FED: Dot Plot: Higher For Longer Message, Softly Held

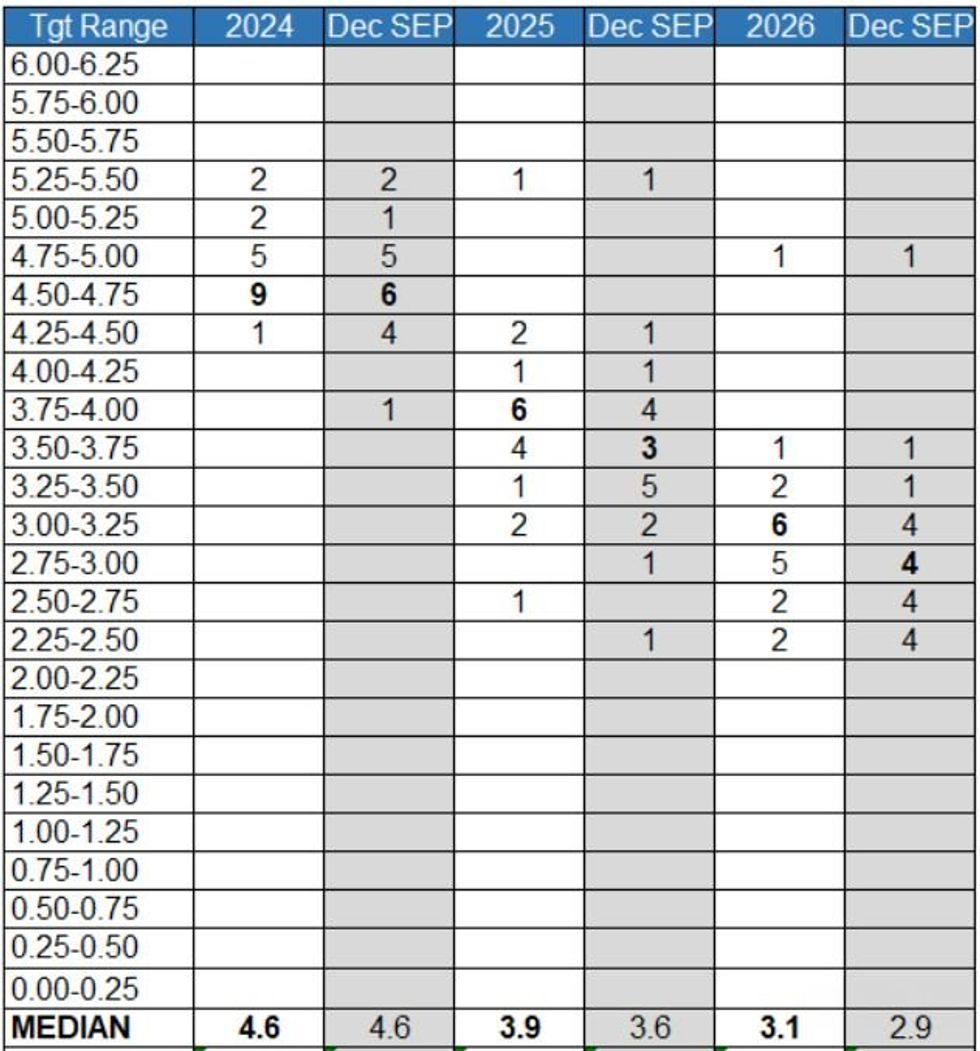

Looking at the Dot Plot, it conveys a more entrenched higher for longer message than the December edition:

- While the 2024 median Dot - the most closely watched individual item in the SEP - remains unchanged at 4.6% (3 cuts this year), there was an upward distribution from 4- and 6-cutters (now just 1 member sees more than 3 cuts this year, vs 5 previously), with a solid 9 at the median 4.6%, versus 6 prior. There is little evidence that the more hawkish end of the FOMC got any more hawkish since December.

- The surprises are further out: the 2025 and 2026 end-year medians have drifted up, showing 1 less cut in those respective years. Note also that the dovish dots have drifted up, with the most hawkish 3-4 dots not really changing.

- The higher 2025-26 profile may reflect a higher path converging with a higher longer-run dot: 2.6% (actually it looks like it is a split between 9 at 2.50% and below, and 9 at 2.625% and above, meaning a 2.5625% median rounding up to 2.6%). Effectively, two of the longer-run 2.375% dots moved higher from last time, boosting the median.

- Overall this paints a higher for longer message: fewer cuts in 2025 and 2026 are reflective of the stronger economy and higher inflation portrayed in the economic projections, and the 2024 and 2025 drifts may suggest a bias toward cutting later rather than earlier in the year than seen in the December Dots.

- However we would note that the 2025 and 2026 medians are fairly "soft" - just one participant moving down from either median level would shift the medians down (currently both medians have 10 at or above, 9 below).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURUSD TECHS: Trend Needle Points South

- RES 4: 1.1046 High Jan 2

- RES 3: 1.0998 High Jan 5

- RES 2: 1.0932 High Jan 24 and a reversal trigger

- RES 1: 1.0804/98 20-day EMA / High Feb 02

- PRICE: 1.0767 @ 15:56 GMT Feb 19

- SUP 1: 1.0695 Low Feb 14

- SUP 2: 1.0656 Low Nov 10

- SUP 3: 1.0611 76.4% retracement of the Oct - Dec bull leg

- SUP 4: 1.0568 Low Nov 2

EURUSD conditions remain bearish and short-term gains are considered corrective. This week’s bearish extension reinforces the current downtrend. The pair traded to a fresh trend low and maintains the bearish price sequence of lower lows and lower highs. Support at 1.0724, the Dec 8 low, and 1.0712, 61.8% of the Oct - Dec bull leg, have been breached. This opens 1.0656 next, the Nov 10 low. Initial resistance is 1.0804, the 20-day EMA.

OPTIONS: Limited Trade On US Holiday Monday

Monday's Europe bond/rates options flow included:

- DUH4 105.30/105.00 put spread 5K sold at 5.25 (v 105.335)

BONDS: EGBs-GILTS CASH CLOSE: Core FI Twist Steepens, BoE Speak / ECB Wages Eyed

Bunds and Gilts closed relatively unchanged Monday, with trading activity, macro developments and headlines all dulled by a US market holiday.

- Yields bottomed by mid-morning without any major catalysts evident, before drifting higher - though all very much within Friday's ranges. In futures terms, 450k March Bund contracts traded - around half of the usual volume.

- The German and UK curves leaned twist steeper with yields across almost all tenors closing within 1.0bp of Friday's close. Periphery spreads were mixed, with BTPs underperforming and PGBs outperforming, but the moves were fairly negligible.

- ECB pricing remained relatively steady: still around 104bp of ECB rate cuts seen through 2024 (first cut fully priced by June), while the 69bp priced for the BoE was about 4bp more than seen at Friday's close (first cut remains fully priced by Aug though now a little more firmly).

- Turning to Tuesday, focus will be on supply (EU syndication, German Schatz auction among others) and ECB negotiated wage data (scheduled for 1000GMT release).

- BoE's Bailey, Broadbent, Greene and Dhingra give testimony on the February Monetary Policy Report - see MNI's Gilt Week Ahead.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at 2.816%, 5-Yr is down 0.3bps at 2.387%, 10-Yr is up 0.9bps at 2.411%, and 30-Yr is up 2.5bps at 2.569%.

- UK: The 2-Yr yield is down 0.6bps at 4.614%, 5-Yr is down 0.2bps at 4.134%, 10-Yr is unchanged at 4.108%, and 30-Yr is down 0.4bps at 4.644%.

- Italian BTP spread up 0.8bps at 149.1bps / Greek down 0.7bps at 107.9bps