EU UTILITIES: EDP (EDPPL Baa2/BBB/BBB): Naturgy Approach Reported

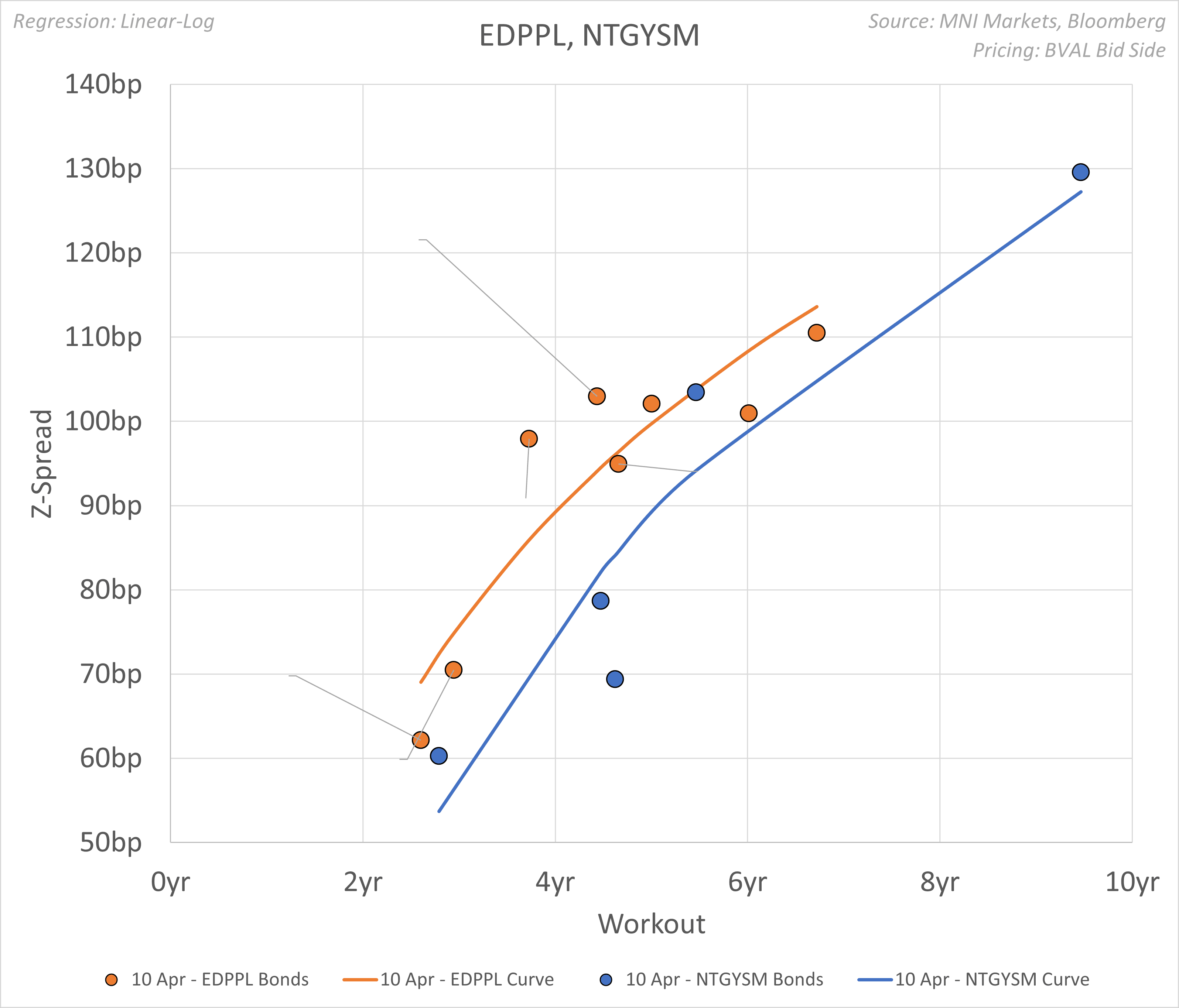

Having mostly exited Iberian gas assets, it seems unlikely that EDP would find a full merger appealing. EDPPL spreads trade flat to slightly wide of NTGYSM.

- Jornal Economico reported that Naturgy approached EDP shareholders regarding a possible merger. Naturgy denied this, EDP declined to comment.

- There were similar reports back in 2016, which ultimately didn’t lead anywhere.

- EDP reportedly approached SSE regarding a potential merger last year.

Naturgy was approached by Taqa last year, but the deal fell through; reports suggest this interest could be revived. With key shareholders thought to want an exit, Naturgy remains in play.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGBS: Impending 10-year Supply Caps Rallies In Bund Futures

Bund futures have recovered from yesterday evening’s Russia-Ukraine ceasefire and US-Canada tariff reprieve inspired lows. Rallies have been capped by today’s 10-year Bund supply, due at 1030GMT. Futures are -7 ticks at 127.00, with a bearish technical theme still intact.

- The German curve has bear flattened, with 2-year yields 2bps higher and 30-year yields 0.5bps higher. Green leader Habeck re-stated his party’s position that debt brake reform for defence spending is not acceptable, but remains open to negotiation.

- 10-year EGB spreads to Bunds are biased slightly tighter, with the exception of DSLs. The 10-year OAT/Bund spread has pushed below 70bp for the first time since September in recent days.

- PGBs lag peripheral peers at the margin after the expected ousting of the Portuguese government and with 10- & 13-Year paper set to be auctioned this morning.

- Comments from ECB President Lagarde were not market moving, while Simkus and Centeno stuck to previous rhetoric.

- The ECB’s forward-looking wage tracker is due at 1100GMT, though broader macro focus remains on the US CPI report at 1330GMT.

EURIBOR OPTIONS: Put fly buyer trades for more

ERJ5 97.6875/97.62/97.5625p fly, bought for 0.75 in 14.5k Total.

FOREX: JPY Slippage Stands Out as Equity Bounce Holds

- JPY slippage is the standout currency move early Wednesday, as equity futures globally smoothly absorb the formal installation of tariffs on aluminium and steel headed to the US. Risk sentiment is seemingly underpinned by hopes for a formal 30-day ceasefire between Ukraine and Russia. While Ukraine have agreed to the terms, Reuters sources this morning report that Russian sources are more wary on the approach - which leaves today's negotiations between Washington and Moscow in focus - particularly after Trump suggested he may talk to Putin as soon as today.

- EUR/USD gains slowed as the leader of Germany's Green party re-stated their opposition to debt brake reform in its current structure - while rejecting the defence spending plan, the door seemingly remains open to negotiations, which have extended across this week, leaving Merz and CDU / SPD officials still hopeful of a last minute deal here.

- The US inflation print and Bank of Canada decision take focus today, with CPI seen moderating to 2.9% from 3.0% for the headline, and down to 3.2% from 3.3% for the ex-food and energy figure. Covering February, the data will be the last look at price pressures in a pre-tariff era, although the sharp run higher for prices paid in sentiment surveys over the past few weeks may mean company stockpiling will still show through in headline stats.

- The Bank of Canada are seen trimming another 25bps off the benchmark policy rate today, and the accompanying policy statement will be carefully watched for any observations on tariff pressure or US-Canada tensions.