EM CEEMEA CREDIT: DPWDU: Strong FY24 results and pos for spreads

DP World (DPWDU: Baa2/-/BBB+)

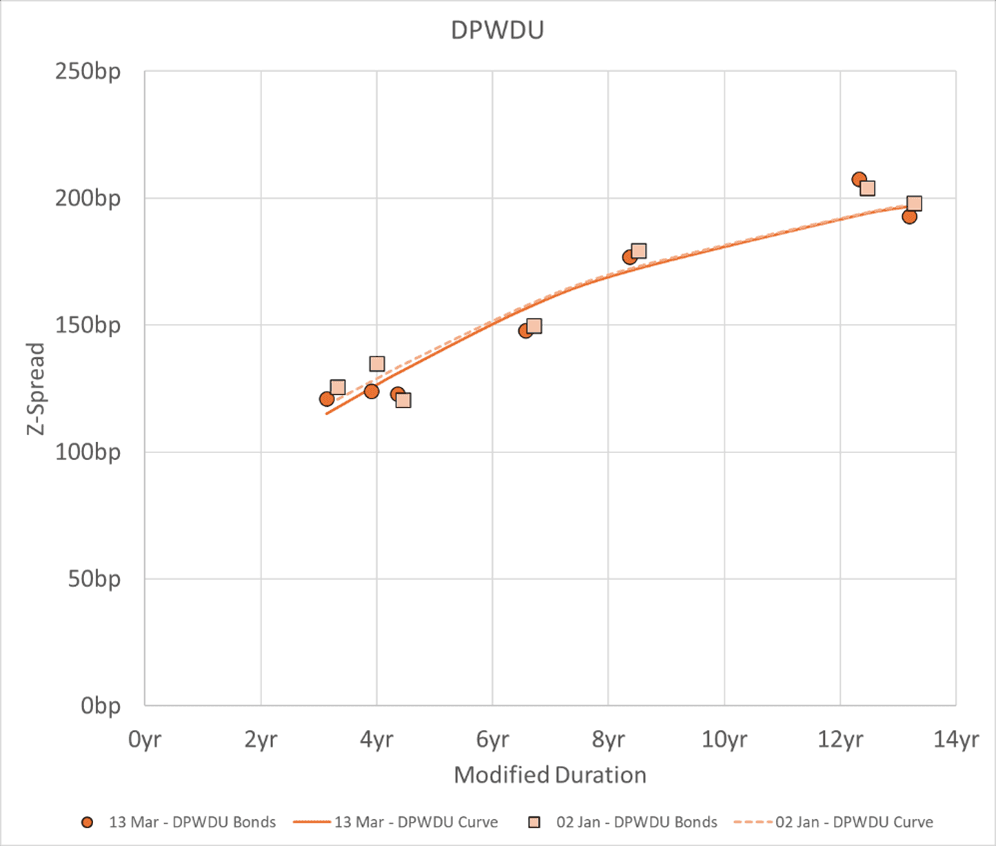

Strong results from DPWDU and positive for spreads.

- DPWDU Rev’s USD20bn +9.7% YoY. Growth driven by Asia pacific and India 11.1% YoY and by Australia and America’s +14.9%. Divisionally, Ports and terminals +20% YoY, with rev per TEU +10%.

- Adj. EBITDA +6.7% YoY to USD5.5bn while margins deteriorated 80bp to 27.1%. FCF was strong around USD3bn in 24 and resulted in net debt decreasing to 3.5x from 3.7x in 23.

- DPWDU spreads have tightened by around 5bp YTD across the curve. The strong operating performance supports the trajectory in spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BOBL TECHS: (H5) Holding On To Its Recent Gains

- RES 4: 118.310 High Dec 20

- RES 3: 118.27 61.8% retracement of the Dec 2 - Jan 14 bear leg

- RES 2: 118.100 High Jan 2

- RES 1: 117.980 High Jan 3 / 5

- PRICE: 117.780 @ 08:06 GMT Feb 11

- SUP 1: 117.583 50-day EMA

- SUP 2: 117.373 20-day EMA

- SUP 3: 116.550 Low Jan 24

- SUP 4: 116.280 Low Jan 14 / 15 and a key support

Bobl futures remain in a bull cycle and the contract is holding on to its recent gains. Last week’s climb reinforces current bullish conditions. The contract has traded through both the 20- and 50-day EMAs. A clear breach of 117.880, 50.0% of the Dec 2 - Jan 14 bear leg, would signal scope for an extension towards 118.258, the 61.8% retracement of the Dec 2 - Jan 14 bear leg. Initial support to watch lies at 117.373, the 20-day EMA.

BUND TECHS: (H5) Bull Phase Remains In Play

- RES 4: 134.94 High Dec 17

- RES 3: 134.54 61.8% retracement of the Dec 2 - Jan 14 bear leg

- RES 2: 134.29 High Dec 20

- RES 1: 133.73 50.0% retracement of the Dec 2 - Jan 14 bear leg

- PRICE: 133.24 @ 08:03 GMT Feb 11

- SUP 1: 132.53 20-day EMA

- SUP 2: 131.00 Low Jan 16 / 24

- SUP 3: 131.00/130.28 Low Jan 16 / Low Jan 15 and the bear trigger

- SUP 4: 130.44 Low Jul 5 ‘24 (cont)

Bund futures remain in a bull cycle and the contract is holding on to its latest gains. The recent pause appears to be a flag formation - a bullish continuation signal. Price has recently cleared both the 20- and 50-day EMAs. The break higher confirms a resumption of the corrective bull cycle that started Jan 14. Sights are on 133.73, a Fibonacci retracement point. Firm short-term support has been defined at 131.00, the Jan 16 / 24 low.

EU-BOND SYNDICATION: Dual tranche tap: 2.50% Dec-31 EU-bond / 3.25% Feb-50 Green

2.50% Dec-31 EU-bond

- Guidance: MS + 39bps area

- Size: E6bln WNG (MNI expected E4-6bln)

- ISIN: EU000A3L1DJ0

3.25% Feb-50 Green EU-bond

- Guidance: MS + 110bps area

- Size: E5bln WNG (MNI expected E4-6bln)

- ISIN: EU000A3K4EU0

For both

- Settlement: 18 February 2025 (T+5)

- JLMs: Citi / DB / HSBC / Morgan Stanley (B&D/DM) / Societe Generale

- Timing: Books open, today's business