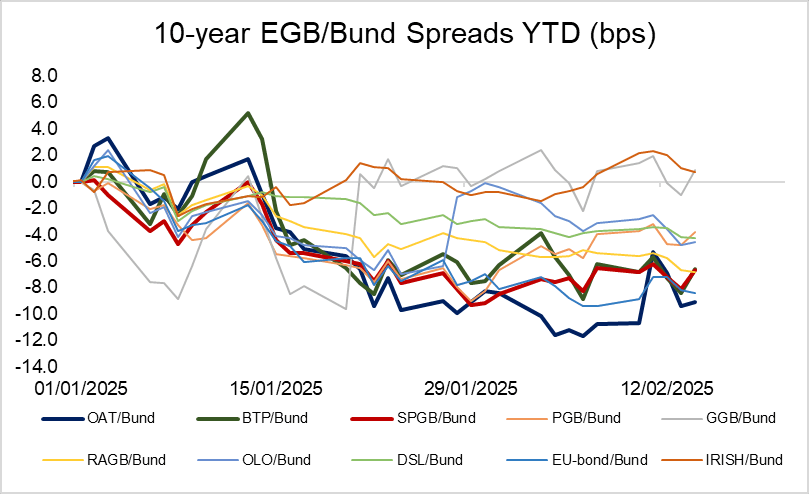

EGBS: December Low Contains 10-year BTP/Bund Downside This Week

The December low contained downside in the 10-year BTP/Bund spread this week. The spread has drifted 2bps wider through the day, now at 109bps, bringing week-to-date tightening to just ~0.5bps.

- Year-to-date, the spread has tightened ~6.5bps. European equities have been happy to look through US tariff risks through the course of this year, which has been conducive to spread tightening.

- US tariffs on the EU have been announced, but not yet imposed. 25% tariffs on steel and aluminium will apply from March 12 while broader reciprocal tariffs won't come until April 2 at the earliest. Meanwhile, markets remain cognizant of the April 1 trade report Trump ordered on inauguration day. This report is expected to provide Trump with an economic rationale to impose (further) tariffs on trade partners like China and the EU.

- OATs have outperformed EGB peers year-to-date, even after taking account this week’s 10-year benchmark roll (which mechanically widened the spread by 3bps on Tuesday).

- French PM Bayrou has survived five no-confidence votes over the past few weeks, as he pushed his 2025 budget through the National Assembly using Article 49.3. However, medium-term fiscal and political risks remain prevalent, which may limit tightening moves beyond the 70bps handle for now.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: EURUSD Reverses Post-CPI Move, EURJPY Down 1.05%

- The US dollar has been gradually paring losses in recent trade, with the greenback assisted by equities moderately off their best levels. EURUSD stands out, having entirely reversed the post-CPI move to trade back at 1.0300. Notably, the single currency underperformance keeps EURGBP on the backfoot, edging closer back to 0.8400, while EURJPY extends session declines to over 1%. Below here for EURJPY, the focus will be on 160.00, a notable pivot for the cross, coinciding with the Monday low.

US INFLATION: Core PCE Estimates Tilt Lower After CPI Report

Some post-CPI core PCE estimates below - while not all had pre-CPI/PPI forecasts, it's pretty clear that CPI points to a slightly softer figure than seen coming into this week and certainly after PPI (pre-PPI it was around 0.20%, post-PPI it looked to be closer to 0.25%, now looks to be back to 0.20% or the high 0.10s%).

December Core PCE % M/M ests (0.11% prior):

- Wells Fargo 0.21%

- Nomura: 0.205% (had been 0.272% pre-CPI, post-PPI)

- HSBC: 0.2% (rounded)

- Cleveland Fed nowcast: 0.189% (had been 0.23% pre-PPI and pre-CPI)

- JPM 0.186%

- Morgan Stanley: 0.166%

US-RUSSIA: Treasury Announces New Measures On Russia To Curb Sanctions Evasion

The US Treasury Department has announced a raft of new sanctions on financial institutions determined to aid Russia in evading US-led sanctions or supporting Russia's military-industrial base.

- The measures are part of a major push by the Biden administration to harden rules against Russia and China before President-elect Donald Trump takes office next week. Other measures announced include strict sanctions on Russia's energy sector and an expansion of export controls on semiconductors related to AI to China.

- A Treasury statement notes: "This action targets a sanctions evasion scheme established between actors in Russia and the People’s Republic of China (PRC) to facilitate cross-border payments for sensitive goods."

- The statement adds: "Today’s sanctions also include dozens of companies across multiple countries that continue to support Russia’s efforts to evade U.S. sanctions, particularly in the PRC, which remains the largest supplier of dual use items and enabler of sanctions evasion in support of Russia’s war effort."

- Deputy Treasury Secretary Wally Adeyemo said in a statement: “Today’s actions frustrate the Kremlin’s ability to circumvent our sanctions and get access to the goods they need to build weapons for their war of choice in Ukraine. Today’s expansion of mandatory secondary sanctions will reduce Russia’s access to revenue and goods.”

- The Treasury Dept notes: "...foreign financial institutions that conduct or facilitate significant transactions or provide any service involving Russia’s military-industrial base... run the risk of being sanctioned by [Office of Foreign Assets Control]."