SOUTH KOREA: DPK Early Favourites For Presidency After Yoon's Impeachment

A spox for the South Korean National Election Commission (NEC) says that acting President Han Duck-soo and the head of the NEC have "agreed that 3 June is a good date for a presidential election" but that that date "is not yet final". A snap presidential election is required within 60 days following the Constitutional Court's unanimous decision earlier today to uphold the impeachment of Yoon Suk-yeol after his short-lived imposition of martial law in Dec 2024. As we noted earlier (see 'SOUTH KOREA: Yoon Impeachment Upheld, Election Within 60 Days', 0239BST, and 'SOUTH KOREA: Country Wrap: Yoon Impeached', 0636BST) 3 June has for some time been viewed as the most likely date for a poll should the Court back Yoon's removal from office.

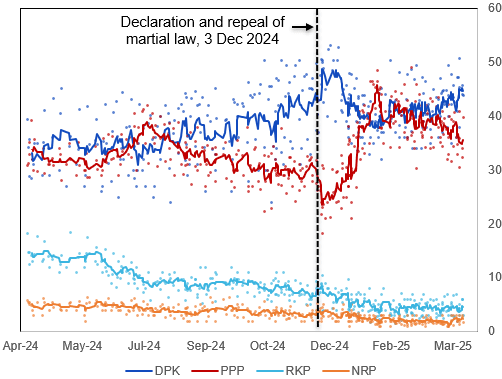

- Hypothetical presidential polling may not be hugely useful at present, with the conservative People Power Party (PPP) - Yoon's former party - yet to select a candidate. As noted earlier, opposition liberal Democratic Party of Korea (DPK) leader Lee Jae-myung holds a sizeable lead in hypothetical scenario polling, bolstered by his widespread name recognition (he was the defeated DPK candidate in the 2022 presidential election) and benefiting from a recovery in support for the DPK over the past two months. While he is not the official DPK candidate yet, it is all but assured he will be nominated in due course.

- Protests from both pro- and anti-Yoon camps are set to continue this weekend, but notably the main pro-Yoon 'Save Korea' group has said the court's decision must be respected and cancelled its rally on 5 April, limiting the prospect of any widespread unrest.

Chart 1. Legislative Election Opinion Polling, % and 6-Poll Moving Average

Source: EveryResearch, Researchview, KSOI, KOPRA, Flower Research, Realmeter, Gallup, Media Research, NBS, Gongjung, Jowon C&I, Win G, Media Tomato, Ace Research, Hangil Research, MNI

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: Some notable recovery off the lows in EGBs

- Some broader recovery in EGBs, and especially German Govies, some position adjustments likely at play.

- Looking at Volumes and ignoring the past two sessions since these were Spread related, Volume in Bund with over 500k lots traded in less than 2 hours since the Cash Open will be up there in terms of record, albeit not a all time record.

- Small initial resistance in Bund is at 130.22, Buxl look to test the overnight intraday high of 122.28.

MNI: ITALY FEB SERVICES 53.0 (FCST: 51.0); JAN 50.4

- MNI: ITALY FEB SERVICES 53.0 (FCST: 51.0); JAN 50.4

- ITALY FEB COMPOSITE 51.9 (FCST: 50.0); JAN 49.7

GBPUSD TECHS: Northbound

- RES 4: 1.2990 High Nov 8 2024

- RES 3: 1.2924 61.8% retracement of the Sep 26 ‘24 - Jan 13 bear leg

- RES 2: 1.2874 High Nov 12 ‘24

- RES 1: 1.2852 Intraday high

- PRICE: 1.2839 @ 08:38 GMT Mar 5

- SUP 1: 1.2679 Low Mar 4

- SUP 2: 1.2595 20-day EMA

- SUP 3: 1.2554 50-day EMA and a short-term pivot support

- SUP 4: 1.2440 Low Feb 13

The trend outlook in GBPUSD remains bullish and Tuesday’s strong gains reinforce this theme. Note that moving average studies have recently crossed into a bull-mode position, highlighting a potentially stronger bull cycle. The pair is again trading higher, today, and sights are on a climb towards 1.2924, a Fibonacci retracement. Initial firm support to watch is 1.2554, the 50-day EMA.