ECB VIEW: Downside Inflation Risks Have Grown Since March ECB [2/2]

Apr-15 18:33

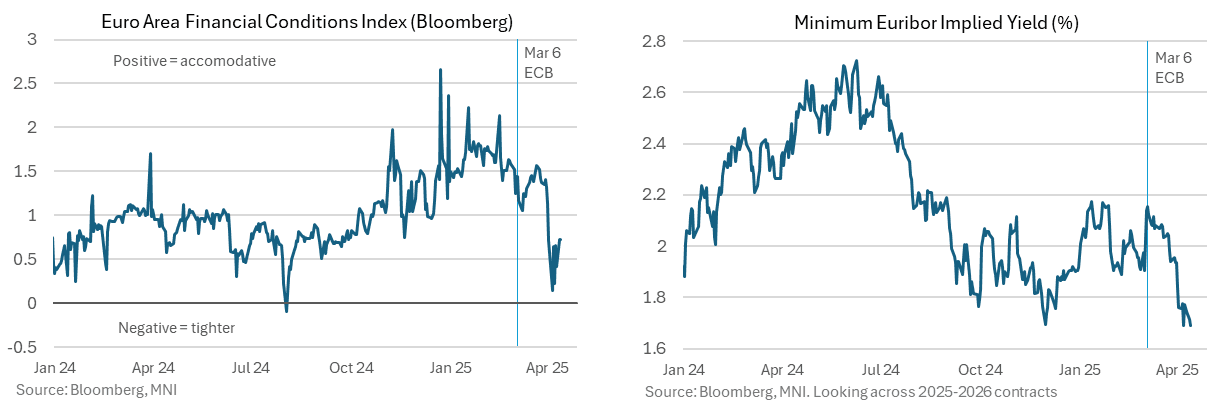

- On top of this euro appreciation, financial conditions have tightened as equities have tumbled since President Trump’s “Liberation Day” tariff announcements and 5Y5Y inflation swaps have fully reversed the 15bp push higher seen on the defence and infra spending plans.

- Whilst there has been some tariff reprieve for the European Union with Trump’s 90-day ‘pause’ at a reciprocal rate of 10% rather than 20%, the huge 145% tariffs imposed by the US on China has further bolstered the risk that “a re-routing of exports into the euro area from countries with overcapacity would put downward pressure on inflation.”

- Our policy team has been closely following this amongst other areas - see MNI: Europe to Sharpen Trade Tools To Tackle Dumping (Feb 24) and MNI: EU To Keep China Option In Reserve As Seeks US Deal (Apr 11).

- The combination sees terminal rate expectations close to cycle lows heading into the meeting, roughly consistent with a policy rate bottoming out below 1.6%.

- It should also see the Governing Council hawks having a little less sway in this meeting’s communications but would also make any hawkish skew more notable.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: March Economic Projections: Higher Inflation, Weaker Growth, Same Rates

Mar-14 21:28

The MNI Markets Team’s expectations for the updated Economic Projections in the March SEP are below.

- The unemployment rate is likely to rise slightly for 2025 alongside a downgrade in GDP growth, while the 2025 core and headline PCE inflation projections are set to rise again. Changes to later years will likely be limited, however.

- More detail on the shift in Fed funds rate medians is in our meeting preview - we will add more color next week.

FED: Market Pricing Nearly 3 2025 Cuts As Conditions Tighten

Mar-14 21:25

Amid rising government policy uncertainty, sentiment among businesses and consumers has fallen sharply since the start of the year, while equities and the dollar have reversed their post-election rise. Overall, financial conditions have tightened, even if stress is not yet mounting, e.g. no major widening of credit spreads (the accompanying chart shows the Fed’s financial conditions impulse index but only through January).

- Combined with growth fears, this has affected expectations for the Fed’s rate path, with around 18bp more cuts expected in 2025 compared with what was seen after the January FOMC. 65bp of cuts are priced for the year as a whole. 2025 cut pricing reached 71bp before the February inflation data and 76bp before the February payrolls report.

- A rate cut is seen with near zero probability for March’s meeting, but the first full cut is just about priced for June, with a second nearly priced by September.

- Chair Powell has no reason to endorse or refute these expectations – he’s likely to be happy with a press conference that ends with little discernable change in pricing.

CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX

Mar-14 21:17

- CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX