TARIFFS: Europe To Respond To US Later, Watching Pharma Developments

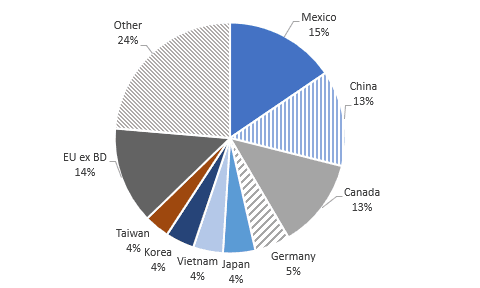

While Canada and Mexico were excluded from the US’ reciprocal tariffs, other non-Asian countries were targeted with rates above the minimum 10% set. USCMA compliant exports will continue to face 0% including autos and parts but non-compliant items face 25% and energy 10%. The EU provided 18.5% of US imports in 2024 and ran a surplus of $235.6bn rising $27bn from 2023 thus it isn’t surprising that it was targeted with a 20% tariff.

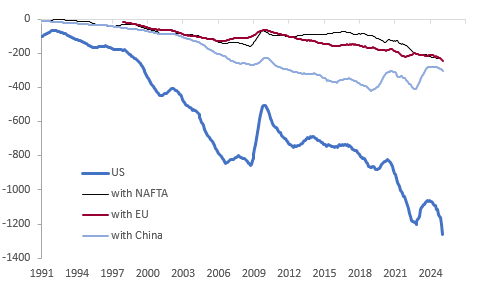

US merchandise trade US$bn 12m sum

- With the main sources of US imports facing an import tax of between 20% and 54%, imported inflation is likely to rise directly in the US and indirectly to others through supply chains. The question for central banks is if there will be second round effects.

- The euro area is the largest source of US imports with Germany the greatest provider. Around 16.7% of euro area exports went to the US worth 3.2% of 2024 GDP and tariffs will hurt specific sectors significantly, especially autos which will continue to face 25% (10.2% of 2024 US auto imports came from the EU). But the east coast of the US receives refined products from Europe and a 20% tax is likely to impact retail fuel prices materially.

- EU President von der Leyen will respond later today but some sectors including chemicals have requested that the region not retaliate. The group is likely to negotiate with the US and reduce some of its own barriers in a deal.

- Ireland is particularly exposed to pharmaceuticals accounting for almost 30% of US imports. The US said that tariffs on chips, pharmaceuticals, timber and copper are coming soon.

- The UK receives the minimum 10% as it runs a small deficit with the US but around 2% of GDP is exposed.

- Switzerland though faces 31%. This is likely to hurt the alpine economy with 13.4% of its 2024 exports going to the US worth 6.4% of GDP. It is also the second largest supplier of US pharmaceutical imports.

US imports by country % total 2024

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI EXCLUSIVE: RBNZ Outlook View

A former RBNZ economist shares his OCR outlook.

On MNI Policy MainWire now, for more details please contact sales@marketnews.com

FOREX: Yen Outperforming, AUD and NZD Weaker

Yen is the only G10 currency tracking higher against the USD at this stage. The BBDXY index is close to unchanged in the first part of Tuesday dealings, last near 1292.4.

- USD/JPY was last near 149.20/25, up around 0.25% in yen terms. Session lows rest at 148.99, which is just under Monday intra-session lows of 149.10.

- We have had comments from Japan's Finance Minister Kato, who stated the country is not devaluing the currency. This comes after Monday comments from US President Trump that weaker FX levels from Japan (and China) were harmful to the US and could result in tariffs.

- US yields continue to track lower, the 10yr last near 4.12%, off a further 3.5bps. This is lows back to Oct last year. This is likely helping yen at the margins. US equity futures are marginally higher, following strong cash losses in Monday trade. Regional equities are mostly tracking lower in line with Wall St moves.

- Tariff concerns remain front and center, while the US has also announced it will cease military aid to the Ukraine.

- On the data front, Japan's Q4 Capex was weaker than expected. This suggests Q4 GDP will be revised lower. Ex software spending was still positive in q/q terms. Company profits were also up strongly, providing some offset.

- AUD/USD is down, but at 0.6205/10 is still up from Monday lows (0.6199). We are 0.25% weaker against the USD, with NZD/USD down by a similar amount, last near 0.5605/10.

- The RBA mins have printed, which outlined the RBA's hawkish cut case. On the data front, retail sales rose 0.3%m/m, in line with forecasts, while net exports will add 0.2ppts to Q4 GDP (which prints tomorrow). Public sector demand is expected to have added 0.2ppt to Q4 growth.

JGBS: Cash Bonds Richer After Weak Domestic Data Drop, 10Y Supply Due

In Tokyo morning trade, JGB futures are stronger, +8 compared to settlement levels, after reversing overnight weakness.

- Alongside a slightly higher-than-expected jobless rate, today’s data calendar has revealed other softer-than-expected economic indicators. Capital spending fell 0.2% y/y, missing the +5.0% estimate, while company profits rose 2.5%, falling short of the 3.0% forecast. Meanwhile, February’s monetary base data aligned with expectations at -1.8% y/y.

- “Japanese businesses boosted capital investment in the final three months of 2024, but the pace of gains slowed on a quarterly basis, and outlays fell year on year for the first time since early 2021, as some firms turned cautious due to emerging concerns over the incoming US administration’s protectionist policies.” (per BBG)

- Cash US tsys are 2-3bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s solid gains.

- Cash JGBs are flat to 3bps richer across benchmarks, with a flattening bias. The benchmark 10-year yield is 1.3bps lower at 1.401% ahead of today’s supply.

- Swap rates are 1-3bps lower, with a flatter curve. Swap spreads are mostly tighter.