STIR: Euribor Futures Extending Higher As ECB Presser Concludes

Jan-30 14:49

Euribor futures are extending higher again with the ECB's press conference in the rear-view, with futures are +4.5 to +9.5 ticks through the blues. Volumes continue to be most pronounced in ERM5.

- The press conference did not bring too many surprises – and thus did not push back on recent rounds of dovish Euribor positions/option structures that we have flagged over the past few weeks.

- President Lagarde noted that the 25bp cut was a unanimous decision, and that a 50bp cut was not discussed. The ECB continues to have confidence in the inflation outlook and the economic recovery, but noted that tariffs would have a "global negative impact".

- Analysis on whether policy rates are getting close to neutral, and the possible impact of increased trade barriers, will likely be more prominent at the March meeting.

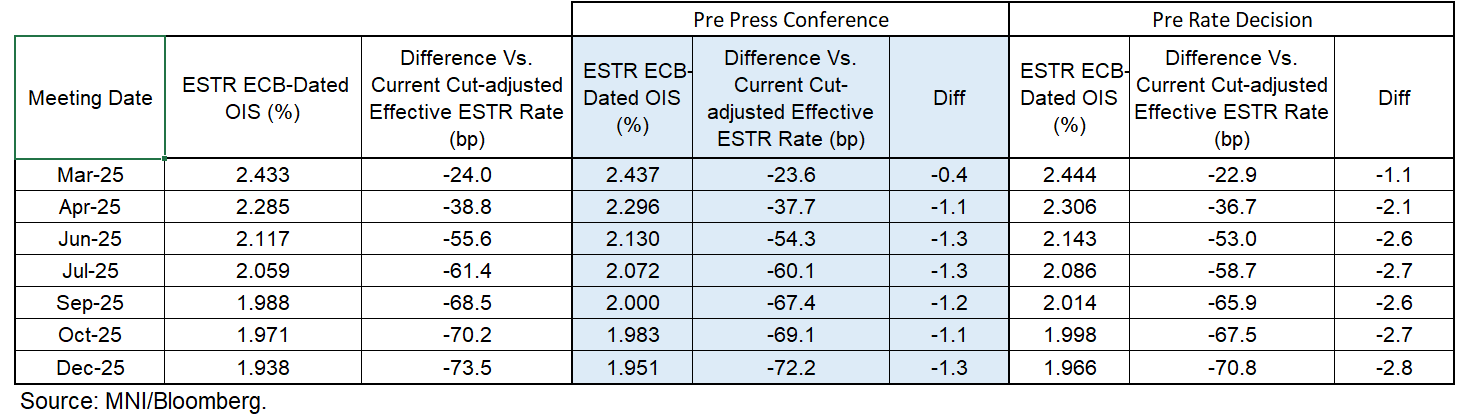

- ECB-dated OIS price 24bps of easing through March, and ~73.5bps of cuts through year-end (versus the current cut-adjusted ESTR effective rate).

- A few dates to keep in mind:

- The ECB Corporate Telephone Survey will be released tomorrow (Jan 31).

- The ECB wage tracker will be released next Wednesday (Feb 5)

- A report on neutral interest rates will be published next Friday (Feb 7)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: Dollar Index Consolidating 6.8% Advance This Year

Dec-31 14:40

- We have seen some constructive price action for the greenback to finish the year, with the USD index shrugging off the early session declines to now trade in the green. The DXY has spent late December consolidating the post-election advance, up ~6.8% on the year.

- In most recent trade, EURUSD has slipped to the worst level of the session at 1.0378, just ahead of yesterday’s 1.0372 low. The trend condition continues to highlight scope for a test of key support at 1.0335, the Nov 22 low and a bear trigger. However, it is worth noting that some option expiries around the 1.0400 mark might limit the chance of a meaningful breakout this week. For reference, we have 1.59bn rolling off at 1.0400 on Thursday.

- USDJPY has also recovered well, rallying over 100 pips from the overnight lows, with spot now consolidating at the 157.00 handle. Officials at the BOJ fear that the real neutral rate of interest could be even lower than the previously-estimated range, MNI understands.

- Aussie and Kiwi are the clear underperformers to end the year, with both AUDUSD and NZDUSD sitting at cycle lows and the lowest levels since October 2022, around 0.62 and 0.56 respectively. For AUDUSD, scope is seen for an extension towards 0.6158 next, a Fibonacci projection.

STIR FUTURES: BLOCK: Red Dec'25 SOFR

Dec-31 14:23

- 4,000 SFRZ5 96.08 (+0.020), post-time bid going into the cross at 0918:29ET, appears to be a sale - though futures continue to rise, the contract trades 96.09 last (+0.030).

STIR FUTURES: BLOCK: Jun'25 SOFR 1Y Bundle

Dec-31 14:10

Total 6,000 SFRM5 1Y bundles (SFRM5-SFRH6) from 0857ET to 0903ET, 4,000 crossed +0.015, 2,000 +0.010. Most likely swap-tied selling with spds running wider in the short end.