STIR: ECB Rates Rally On Dovish Commentary But With Caveats

Apr-24 16:49

- Today’s European rates rally has primarily been driven by dovish ECB headlines, even if there have been caveats to them.

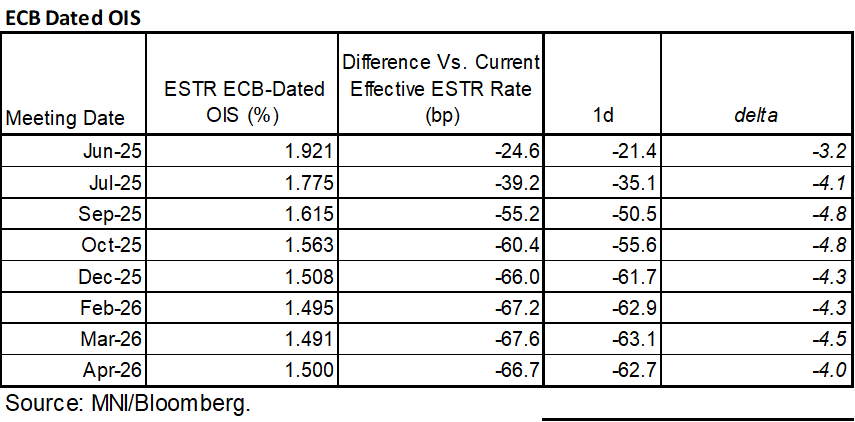

- Cut expectations have climbed 3-5bp across ECB meetings out to 2Q26, starting with now 24.5bp of cuts for the next meeting in June before a cumulative 39bp for Jul and 66bp by year-end.

- Euribor futures are up to 7 ticks higher in mid-2027 contracts, slightly underperforming US rates.

- The Euribor terminal implied yield of 1.615% (still in ERH6) is 5bp lower on the day although doesn’t fully reverse yesterday’s climb.

- The beat for the German Ifo business survey had little lasting impact, only stalling a rally which was then pushed on by Rehn in the most dovish comments of the day.

- Part two will follow with a recap of today's ECB speak.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS/SUPPLY: WI 2Y

Mar-25 16:47

- WI recedes to 3.985% from 3.990%, 18.4bp rich to last month's stop: 4.169% high yield vs. 4.179% WI.

FED: US TSY 2Y AUCTION: NON-COMP BIDS $415 MLN FROM $69.000 BLN TOTAL

Mar-25 16:45

- US TSY 2Y AUCTION: NON-COMP BIDS $415 MLN FROM $69.000 BLN TOTAL

FOREX: Most Recent Comments on EURUSD

Mar-25 16:43

- JP Morgan notes the dollar-downtrend has consolidated of late, perhaps reflecting heightened sensitivity to early-April tariff delivery, but for now JPM stick with more medium-term shorts. They continue to run USD-short positions via DXY, and on across a range of pairwise expressions (vs EUR, Scandis, JPY, AUD). These are strategic views, representing a combination of 1) the longer-term implications of the European fiscal plan, 2) JPM’s constructive Scandi views and 3) the broader ongoing carry-to-value rotation which should benefit from continued moderation of US data.

- ING said they saw upside risks for EURUSD today given the US consumer confidence risk event, but their preference remains for a depreciation to <1.07 in April.

- Rabobank see risks that EUR/USD could dip further on a 1-to-3-month view before climbing to 1.12 on a 1-year outlook.