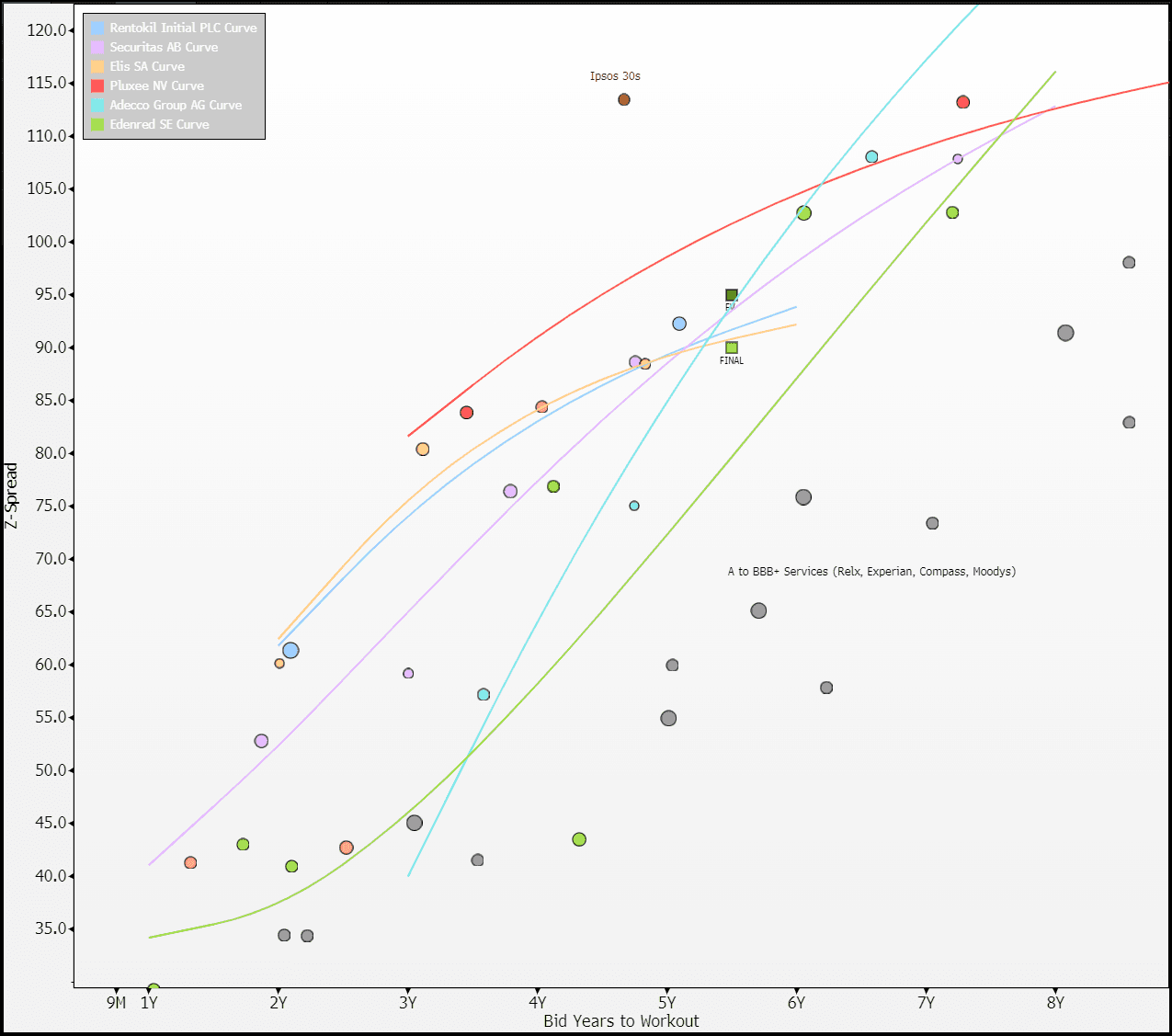

EU CONSUMER CYCLICALS: Edenred; FINAL

(NR/A-)

Investors willing to reduce the regulation discount. We are less keen - as mentioned this morning, Italy fare caps had a seemingly outsized impact (changes you will have little visibility on till it arrives). Another reason is potential M&A; Pluxee sits on a €1b net cash position that will reverse on eventual M&A (has done few bolt-on's thus far) while Edenred is sending most of its FCF to equity holders now (€600m/880m). It has headroom to ratings - now singe-digit growth may motivate it towards chasing more inorganic growth as well (in which case we would see supply).

- €750m 5.5y +90 vs. FV +95 (-5bps through)

- -40 in from IPT, books>€2.85b (down from >€3.6b)

- 3m-par call, CoC

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILTS: DMO Consultations Also Factoring Into Bid/Flattening

To add to the recent bullet, a reminder that the minutes of yesterday’s DMO consultations with gilt market participants (released this morning) revealed that there was “GEMM support for "a reduction in the duration of conventional gilt issuance in 2025-26 relative to the current year [...] some attendees cited declining structural demand for gilts from the UK pension sector as a factor in their recommendation to reduce long issuance."

- This, coupled with the removal of hedging pressure surrounding the pricing of the syndicated tap of the Jan-40 line, is likely promoting the recent bid/cure flattening.

BONDS: Dragged Away From Lows By Gilts

The bid in gilts (covered in the previous bullet) seems to help wider core global FI markets off session lows.

- German yields now little changed to 1.5bp lower on the day, while U.S. Tsy yields are 2.5-5.5bp lower.

- Flattening biases also apparent on both curves.

- A reminder that Tsys are playing catch up after the observance of MLK day in the U.S. and resultant closure of cash markets on Monday.

GILTS: Firmer After Syndication Hedging Pressure Abates

Gilts outperform over the last 40 minutes or so, with pricing of this morning’s syndicated tap of the Jan-40 line now in the rear-view and any hedging related pressure passing.

- The offering attracted record demand.

- Futures to fresh session highs above 91.80 at typing, bulls eye resistance at the Jan 17 high (91.96).

- Yields now 2.0-2.5bp lower across the curve, with the long end now outperforming after some modest curve steepening ahead of the supply