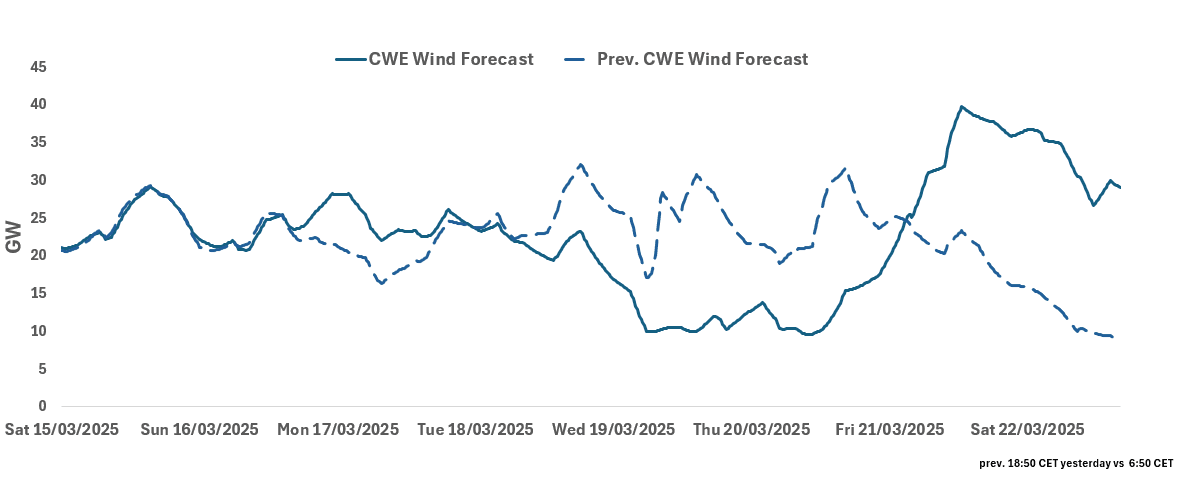

RENEWABLES: CWE Morning Wind Forecast

See the latest CWE Wind forecast for base-load hours from this morning for the next seven days.

- CWE wind is forecast to be at 21-24% load factors over 17-18 March before falling between 11-12% load factors over 19-20 March.

- CWE Wind for 15-22 March:

- 15 March: 24.84GW

- 16 March: 23.19GW

- 17 March: 24.73GW

- 18 March: 22.22GW

- 19 March: 12.87GW

- 20 March: 11.73GW

- 21 March: 28.07GW

22 March: 33.36GW

- CWE Wind for 15-22 March:

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BTP TECHS: (H5) Bull Phase Remains In Play

- RES 4: 123.34 High Dec 11

- RES 3: 122.85 High Dec 12

- RES 2: 121.88 76.4% retracement of the Dec 11 - Jan 13 bear leg

- RES 1: 120.98/121.00 61.8% of Dec 11 - Jan 13 bear leg / High Feb 7

- PRICE: 119.97 @ Close Feb 11

- SUP 1: 119.59 Low Feb 3

- SUP 2: 118.65/117.16 Low Jan 24 / 13 and the bear trigger

- SUP 3: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 4: 116.07 Low Jul 8 ‘24 (cont)

A bullish cycle in BTP futures remains intact and the latest pullback appears corrective. Price has recently breached both the 20- and 50- day EMAs. This signals scope for an extension of the upleg and sights are on 120.98 (pierced) and 121.88, Fibonacci retracement points. On the downside, initial key support to watch lies at 118.65, the Jan 24 low. Clearance of this price point would highlight a reversal and the end of the corrective bull cycle.

EURJPY TECHS: Corrective Gains

- RES 4: 162.70 High Jan 28

- RES 3: 162.49 High Jan 29

- RES 2: 161.09 50-day EMA

- RES 1: 159.93 20-day EMA

- PRICE: 159.12 @ 07:02 GMT Feb 12

- SUP 1: 157.90/155.61 Intraday low / Low Feb 10 and the bear trigger

- SUP 2: 155.15 Low Sep 16 ‘24

- SUP 3: 154.42 Low Aug 5 ‘24 and key medium-term support

- SUP 4: 153.87 Low Dec 14 ‘23

EURJPY is firmer today as the cross extends the rebound from Monday’s low. MA studies are in a bear-mode position and this suggests that the latest recovery is likely a correction. The move higher is allowing a recent oversold condition to unwind. Initial resistance to watch is 159.93, the 20-day EMA. Key short-term resistance is at 161.09, the 50-day EMA, where a break would highlight a stronger reversal. The bear trigger lies at 155.61, the Feb 10 low.

STIR: SFRH5 Lifted

SFRH5 paper paid 95.700 on 6.4K, taken bid over.